High Yield Bond Funds

High yield mutual funds invest most of its assets in lower rated corporate bonds or junk bonds. It may invest in U.S. corporate or foreign corporate debts. These bond funds provide high yield income for investors. It also paid the distribution yield either monthly or quarterly. They have higher risk than investment grade bond funds.

High yield mutual funds invest most of its assets in lower rated corporate bonds or junk bonds. It may invest in U.S. corporate or foreign corporate debts. These bond funds provide high yield income for investors. It also paid the distribution yield either monthly or quarterly. They have higher risk than investment grade bond funds.From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its year to date performance in 2012 (up to September 29, 2012).

Best Performing Mutual Funds

The 10 best performing high yield mutual funds 2012 are:- JHancock High-Yield A (JHHBX)

- Loomis Sayles High Income A (NEFHX)

- Federated High-Yield Service (FHYTX)

- Waddell & Reed High-Income A (UNHIX)

- American Beacon SiM High Yield Opportunities Inv (SHYPX)

- Invesco High-Yield Securities A (HYLAX)

- MainStay High Yield Opportunities A (MYHAX)

- Fidelity Advisor High Income Advantage A (FAHDX)

- Western Asset Global High Yield Bond A (SAHYX)

- Nuveen High Income Bond A (FJSIX)

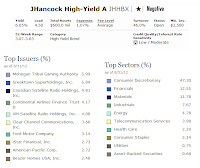

JHancock High-Yield Fund (JHHBX)

This John Hancock High Yield fund objective is to provide high income level and capital appreciation. It was introduced to public in June 1993. It has 6.05% dividend yield. The annual holdings turnover as of September 12, 2012 is 46.00%, slightly lower than the category average (58.33%). This fixed income fund has total net assets of $590.13 million. The annual expense ratio is 1.07%.

This John Hancock High Yield fund objective is to provide high income level and capital appreciation. It was introduced to public in June 1993. It has 6.05% dividend yield. The annual holdings turnover as of September 12, 2012 is 46.00%, slightly lower than the category average (58.33%). This fixed income fund has total net assets of $590.13 million. The annual expense ratio is 1.07%.Best Diversified Bond Mutual Funds

This best performing high yield mutual fund has YTD return of 15.05%. The 5-year average return is 1.09%. The top issuers as of August 2012 are Mohegan Tribal Gaming Authority (5.99%), Greektown Superholdings Inc (5.89%), Canadian Satellite Radio Holdings Inc (4.81%) and Continental Airlines Finance Trust Inc (4.17%). The top sector is Consumer Discretionary (47.30%) and the top industries are Hotel, Restaurants & Leisure (15.32%) and Media (14.53%).

Loomis Sayles High Income Fund (NEFHX)

Loomis Sayles High Income Fund is rated with 2-stars rating. The mutual fund utilizes its assets to purchase below investment-grade securities. It is part of the Natixis Funds Family. Its total net assets are $200.96 million. The 12-month dividend yield is 6.19%. The most recent distribution was given in September 21, 2012 ($0.02). There is management fee of 0.25% for investing in this fund. The front-end sales load fee is 4.50%. The CUSIP is 543487383.Based on the load adjusted returns, it has returned 9.02% over the past 10-year and 10.19% over the past 3-year. The effective duration is 5.85 years and average maturity is 10.09 years. The top sector as of June 2012 is High Yield Credit (56.54%). The top 2 countries are United States (74.42%) and Canada (7.42%).

Federated High-Yield Fund (FHYTX)

Managed by Gene E. Neavin, Federated High-Yield Fund invests most of its assets in a diversified portfolio of high-yield, lower-rated domestic corporate bonds. It is ranked with 4-stars rating by Morningstar. Its expense ratio is 0.99%. The no load fund is available for purchase through 106 brokerages. There is 6.37% dividend.More: Best High Yield Bond Mutual Funds 2012

Since its inception in 1984, this best performing high yield bond mutual fund has recorded 21 years of positive return. The best 1-year total return was achieved in 2009 (55.52%). It has 13.45% YTD return. The top holdings as of August 2012 are HCA Holdings Inc (1.9%), Reynolds Group (1.8%), Sprint Nextel Corp (1.8%), Ally Financial Inc (1.7%) and American International Group Inc (1.6%).

Waddell & Reed High-Income Fund (UNHIX)

This Waddell & Reed High-Income fund seeks to provide total return through income and capital growth. It can be purchased with minimum initial investment of $500 for brokerage account. The dividend yield is 7.75%. The latest distribution was in August 2012 ($0.04). It has total net assets of $1.72 billion. It also has 3-stars rating from Morningstar.The 5-year annualized return is 8.96%. This high yield bond fund also has returned 7.68% over the past 5-year and 11.62% over the past 3-year. The top holdings as of the second quarter of 2012 are Laurate Education Inc (2.2%), CKE Holdings Inc (2.0%), Offshore Group Investment Limited (1.6%) and Misys plc and Magic Newco LLC (1.5%).

American Beacon SiM High Yield Opportunities Fund (SHYPX)

American Beacon SiM High Yield Opportunities fund uses its assets to buy non-investment grade securities. The mutual fund has just been incepted in February 2011. The fund manager is Kirk L. Brown. It has 7.27% dividend yield. The annual portfolio turnover as of September 16, 2012 is 20%. The expense ratio is 1.19% per year.Best High Yield Bond Closed End Funds 2012

This top performer high yield fund has YTD return of 12.28%. It is available in other classes, such as Institutional Class (SHOIX), Class A (SHOAX), Class C (SHOCX) and Class Y (SHOYX). The top holdings out of total 58 holdings are Marine Harvest ASA (3.1%), Continental Airlines Finance Trust II (2.9%), Syncreon Global Ireland Ltd (2.8%), Mexican Bonos (2.8%) and HCA Inc (2.8%).

Fidelity Advisor High Income Advantage Fund (FAHDX)

This High Yield bond has 3-stars rating from Morningstar. The total net assets are $1.98 billion. It also has an expense ratio of 1.03%. The current fund manager is Harley Lank. He started managed this fund in September 2009.The 5-year annualized return is 6.72%. The YTD return is 12.54%. The short-term trading fee is 1.00% and for the period of 90 days. The benchmark of this fund is BofA ML US High Yield/ High Yield Const BL.

Disclosure: No Position

High Yield Fund Performance

| No | Fund Description | Ticker | Rating | YTD Return (%) | Expense Ratio (%) | Total Assets (Mil) |

|---|---|---|---|---|---|---|

| 1 | JHancock High-Yield A | JHHBX | 1 | 19.11 | 1.07 | 605 |

| 2 | Loomis Sayles High Income A | NEFHX | 2 | 17.85 | 1.15 | 217 |

| 3 | Federated High-Yield Svc | FHYTX | 4 | 15.99 | 0.99 | 314 |

| 4 | Waddell & Reed High-Income A | UNHIX | 3 | 15.38 | 1.08 | 1716 |

| 5 | American Beacon SiM High Yld Opps Inv | SHYPX | - | 15.34 | 1.19 | 300 |

| 6 | Invesco High-Yield Secs A | HYLAX | 3 | 15.27 | 1.59 | 119 |

| 7 | MainStay High Yield Opportunities A | MYHAX | 2 | 14.82 | 1.75 | 1129 |

| 8 | Fidelity Advisor High Income Advantage A | FAHDX | 3 | 14.73 | 1.03 | 1980 |

| 9 | Western Asset Global High Yield Bd A | SAHYX | 2 | 14.65 | 1.31 | 617 |

| 10 | Nuveen High Income Bond A | FJSIX | 2 | 14.46 | 1.04 | 704 |

No comments:

Post a Comment