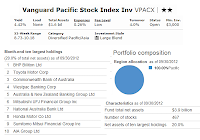

Vanguard Pacific Stock Index Fund (MUTF: VPACX)

The Vanguard Pacific Stock Index Fund objective is to track the performance of the MSCI Pacific Index, a benchmark index. The index comprises of stocks issued by companies located in the major markets of the Pacific region. The MSCI Pacific Index consists of approximately 470 common stocks of companies located in Japan, Australia, Hong Kong, Singapore, and New Zealand.

Fund Details

- Fund Inception Date: 06/17/1990

- Ticker Symbol: VPACX

- CUSIP: 922042106

- Beta (3yr): 0.77

- Rank in category (YTD): 83%

- Category: Diversified Pacific/ Asia

- Distribution: 4.42%

- Capital Gains: 0%

- Expense Ratio: 0.26%

- Net Assets: $ 3.91 billion

- Number of Years Up: 13 years

- Number of Years Down: 8 years

- Annual Turnover Rate: 4.00%

The current fund manager is Michael H. Buek. He has been managing this fund since December 1997. Its expense ratio is 0.26% per year. This expense fee is lower than the average expense ratio of Diversified Pacific/ Asia category, 1.55%. It also has total net assets of $3.91 billion. This best rated fund also has a dividend yield of 4.42%.

The annual holdings turnover as of October 11, 2012 is only 4.00%, much lower than the category average, 52.86%. VPACX fund has no management fee. Since it is index fund, there is no sales load fund.

Best No Load Diversified Emerging Markets Mutual Funds 2012

This top international stock fund has 2-stars rating from Morningstar. It has returned 3.36% over the past one year and 4.14% over the past ten years. Since its inception in 1990, the fund has recorded in 13 years of positive return and 8 years of negative return. The best 1-year total return was recorded in 1999 with 57.05% and the worst 1-year total return in 2008 with -34.36%. The 3-year beta risk is 0.77. The benchmark of this fund is MSCI Pacific Index.

Investors will need $3,000 minimum initial investment to buy this fund for regular brokerage account. The minimum subsequent investment is $100. For retirement account, please check with your broker. This VPACX fund can be purchased from 84 brokerages, such as JP Morgan, T Rowe Price, EP Fee Small, Schwab Retail, Ameriprise Brokerage, E Trade Financial, Schwab Institutional, Fidelity Retails Funds Network, etc. The other class of this fund is the Admiral Class (VPADX).

The 10 largest holdings of this fund represent 20.0% of the total net assets. They are BHP Billiton Ltd, Toyota Motor Corp, Commonwealth Bank of Australia, Westpac Banking Corp, Australia & New Zealand Banking Group Ltd, Mitsubishi UFJ Financial Group Inc, National Australia Bank Ltd, Honda Motor Co Ltd, Sumitomo Mitsui Financial Group Inc and AIA Group Ltd.

According to the fund prospectus, the principal investing risks are Stock market risk, country/regional risk, currency risk, etc.

Disclosure: No Position

Other international stock mutual fund review:

No comments:

Post a Comment