Best Performing Small Value Funds

Best Performing Small Value FundsSmall value mutual fund is part of domestic stock mutual fund or U.S. stock mutual fund. This small value fund focuses its assets in undervalued small U.S. companies. The market capitalization is typically lower than $300 million. This equity fund usually provide higher dividend yield than growth fund. The companies usually have low price ratios and slow growth in term of earning growth, book value, & cash flow.

These top performing funds are sorted based on their performance up until December 10, 2012. You can find the fund review, expense ratio, objective, risk, how to buy, yield, year to date performance, etc.

Top performer small value stock mutual funds 2012 are:

- Schneider Small Cap Value (SCMVX)

- Chou Opportunity (CHOEX)

- Walthausen Small Cap Value (WSCVX)

- Huber Capital Small Cap Value Investor (HUSIX)

- CSC Small Cap Value Investor (CSCSX)

- Hodges Pure Contrarian Retail (HDPCX)

- Bridgeway Ultra-Small Company (BRUSX)

- Robeco Small Cap Value II Investor (BPSCX)

- Hotchkis and Wiley Small Cap Value A (HWSAX)

- Undiscovered Managers Behavioral Value A (UBVAX)

Schneider Small Cap Value Fund (Ticker: SCMVX)

Schneider Small Cap Value Fund (Ticker: SCMVX)Schneider Small Cap Value fund objective is to provide long term capital appreciation. It invests in undervalued small cap companies. Arnold C. Schneider III is the fund manager. He is the president and chief investment officer with Schneider Capital Management Company. He managed it since its inception in September 1998. The annual expense ratio is 1.15% and the total net assets are $65.41 million.

Best Small Cap Stock Mutual Funds 2012

This top performer small value stock mutual fund has YTD return of 29.45% and the 5-year annualized return of -0.51%. The best 1-year total return was in 2003 with 106.05%. Morningstar has ranked this small value fund with 1 star rating. Based on the load adjusted returns, the performance of this fund is as below:

- 1-year: 23.29%

- 3-year: 12.25%

- 5-year: -0.51%

- 10-year: 12.68%

Chou Opportunity Fund (MUTF: CHOEX)

Chou Opportunity fund utilizes its assets to purchase undervalued equity securities of companies located in developed and emerging markets throughout the world. Morningstar hasn’t ranked it with rating just yet. It has total assets of $46.17 million. It also has 1.53% expense ratio and 1.09% dividend yield. Francis Chou, the President and CEO of Chou Associates Management Inc, is the fund manager.

This best performing small value fund has its year-to-date achievement of 26.78%. Last year, in 2011, it has -17.78% total returns. Based on the load adjusted returns, it has returned 27.41% over the past year. The shares price is $12.63 (12/10/2012).

As of September 2012, the top holdings of this fund are Overstock.com Inc (22.9%), Resolute Forest Products Inc (14.8%), Sears Holdings Corp (11.4%), MannKind Corp (11.4%), MBIA Inc (7.0%), UTStarcom Holdings (6.9%), Citigroup Inc (6.1%), Bank of America warrants (5.4%), JP Morgan Chase warrants (4.7%) and ASTA Funding Inc (3.4%).

Walthausen Small Cap Value Fund (Ticker: WSCVX)

The investment aim of Walthausen Small Cap Value Fund is to provide capital growth through investment in common stocks of small capitalization companies with appreciation potential. This WSCVX fund has $476.22 million of total assets. It has an expense ratio of 1.32%. It is managed by John B. Walthausen since 2008. The annual holdings turnover as of November 13, 2012 is 55.36%. The fund’s CUSIP is 933310104.

The investment aim of Walthausen Small Cap Value Fund is to provide capital growth through investment in common stocks of small capitalization companies with appreciation potential. This WSCVX fund has $476.22 million of total assets. It has an expense ratio of 1.32%. It is managed by John B. Walthausen since 2008. The annual holdings turnover as of November 13, 2012 is 55.36%. The fund’s CUSIP is 933310104.Top 10 Small Cap Stock ETFs 2012

Morningstar ranks this top performer fund with 5-stars rating. For 2012, the year-to-date return is 26.61%. The yearly fund’s performance since its inception is as below:

- Year 2009: 42.39% (highest)

- Year 2010: 41.87%

- Year 2011: -5.94% (lowest)

Huber Capital Small Cap Value Investor (HUSIX)

The Huber Capital Small Cap Value fund is managed by Joseph R. Huber since June 2007. The total assets are rather small with only $40.34 million. The fund has 4-stars rating from Morningstar. Its annual expense ratio is 1.99%. The Institutional Class (HUSEX) has lower expense ratio of 1.35%. The 12b1 fee is 0.25%, but there is no front-end sales load fee.

Based on the load adjusted returns, this top performer small value mutual fund has returned 23.06% over the past year and 7.62% over the past five years. The best 1-year total return was in 2009 with 85.80%.

Top Performing Small Growth Mutual Funds December 2012

The top 5 stocks in its assets as per September 2012 are CNO Financial Group (6.6%), Global Cash Access (5.3%), Granite Real Estate (5.2%), Virtus Investment Partners (5.1%) and Uranium Energy Corp (4.1%). The top sectors are Financial Services (39.7%), Consumer Discretionary (18.7%), Materials & Processing (17.0%) and Producer Durables (10.3%).

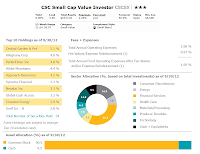

CSC Small Cap Value Investor (CSCSX)

As part of Cove Street Capital fund, CSC Small Cap Value fund invest majority of its assets in small capitalization companies either domestic or foreign corporations. It may invest in common stocks, and preferred stocks. Jeffrey Bronchick has managed this fund since 1998.

This top performer mutual fund has 23.25% year-to-date return. It ranks with 3-stars rating by Morningstar. Its expense ratio is 1.20%. It also has only $22.59 million of assets.

This top performer mutual fund has 23.25% year-to-date return. It ranks with 3-stars rating by Morningstar. Its expense ratio is 1.20%. It also has only $22.59 million of assets.Within the 9 years of positive return, the fund has its best 1-year total return in 2009 with 59.97%. Based on the load adjusted return, it has returned 25.33% over the past 3-year and 5.55% over the past decade. It also has 5-year average return of 0.95%.

The top holdings are Central Garden & Pet (5.1%), Alleghany Corp (4.8%), PerkinElmer Inc (4.8%), White Mountains (4.4%) and Approach Resources (4.2%). The top sector allocation is 31.7% in financial services, 16.8% in consumer discretionary and 12.8% in Technology.

Disclosure: No Position

Fund Performance

| No | Fund Description | Ticker | YTD Return % | Expense Ratio % | Total Assets (Mil) | Rating |

|---|---|---|---|---|---|---|

| 1 | Schneider Small Cap Value | SCMVX | 29.45 | 1.15 | 66 | 1 |

| 2 | Chou Opportunity | CHOEX | 26.78 | 1.53 | 40 | N/A |

| 3 | Walthausen Small Cap Valu | WSCVX | 26.61 | 1.32 | 512 | 5 |

| 4 | Huber Capital Small Cap Value Investor | HUSIX | 23.35 | 1.99 | 44 | 4 |

| 5 | CSC Small Cap Value Inves | CSCSX | 23.25 | 1.2 | 23 | 3 |

| 6 | Hodges Pure Contrarian Retail | HDPCX | 22.81 | 1.4 | 7 | 1 |

| 7 | Bridgeway Ultra-Small Company | BRUSX | 20.19 | 1.22 | 103 | 2 |

| 8 | Robeco Small Cap Value II Investor | BPSCX | 19.89 | 1.55 | 127 | 4 |

| 9 | Hotchkis and Wiley Small Cap Value A | HWSAX | 19.25 | 1.34 | 382 | 3 |

| 10 | Undiscovered Mgrs Behavioral Value A | UBVAX | 18.49 | 1.59 | 70 | 3 |

No comments:

Post a Comment