Top Consumer Cyclical Mutual Funds 2012

The consumer cyclical mutual fund is also part of domestic stock mutual fund. This sector fund invests primarily in stocks of companies that involve on the business cycle and economic conditions. The consumer cyclical companies may include automotive industry, housing, entertainment, and retail. It can be classified into 2 main categories: durable goods and non-durable goods. Durable sections are hardware and vehicle or auto. The non-durables are movie or hotel services.

These top consumer cyclical mutual funds are selected based on its expense ratio fee, turnover rate, management, fund performance, etc. You can find the fund review and fund performance or return below.

The 5 best consumer cyclical mutual funds 2012 are:

- Fidelity Select Leisure Fund (FDLSX)

- Fidelity Select Retailing Fund (FSRPX)

- Fidelity Select Consumer Discretionary Fund (FSCPX)

- Rydex Retailing Fund (RYRIX)

- ICON Consumer Discretionary Fund (ICCAX)

Fidelity Select Leisure Fund (FDLSX)

Fidelity Select Leisure Fund (FDLSX)The investment aim of Fidelity Select Leisure Fund is to achieve capital appreciation. It utilizes its assets to purchase securities of leisure industries companies. The company may involve in the design, production, or distribution of goods or services. The fund invests in domestic and foreign equities.

This consumer cyclical mutual fund has 4-stars rating from Morningstar. It has total net assets of $353.31 million. Jean Park is the fund manager since July 2010. The annual expense ratio is 0.86%. The 5-year annualized return is 6.41%. Over the past 10-years, the fund has returned 11.11%.

The top holdings of this fund represent 70.45% of the total portfolio. They are Starbucks Corp, McDonalds Corp, Las Vegas Sands Corp, Wyndham Worldwide Corp, Yum Brands Inc, Chipotle Mexican Grill Inc, Panera Bread Co Class A, Steiner Leisure Ltd, Texas Roadhouse Inc and Dollar General Corp.

Fidelity Select Retailing Fund (FSRPX)

The Fidelity Select Retailing Fund invests majority of assets in common stocks of companies that are engaged in merchandising finished goods and services to individual consumers. It may invest in U.S. and Non-U.S. stocks. Its dividend yield is 0.43%. The most recent distribution was given on April 12, 2012 ($0.01). The annual expense ratio is 0.88%.

Top Technology Stock Mutual Funds 2012

Morningstar rated this best consumer cyclical mutual fund with 4-stars rating. The YTD return of this fund is 22.31%. The performance of this fund is 22.80% over the past 1-year and 22.03% over the past 3-year. The current shares price is $63.54.

The major market sectors are Consumer Discretionary (90.92%) and Consumer Staples (5.66%). The top 5 stocks are Amazon.com Inc, Lowes Cos Inc, Home Depot Inc, TJX Companies Inc New and Priceline.com Inc.

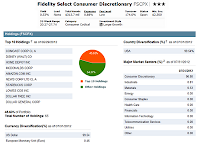

Fidelity Select Consumer Discretionary Fund (FSCPX)

The investment aim of Fidelity Select Consumer Discretionary Fund is to seek capital growth. The mutual fund uses its assets to buy stocks of consumer discretionary products and services companies. The companies may engage in the manufacture and distribution of the products or services. It may invest in domestic and foreign stocks. The fund manager is Gordon Scott. He has just been with this fund since April 2012.

The investment aim of Fidelity Select Consumer Discretionary Fund is to seek capital growth. The mutual fund uses its assets to buy stocks of consumer discretionary products and services companies. The companies may engage in the manufacture and distribution of the products or services. It may invest in domestic and foreign stocks. The fund manager is Gordon Scott. He has just been with this fund since April 2012.As a no load fund, this stock mutual fund has total annual expense ratio of 0.88%. This fee is lower than the average in Consumer Cyclical category which is 1.59%. The 5-year average return is 4.43%. The fund has returned 6.53% over the past 10-year. The fund’s CUSIP is 316390558.

The top 10 stocks are Comcast Corp Class A, Walt Disney Co, Home Depot Inc, McDonalds Corp, Amazon.com Inc, News Corp Ltd Class A, Starbucks Corp, Lowes Cos Inc, Dollar Tree Inc and Dollar General Corp.

Rydex Retailing Fund (RYRIX)

The Rydex Retailing fund invests mainly in equity securities of Retailing Companies that are traded in the United States. It may invest in derivatives such as futures contracts and options on securities, futures contracts, and stock indices. It will invest in small to mid-sized capitalizations. The fund also may purchase American Depositary Receipts (ADRs) and U.S. government securities. It is non-diversified.

This best consumer cyclical fund is part of Guggenheim Investments fund family. It has 3-year rating from Morningstar. The dividend yield is only 0.08%. Since 1998, this stock fund has been managed by Michel P. Byrum. The YTD return of this fund is 14.42% and the 5-year average return is 4.77%.

Best Natural Resources Mutual Funds 2012

The top 3 sectors are Specialty Retail (53.14%), Food & Staples Retailing (16.38%) and Multiline Retail (15.88%). The top 5-holdings as of August 2012 are Wal-Mart Stores Inc (6.54%), Amazon.com Inc (4.84%), Home Depot Inc (4.12%), CVS Caremark Corp (3.11%) and Target Corporation (2.88%).

ICON Consumer Discretionary Fund (ICCAX)

It has high expense ratio of 1.98%. The minimum initial investment of this fund is $1,000. There is no dividend yield. The fund is ranked 2-stars rating by Morningstar. This consumer discretionary fund has returned 19.55% over the past 3-year and 4.45% over the past 10-year.

The top industries are Home Improvement Retail (15.74%) and Apparel Retail (13.80%). The top 5 equity holdings are Home Depot Inc (8.51%), Comcast Corp Class A (8.24%), TJX Cos (8.16%), Walt Disney Co (7.85%) and Lowe’s Cos (7.23%).

Disclosure: No Position

Fund Performance

| No | Fund Description | Ticker | 1 Year Return % | 3 Year Return % | 5 Year Return % | 10 Year Return % | Expense Ratio |

|---|---|---|---|---|---|---|---|

| 1 | Fidelity Select Leisure | FDLSX | 16.85 | 32.67 | 8.06 | 9.28 | 0.9 |

| 2 | Fidelity Select Retailing | FSRPX | 15.7 | 36.36 | 7.75 | 8.88 | 0.93 |

| 3 | Fidelity Select Consumer Discretionary | FSCPX | 8.67 | 32.92 | 3.26 | 4.47 | 0.96 |

| 4 | Rydex Retailing Inv | RYRIX | 15.2 | 30.09 | 3.15 | 4.21 | 1.39 |

| 5 | ICON Consumer Discretionary A | ICCAX | 16.9 | 37.16 | 2.94 | 3.66 | 18.49 |

No comments:

Post a Comment