T. Rowe Price Mid-Cap Growth (Ticker: RPMGX)

The investment aim of T. Rowe Price Mid-Cap Growth fund is to provide long-term capital appreciation. This fund utilizes its net assets to purchase a diversified portfolio of common stocks of mid-cap companies with a faster rate earning. It uses the S&P MidCap 400 Index or the Russell Midcap Growth Index as its benchmark.

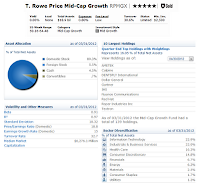

Fund Profile

- Fund Inception Date: June 29, 1992

- Ticker Symbol: RPMGX

- CUSIP: 779556109

- Beta (3yr): 1.09

- Rank in category (YTD): 67%

- Category: Mid-Cap Growth

- Distribution Rate: 0.00%

- Capital Gains: 0%

- Expense Ratio: 0.80%

- Net Assets: $ 19.31 billion

- Number of Years Up: 15 years

- Number of Years Down: 4 years

- Annual Turnover Rate: 30.60%

updated on 7/19/2012

The 5-year average return of this top fund is 13.05%. Morningstar analysts have ranked this mutual fund with Gold and 5-stars rating. Within its 19 years in the market, this best fund has recorded 15 years of positive return. Its best 1-year total return was occurred in 2009 with 45.44%. The YTD return is 13.05%. Based on the load adjusted returns, the fund has returned 0.03% over the past 1-year, 23.48% over the past 3-year and 9.08% over the past 10-year. The 3-year beta risk is 1.09.

Besides from T. Rowe Price brokerage itself, investors can also purchase this mutual fund from the other brokerages, such as JP Morgan, Vanguard, Schwab Retail, Fidelity Retail Funds Network, Royal Alliance, etc. The minimum initial investment for brokerage account is $2,500. This fund is also available for IRA or retirement account with minimum initial purchase of $1,000. It only has a minimum subsequent investment of $100. Another alternative for growth fund is Baron Growth fund.

The top holdings represent 16.05% of the total net assets. As of April 2012, the top 10 stocks in its holding are Ametek, Calpine, Dentsply International, Dollar General, Gartner, IHS, Nuance Communications, Red Hat, Roper Industries Inc and Textron. The top sector diversifications as of March 2012 are Information Technology (22.9%), Industrials & Business Services (22.9%), Health Care (16.3%) and Consumer Discretionary (14.8%).

Some of the principal investment risks are: active management risk, risks of stock investing, market capitalization risk, investment style risk and foreign investing risk.

The pros of investing in this fund are:

- Low expense ratio and no sales load

- Low annual holding turnover rate

- None

No comments:

Post a Comment