American Funds

American Funds have been around the investment world since 1931. Their objective is to provide assistance for investors to achieve long term investing success. There are several advantages in choosing American Funds such as they provides consistent approach with team of portfolio managers, they have a good system with diverse portfolio, and they have great long-term track record especially equity funds.Top Mutual Funds

These best mutual funds are selected based on its long term track record. They may include growth fund, domestic stock fund, international stock fund, growth and income fund, equity income fund, balanced fund, high yield bond fund, taxable bond fund, municipal bond fund, etc.Top 10 American Funds Mutual Funds of 2012 are:

- American Funds Fundamental Investors A (ANCFX)

- American Funds EuroPacific Growth A (AEPGX)

- American Funds New World A (NEWFX)

- American Funds SMALLCAP World A (SMCWX)

- American Funds Bond Fund of Amer A (ABNDX)

- American Funds Capital World Bond A (CWBFX)

- American Funds American Hi Inc Tr A (AHITX)

- American Funds Tax-Exempt Bond A (AFTEX)

- American Funds Income Fund of Amer A (AMECX)

- American Funds Capital Inc Bldr A (CAIBX)

New: Best American Funds Mutual Funds for 2013

Morningstar has rated this large blend stock fund with gold and 4 star rating. It has returned 15.17% over the past 3 year, and 5.93% over the past 10 year. As of April 2012, the top 3 sectors are oil, gas & consumable fuels; chemicals; and pharmaceuticals. The top 5 stocks in its portfolio include Home Depot, Merck, Apple, Microsoft, and Dow Chemicals.

Another alternative fund is American Funds Investment Company of America A (AIVSX). This fund has a sales load of 5.75%.

The American Funds EuroPacific Growth Fund aim is to seek long term capital appreciation through investment in companies based mainly in Europe and the Pacific Basin. It may invest from small to large companies. The fund managers are Stephen E. Bepler, Mark E. Denning, Nicholas J. Grace, Carl M. Kawaja, Jonathan Knowles, Sung Lee, Robert W. Lovelace, Jesper Lyckeus, and Andrew B. Suzman.

The American Funds EuroPacific Growth Fund aim is to seek long term capital appreciation through investment in companies based mainly in Europe and the Pacific Basin. It may invest from small to large companies. The fund managers are Stephen E. Bepler, Mark E. Denning, Nicholas J. Grace, Carl M. Kawaja, Jonathan Knowles, Sung Lee, Robert W. Lovelace, Jesper Lyckeus, and Andrew B. Suzman.

This foreign large blend stock fund has a sales load of 5.75%. The current dividend yield is 1.67%. The portfolio turnover rate is 24%. It also has an expense ratio of 0.84%. This gold rated fund has an annualized 5 year return of -1.76%.

Another popular fund is the American Funds Capital World G/I fund (CWGIX). This world stock fund invests majority of assets in blue chip stocks of paying dividend companies in the world largest stock markets.

You can buy this diversified emerging markets stock fund with $250 minimum initial funding. The other classes of this equity fund are Class B (NEWBX), Class C (NEWCX), Class F-1 (NWFFX), Class F-2 (NFFFX), Class 529A (CNWAX), Class 529B (CNWBX), Class 529C (CNWCX), Class 529E (CNWEX), Class 529F (CNWFX), Class R1 (RNWAX), Class R2 (RNWBX), Class R3, (RNWCX), Class R4 (RNWEX), Class R5 (RNWFX), and Class R6 (RNWGX).

This world stock fund is rated with 4 stars and bronze rating by Morningstar. It has a 10-year average return of 8.24%. In 2011, it has a 1-year total return of -14.34%. The minimum initial investment is only $250. The fund CUSIP number is 831681101.

more: 10 Best T. Rowe Price Mutual Funds of 2012

This intermediate term bond fund has a year-to-date return of 3.13%. The fund has returned 4.04% over the past 5 year, and 5.08% over the past decade. The 3 year beta risk is 0.95. The average effective duration is 4.28 years. The average credit quality of this best American Funds fund is BBB (investment grade).

Another alternative is American Funds Intermediate Bond Fund of America A (AIBAX)

This world bond fund is ranked with 3 stars rating. Its 5-year average return is 5.98%. The top 5 bond sectors are government (50.49%), corporate bond (23.85%), agency mortgage-backed (9.23%), agency/quasi-agency (1.65%), and convertible (1.44%).

This American Funds American High Income Trust fund is a high yield bond mutual fund. This taxable bond fund invests in a diversified portfolio of lower rated higher yielding bonds. It provides 7.78% yield and 0.67% expense ratio. It opens to new investors. The minimum initial investment is only $250.

This American Funds American High Income Trust fund is a high yield bond mutual fund. This taxable bond fund invests in a diversified portfolio of lower rated higher yielding bonds. It provides 7.78% yield and 0.67% expense ratio. It opens to new investors. The minimum initial investment is only $250.

This 3-star rated fund is offered by 84 brokerages such as UBS Financial Services Inc, TD Ameritrade, Merrill Lynch, Morgan Stanley TRAK Fund Solution, Firstrade, etc. This best bond fund has returned 13.83% over the past 3 year, and 8.40% over the past 10 year.

This intermediate term national muni bond fund has a low portfolio turnover rate of 12%. As of April 2012, the top 4 sectors include health (20.84%), transportation (16.88%), state & local general obligation (15.76%), and education (15.01%). Morningstar has ranked this tax free bond fund with neutral rating.

This moderate allocation mutual fund is ranked with silver and 3-star rating. In 2011, it has a total return of 5.58%. It has an annualized 5-year return of 1.18%. As of June 2012, the top 5 largest stock holdings are Verizon, Bristol-Myers Squibb, Home Depot, Merck, and General Electric.

As of June 2012, the 4 largest industry holdings are tobacco, diversified telecommunication services, pharmaceuticals, and oil gas & consumable fuels. This best balanced fund has returned 11.07% over the past 3 year, and 6.76% over the past decade.

Another alternative is American Funds American Balanced A (ABALX).

Disclosure: No Position

You can also check other best fund families:

American Funds Fundamental Investors Fund (Ticker: ANCFX)

The investment aim of American Funds Fundamental Investors fund is to provide long term capital growth and income. This fund utilizes its assets to purchase undervalued and overlooked companies with strong balance sheets and potential for long term growth. It has $51.5 billion of total net assets. The dividend yield is 1.70%. Its annual expense ratio is 0.63%.Morningstar has rated this large blend stock fund with gold and 4 star rating. It has returned 15.17% over the past 3 year, and 5.93% over the past 10 year. As of April 2012, the top 3 sectors are oil, gas & consumable fuels; chemicals; and pharmaceuticals. The top 5 stocks in its portfolio include Home Depot, Merck, Apple, Microsoft, and Dow Chemicals.

Another alternative fund is American Funds Investment Company of America A (AIVSX). This fund has a sales load of 5.75%.

American Funds EuroPacific Growth Fund (AEPGX)

The American Funds EuroPacific Growth Fund aim is to seek long term capital appreciation through investment in companies based mainly in Europe and the Pacific Basin. It may invest from small to large companies. The fund managers are Stephen E. Bepler, Mark E. Denning, Nicholas J. Grace, Carl M. Kawaja, Jonathan Knowles, Sung Lee, Robert W. Lovelace, Jesper Lyckeus, and Andrew B. Suzman.

The American Funds EuroPacific Growth Fund aim is to seek long term capital appreciation through investment in companies based mainly in Europe and the Pacific Basin. It may invest from small to large companies. The fund managers are Stephen E. Bepler, Mark E. Denning, Nicholas J. Grace, Carl M. Kawaja, Jonathan Knowles, Sung Lee, Robert W. Lovelace, Jesper Lyckeus, and Andrew B. Suzman.This foreign large blend stock fund has a sales load of 5.75%. The current dividend yield is 1.67%. The portfolio turnover rate is 24%. It also has an expense ratio of 0.84%. This gold rated fund has an annualized 5 year return of -1.76%.

Another popular fund is the American Funds Capital World G/I fund (CWGIX). This world stock fund invests majority of assets in blue chip stocks of paying dividend companies in the world largest stock markets.

American Funds New World Fund (MUTF: NEWFX)

American Funds New World fund uses most of its assets to buy equities of companies based in developing countries and companies with significant assets/ revenues due to developing countries. It may invest in bond to provide total return. This fund has an expense ratio of 1.02%. Its dividend yield is 1.61%.You can buy this diversified emerging markets stock fund with $250 minimum initial funding. The other classes of this equity fund are Class B (NEWBX), Class C (NEWCX), Class F-1 (NWFFX), Class F-2 (NFFFX), Class 529A (CNWAX), Class 529B (CNWBX), Class 529C (CNWCX), Class 529E (CNWEX), Class 529F (CNWFX), Class R1 (RNWAX), Class R2 (RNWBX), Class R3, (RNWCX), Class R4 (RNWEX), Class R5 (RNWFX), and Class R6 (RNWGX).

American Funds SMALLCAP World A (SMCWX)

The American Funds SMALLCAP World fund objective is to achieve long term capital growth through investment in stocks, convertible, and preferred of foreign companies with small capitalization. This class A fund has a sales load of 5.75%. The expense ratio is 1.09%. The portfolio turnover rate is 39%. Its investment style is mid growth.This world stock fund is rated with 4 stars and bronze rating by Morningstar. It has a 10-year average return of 8.24%. In 2011, it has a 1-year total return of -14.34%. The minimum initial investment is only $250. The fund CUSIP number is 831681101.

American Funds Bond Fund of America A (ABNDX)

This American Funds Bond Fund of America fund invests in a diversified portfolio of corporate bonds, U.S. and other government bonds, mortgage related securities, and cash. The dividend yield is 3.12%. It has a high annual holding turnover rate of 154%. It opens to new investors. The total net assets are $33.5 billion.more: 10 Best T. Rowe Price Mutual Funds of 2012

This intermediate term bond fund has a year-to-date return of 3.13%. The fund has returned 4.04% over the past 5 year, and 5.08% over the past decade. The 3 year beta risk is 0.95. The average effective duration is 4.28 years. The average credit quality of this best American Funds fund is BBB (investment grade).

Another alternative is American Funds Intermediate Bond Fund of America A (AIBAX)

American Funds Capital World Bond A (Ticker: CWBFX)

The investment aim of American Funds Capital World Bond fund is to provider high total return over long term consistent with prudent management. It utilizes its assets to purchase bonds denominated in various currencies including governments and corporation around the world. The expense ratio is 0.87% per year. Its sales load is 3.75%. The current yield is 3.23%This world bond fund is ranked with 3 stars rating. Its 5-year average return is 5.98%. The top 5 bond sectors are government (50.49%), corporate bond (23.85%), agency mortgage-backed (9.23%), agency/quasi-agency (1.65%), and convertible (1.44%).

American Funds American High Income Trust A (AHITX)

This American Funds American High Income Trust fund is a high yield bond mutual fund. This taxable bond fund invests in a diversified portfolio of lower rated higher yielding bonds. It provides 7.78% yield and 0.67% expense ratio. It opens to new investors. The minimum initial investment is only $250.

This American Funds American High Income Trust fund is a high yield bond mutual fund. This taxable bond fund invests in a diversified portfolio of lower rated higher yielding bonds. It provides 7.78% yield and 0.67% expense ratio. It opens to new investors. The minimum initial investment is only $250.This 3-star rated fund is offered by 84 brokerages such as UBS Financial Services Inc, TD Ameritrade, Merrill Lynch, Morgan Stanley TRAK Fund Solution, Firstrade, etc. This best bond fund has returned 13.83% over the past 3 year, and 8.40% over the past 10 year.

American Funds Tax-Exempt Bond Fund of America A (AFTEX)

The American Funds Tax-Exempt Bond Fund of America fund objective is to achieve high current income level exempt from federal income tax and capital preservation. This muni bond fund managers are Neil L. Langberg, Brenda S. Ellerin, and Karl J. Zeile. It has a distribution yield of 3.70%. The total net assets are $9.3 billion and its expense ratio is 0.55% per year.This intermediate term national muni bond fund has a low portfolio turnover rate of 12%. As of April 2012, the top 4 sectors include health (20.84%), transportation (16.88%), state & local general obligation (15.76%), and education (15.01%). Morningstar has ranked this tax free bond fund with neutral rating.

American Funds Income Fund of America A (Ticker: AMECX)

As a balanced fund, American Funds Income Fund of America fund uses its assets to buy common or preferred stocks, convertible, corporate bonds, government bonds, and cash. It has a dividend yield of 4.15%. The annual expense ratio fee is 0.58%. The fund has an investment style of large value.This moderate allocation mutual fund is ranked with silver and 3-star rating. In 2011, it has a total return of 5.58%. It has an annualized 5-year return of 1.18%. As of June 2012, the top 5 largest stock holdings are Verizon, Bristol-Myers Squibb, Home Depot, Merck, and General Electric.

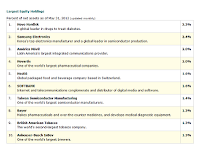

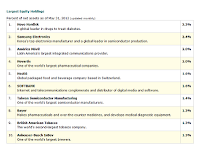

American Funds Capital Income Builder A (CAIBX)

The American Funds Capital Income Builder fund is a silver rated world allocation balanced fund. This fund invests mainly in income-producing securities such as common stocks with dividend, bonds, convertibles, preferred stocks, and cash. The current yield is 4.23% and the expense ratio fee is 0.61%.As of June 2012, the 4 largest industry holdings are tobacco, diversified telecommunication services, pharmaceuticals, and oil gas & consumable fuels. This best balanced fund has returned 11.07% over the past 3 year, and 6.76% over the past decade.

Another alternative is American Funds American Balanced A (ABALX).

Disclosure: No Position

You can also check other best fund families:

Top Fund Performance

| Fund Description | Ticker | Expense Ratio | Yield | Rating | 5 Year Return % | 10 Year Return % |

|---|---|---|---|---|---|---|

| American Funds Fundamental Investors A | ANCFX | 0.63% | 1.65% | 4 | -0.23% | 6.86% |

| American Funds EuroPacific Growth A | AEPGX | 0.84% | 1.59% | 4 | -2.57% | 7.42% |

| American Funds New World A | NEWFX | 1.02% | 1.55% | 4 | 0.12% | 11.73% |

| American Funds SMALLCAP World A | SMCWX | 1.09% | 0.29% | 4 | -1.62% | 8.56% |

| American Funds Bond Fund of Amer A | ABNDX | 0.60% | 3.09% | 2 | 3.97% | 5.25% |

| American Funds Capital World Bond A | CWBFX | 0.87% | 2.98% | 3 | 5.90% | 7.46% |

| American Funds American Hi Inc Tr A | AHITX | 0.67% | 7.74% | 3 | 5.60% | 9.07% |

| American Funds Tax-Exempt Bond A | AFTEX | 0.55% | 3.70% | 3 | 5.13% | 4.74% |

| American Funds Income Fund of Amer A | AMECX | 0.58% | 4.03% | 3 | 1.51% | 6.85% |

| American Funds Capital Inc Bldr A | CAIBX | 0.61% | 4.13% | 3 | 0.46% | 6.86% |

No comments:

Post a Comment