Best Ultrashort Bond Mutual Funds 2012

Best Ultrashort Bond Mutual Funds 2012This ultrashort bond fund is an investment fund which invests only in fixed income securities with very short term maturities (less than 1 year). This ultra-short bond fund provides higher yield than typical money market fund. It has lower risk than other bond fund.

Mutual funds in this article are being selected based on its long term performance, load, management, expense rate, etc. You will also find the full fund review below including turnover rate, fund performance, table comparison, ticker, initial investment information, etc.

The 6 best ultrashort bonds mutual funds 2012 are:

- Calvert Ultra-Short Income Fund (CULAX)

- Wells Fargo Advantage Adjusted Rate Government Fund (ESAAX)

- PIMCO Short-Term Fund (PSHAX)

- TCW Short Term Bond Fund (TGSMX)

- DFA One-Year Fixed-Income Fund (DFIHX)

- Managers Short Duration Government Fund (MGSDX)

Calvert Ultra-Short Income A (CULAX)

Calvert Ultra-Short Income A (CULAX)The investment aim of Calvert Ultra-Short Income fund is to maximize income and achieve capital preservation. It utilizes its assets in in short-term bonds and income-producing securities. It mainly invests in a portfolio of floating-rate securities and securities with durations < 1 year. It may invest in investment grade, U.S. dollar-denominated debt securities, below-investment grade or junk bonds, and bonds rated in default.

This best ultrashort bond mutual fund is currently managed by Michel Abramo, Matthew Duch and Mauricio Agudelo. The most recent dividend distribution was in April 25, 2012 ($0.02). The 12-month dividend yield is 1.67%. The total net assets of this fund are $410.85 million. The current NAV is $15.54.

MORE: Best Long Government Bond Mutual Funds 2012

This fixed income fund has annual expense ratio of 0.89%. The annual holdings turnover rate as per May 10, 2012 is quite high (208.00%). The average turnover rate in the Ultra-short Bond category is 72.86%. It is ranked with 4-stars rating by Morningstar. The YTD return is 1.08%. Since its inception in 2006, this fund has always returned positively. The highest record so far was in 2009 with 7.29% and the lowest in 2011 with 0.20%.

Wells Fargo Advantage Adjusted Rate Government A (ESAAX)

The Wells Fargo Advantage Adjusted Rate Government fund invests majority of its net assets in mortgage-backed (MBS) and asset-backed securities. This mortgage bonds are issued or guaranteed by U.S. government agencies.

This Wells Fargo mutual fund has total net assets of $1.42 billion. It was first introduced to public in June 2000. It has 1.39% dividend yield. This yield is distributed on monthly basis. The annual expense ratio of this fund is 0.74%. It has no management fee but there is a maximum sales charge of 2.00%. The net asset value is $9.19.

Morningstar rated this top ultrashort bond fund with 3-stars rating. The fund’s CUSIP is 94985D665. It has YTD return of 0.83%. Based on the load adjusted returns, this fund has returned 2.11% over the past 3-year and 2.56% over the past 10-year. The only year it has negative return was in 2008 with -1.21%.

The other classes of this fund are Class B (ESABX), Class C (ESACX), Class Institutional (EKIZX) and Admin Class (ESADX). For brokerage account, the minimum first purchase is $1,000 and $250 for brokerage (IRA) account. The minimum subsequent investment needed is $100.

PIMCO Short-Term A (Ticker: PSHAX)

The PIMCO Short-Term fund invests most of its total assets in a diversified portfolio of Fixed Income Instruments of varying maturities. It may invest in forwards or derivatives, investment grade debt securities, preferred stocks, and high yield securities.

The PIMCO Short-Term fund invests most of its total assets in a diversified portfolio of Fixed Income Instruments of varying maturities. It may invest in forwards or derivatives, investment grade debt securities, preferred stocks, and high yield securities.MORE: Top 6 High Yield Bond Mutual Funds

This best PIMCO mutual fund is ranked with 3-stars and Gold rating from Morningstar. The total net assets are $10.74 billion. It is currently managed by Jerome M. Schneider. He started managing this fund since December 2010. The dividend of this fund accrues daily and distributes monthly (1.00%). The fund NAV is $9.87.

The 5-year average return of this mutual fund is 2.63%. This fund has effective maturity of 1.14 years and effective duration of 1.01 years. Since its inception, the fund has recorded in 13 years of positive return and only 1 year of negative return. The best 1-year total return was in 2009 with 9.05%.

The top sector diversifications as per March 2012 are Investment Grade Credit (29%), Government-Agency (23%), Mortgage (15%), other (11%), and Money Market & Net Cash Equivalents (8%).

TCW Short Term Bond I (TGSMX)

The TCW Short Term Bond fund objective is to achieve maximum current income. It invests mainly in a diversified portfolio of debt securities of varying maturities. It invests in bonds, notes and other similar fixed income instruments issued by governmental or corporate sector issuers.

Tad R. Rivelle has started managing this fund since December 2009. He is assisted by Stephen M. Kane and Laird R. Landman. It has 12-month dividend yield of 2.56%. The annual holdings turnover as of April 26, 2012 is 57.84%. It also has annual expense ratio of 0.44%. It has 4-stars rating from Morningstar. The benchmark of this fund is Citigroup 1-Year Treasury I.

This is a no load fund, meaning there is no management fee and no sales charge fee. To open a brokerage account in this fund, the initial purchase has to be at least $2,000. You can buy this investment fund from 71 brokerages. The brokerages include Merrill Lynch, T. Rowe Price, JP Morgan, Vanguard, Schwab Retail, Ameriprise Brokerage, etc.

DFA One-Year Fixed-Income I (DFIHX)

The DFA One-Year Fixed-Income fund aim is to provide a stable real return in excess of the rate of inflation with a minimum of risk. This mutual fund invests normally in a universe of high quality fixed income securities that typically mature in one year or less.

This best ultra-short bond fund has 3-stars and Silver rating from Morningstar. This fund was first introduced to public in July 1983. The total net assets are $7.43 billion. It distributes 0.52% dividend yield to its investor. The most recent distribution was in May 8, 2012 ($0.01). This DFA fund has the lowest annual expense ratio compared to all funds mentioned here (0.17%).

Previou: Top 10 Diversified Bond Mutual Funds 2012

This fund is currently managed by David A. Plecha. There is no sales load fee for investing in this fund. Since its inception, this fund has always recorded in positive return for 28 years consecutively. Based on the load adjusted returns, the fund has returned 0.69% over the past 1-year, 2.31% over the past 5-year and 2.59% over the past 10-year.

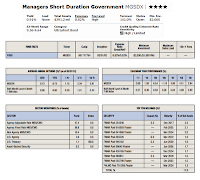

Managers Short Duration Government (MGSDX)

This Managers Short Duration Government fund uses its assets to purchase a portfolio of bonds (debt securities) issued by the U.S. government or its agencies and instrumentalities and synthetic instruments or derivatives. It may use hedging techniques and leverages to protect its portfolio.

This Managers Short Duration Government fund uses its assets to purchase a portfolio of bonds (debt securities) issued by the U.S. government or its agencies and instrumentalities and synthetic instruments or derivatives. It may use hedging techniques and leverages to protect its portfolio.Timothy J. Cunneen has started managing this top bond fund since December 2005. The annual expense ratio is 0.82%. The fund was first introduced to public in March 1992. It has YTD return of 0.92%. The total net assets are $391.23 million.

The best 1-year total return was in 2001 with 7.55%. The only year it has negative return within 19 years in the market, was in year 2008 with -1.19%. This fund has annual holdings turnover as of May 6, 2012 of 141.0%. The benchmark of this fund is BofA Merrill Lynch 6 Month U.S. Treasury Bill.

Disclosure: No Position

Fund Performance

| No | Name | Ticker | 1 Year Return % | 3 Year Return % | 5 Year Return % | 10 Year Return % | Expense Ratio |

|---|---|---|---|---|---|---|---|

| 1 | Calvert Ultra-Short Income A | CULAX | 0.51 | 3.27 | 3.54 | — | 0.89 |

| 2 | Wells Fargo Advantage Adj Rate Govt A | ESAAX | 1.82 | 3.28 | 2.8 | 2.82 | 0.74 |

| 3 | PIMCO Short-Term A | PSHAX | 0.82 | 3.2 | 2.7 | 2.62 | 0.7 |

| 4 | TCW Short Term Bond I | TGSMX | 1.66 | 4.58 | 2.62 | 2.66 | 0.44 |

| 5 | DFA One-Year Fixed-Income I | DFIHX | 0.8 | 1.33 | 2.46 | 2.6 | 0.17 |

| 6 | Managers Short Duration Government | MGSDX | 1.01 | 2.52 | 2.41 | 2.78 | 0.84 |

| 7 | PNC Ultra Short Bond A | PSBAX | 0.19 | 0.97 | 2.41 | — | 0.64 |

| 8 | Federated Ultrashort Bond A | FULAX | 1.11 | 3.92 | 2.06 | 2.1 | 0.93 |

| 9 | DWS Ultra Short Duration Svc | SDUSX | 1.01 | 4.94 | 2.03 | 2.69 | 0.81 |

| 10 | Nationwide Enhanced Income A | NMEAX | 0.29 | 1 | 2.01 | 2.06 | 0.71 |

No comments:

Post a Comment