Intro

IntroFor the past decade, global economy has been the focus for many investors. Investing in this globalization is important for investor portfolio. There are several ways to participate in global growth: investing in international stock mutual funds, buying some foreign individual stocks, purchasing foreign bond (government or corporate bond), etc. Some of the international equity markets, especially those of the emerging market economies are providing great opportunities for investors to diversify their investment portfolio.

By employing good management and international diversification, retail investors and institutional investors can achieve their investment objective. There are several reasons why international mutual funds provide a great opportunity to cash in on the rapid growth in the global equity space such as: higher growth due to young population, higher consumption in future because of higher income, improving infrastructure and transportation, etc. I’ll focus especially the foreign large cap stock mutual funds for this article. You can also find my previous article about Top Emerging Market Stocks Mutual Funds of 2012.

Note: From historical data, international stock mutual funds are more volatile than US stock mutual funds.

Top Foreign Stock Mutual Funds

These best international large cap stock mutual funds list has been compiled by sorting through its performance for the past 5 years. These foreign equity funds are also ranked among the best in their category. I have provided each of these top mutual fund review such as their performance, fund manager, sales load, expense ratio, risk, top sectors, rating, top holdings, etc. These top mutual funds list include: Foreign Large Growth, Foreign Large Blend, and Foreign Large Value stock funds.

The 10 Best International Large Cap Stock Mutual Funds of 2012 are:

- Calamos International Growth A (CIGRX)

- Sextant International (SSIFX)

- Turner International Growth Investor (TICFX)

- Dreyfus International Stock A (DISAX)

- Artisan International Value Investor (ARTKX)

- Harding Loevner International Equity Investor (HLMNX)

- Allianz NFJ International Value A (AFJAX)

- Janus International Equity A (JAIEX)

- Scout International (UMBWX)

- Waddell & Reed International Growth A (UNCGX)

|

| Calamos International Growth |

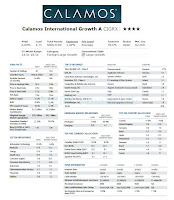

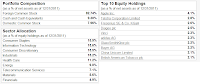

The investment objective of Calamos International Growth mutual fund is to provide long-term capital growth. This top international stock mutual fund utilizes its assets (>40%) to purchase securities of foreign issuers. It may invest in emerging markets stocks. This mutual fund may invest in stock of well-established companies with large market capitalizations and in small companies.

This foreign large growth fund has annual expense ratio of 1.49%. This expense is very similar to the average in its category (1.45%). This fund is managed by John Calamos, Sr., the founder of Calamos Asset Management. This fund has no dividend yield. It has 5-stars rating from Morningstar.

This top stock fund minimum initial investment is $2.500. It has maximum sales charge of 4.75%. The 5-year annualized return of this fund is 3.4%. The other classes of this fund are Class B (CIGBX), Class C (CIGCX) and Class I (CIGIX).

The top holdings as of December 2011 are Novo Nordisk, SAP, Check Point Software Technologies, Accenture PLC, Companhia de Bebidas das Americas, Swatch Group, Barrick Gold Corp, Goldcorp Inc, Wal-Mart de Mexico and Schlumberger.

2. Sextant International (Symbol: SSIFX)

|

| Sextant International |

Nicholas Kaiser has been the fund manager since its inception in 1995. The fund has small dividend yield of 0.82%. The annual holdings turnover as of February 3, 2012 is 7.00%. The management fee for investing in this best international stock mutual fund is 0.25%. There is no sales charge for this SSIFX fund.

The top sectors allocation of this SSFIX fund as of the fourth quarter 2011 report are Cash & Equivalents (27.6%), Cyclical (13.2%), Utilities (11.1%), Technology (10.6%) and Energy (9.9%).

3. Turner International Growth Investor (TICFX)

This Turner International Growth mutual fund invests mainly in equity securities of international non-U.S. companies with market capitalizations higher than $2 billion. The top stock fund usually invests in companies with strong earnings growth potential. It invests in securities of companies that are diversified across many different sectors. It uses the Russell Global ex-U.S. Growth Index (Global ex-U.S. Growth Index) for its sector benchmark and uses the World Growth ex-U.S. Index for its countries benchmark.

Top Performer International Stock Mutual Funds of 2011

The annual expense ratio of this international large cap stock fund is 1.35%. Currently, it has no dividend yield distributed to the investors. The last dividend distribution was done in December 2010. Morningstar has ranked this fund with 5 stars rating. The current lead manager is Mark D. Turner.

The TICFX fund has 6.50% YTD return. Since its inception in 2008, the only year it has negative return was in 2011 (-10.14%). The 3-year annualized returns of this no load mutual fund is 24.93%.

As of March 2012, the top 5 stocks in its holdings are: Nestle SA, Roche Holding AG, British American Tobacco, Unilever NV-CVA, Shire Plc, Diageo Plc, BHP Billiton Ltd, BG Group Plc, Arm Holdings Plc, and Enbridge Inc.

4. Dreyfus International Stock A (DISAX)

This Dreyfus International Stock investment fund seeks long-term total return. This international large cap stock fund normally uses its assets (>80%) to buy stocks in >3 foreign countries. It is considered as a non-diversified mutual fund. This equity fund may invest in the securities of companies of any market capitalization.

This international stock fund has total net assets of $1.43 billion. The YTD return is 5.45%. Morningstar gave this fund 4-star rating for its performance since 2006. The fund is managed by Charlie Macquaker. It can be purchased from 63 brokerages with minimum initial purchase of $1.000 for brokerage account.

The top holdings as of December 2011 are Smith & Nephew Plc (2.32%), Novo Nordisk (2.31%), Komatsu Ltd (2.26%), CSL Limited (2.18%) and Novartis AG-Reg (2.18%).

5. Artisan International Value Investor (ARTKX)

The Artisan International Value mutual fund invests most of its total assets (>80%) in common stocks and other equity and equity-linked securities of non-U.S. companies. It invests mainly in developed markets but also may buy securities in emerging and less developed markets. This stock mutual fund may invest in companies of any size.

Morningstar analysts have rated this fund with Gold rating. It also received 5-stars rating for its performance. Since its inception in September 2002, this top international stock fund has been managed by N. David Samra. He is the managing director of Artisan. The dividend yield is only 0.06%.

The fund’s total net assets are $4.98 billion. It has annual expense ratio of 1.18%. The 3-year annualized return is 10.09%. The top region of this fund as of December 2011 is Europe (65.9%) and Americas (18.6%).

6. Harding Loevner International Equity Investor (HLMNX)

|

| Harding Loevner International Eq Inv |

This HLMNX fund has a dividend yield of 0.41%. The fund has 4-stars rating from Morningstar. It has total net assets of $1.38 billion. The minimum initial investment for brokerage account is $5.000. No retirement account is available currently.

As of December 2011, the top 5 sectors are Information Technology (16.0%), Consumer Staples (15.3%), Health Care (14.5%), Consumer Discretionary (11.7%) and Financials (11.3%).

7. Allianz NFJ International Value A (AFJAX)

This Allianz NFJ International Value fund is part of foreign large value mutual fund. It also has a yield of 2.32%. The current total net assets of this stock fund are $2 billion. Its expense ratio fee is 1.21%. The top 3 stocks in its holdings include Basic Sanitation Company of the State of Sao Paulo ADR, Sasol, Ltd. ADR, AstraZeneca PLC ADR.

Morningstar has ranked this AFJAX fund with 5 stars rating. It has returned 18.79% over the past 3 year, and 1.04% over the past 5 year.

8. Janus International Equity A (JAIEX)

The Janus International Equity fund invests mainly in a main group of 60 to 100 equity securities of issuers from different countries located throughout the world, excluding USA. As part of foreign large blend mutual fund, this fund has an expense ratio of 1.22%. The minimum initial investment is $2,500. It has a sales load of 5.75%. The holding turnover rate is 77%.

9. Scout International

This Scout International fund is rated with gold rating by Morningstar analyst. It also has a yield of 1.35%. The top 5 holdings are: Komatsu Ltd ADR, Enbridge Inc, Toronto-Dominion Bank, Barclays Plc ADR, and Fanuc Corp. The total net assets are $7.9 Billion. This UMBWX is very popular among investors.

10. Waddell & Reed International Growth A

|

| WRA International Growth fund |

This WRA International Growth Fund has 69 holdings in its assets. The top 5 sectors are: consumer staples, information technology, consumer discretionary, industrials, and health care.

Disclosure: No Position

Other Top International Stock Funds articles:

Fund Performance

| No | Name | Ticker | 1 Year Return % | 3 Year Return % | 5 Year Return % | 10 Year Return % | Expense Ratio |

|---|---|---|---|---|---|---|---|

| 1 | Calamos International Growth A | CIGRX | -0.90% | 27.56% | 3.40% | - | 1.40% |

| 2 | Sextant International | SSIFX | -4.40% | 11.29% | 2.11% | 7.99% | 1.03% |

| 3 | Turner International Growth Inv | TICFX | -4.03% | 24.93% | 1.96% | - | 1.35% |

| 4 | Dreyfus International Stock A | DISAX | -5.20% | 15.79% | 1.78% | - | 1.34% |

| 5 | Artisan International Value Investor | ARTKX | -3.97% | 19.09% | 1.32% | - | 1.24% |

| 6 | Harding Loevner International Eq Inv | HLMNX | -5.27% | 20.88% | 1.09% | 6.99% | 1.25% |

| 7 | Allianz NFJ International Value A | AFJAX | -4.37% | 18.79% | 1.04% | - | 1.23% |

| 8 | Janus International Equity A | JAIEX | -7.23% | 18.60% | 0.90% | - | 1.23% |

| 9 | Scout International | UMBWX | -7.60% | 16.94% | 0.79% | 7.71% | 0.94% |

| 10 | Waddell & Reed International Gr A | UNCGX | -3.51% | 16.03% | 0.59% | 5.54% | 1.51% |

No comments:

Post a Comment