Best Performer Mutual Funds

Best Performer Mutual FundsSmall blend mutual fund invests mainly in U.S. companies with small market capitalization. It invests in a mix of value and growth stocks where neither growth nor value characteristics predominate. This equity fund provides higher risk and higher reward opportunity for investors. It is higher risk than typically large cap mutual funds.

These top performers are sorted based on its year to date performance in 2012 (up to December 13, 2012). You can find the fund review from this article. Other fund information can be found below such as expense ratio, Morningstar rating, fund’s NAV, managers, fund’s holdings, yield, etc.

The 12 top performer small blend mutual funds December 2012 are:

- Hennessy Cornerstone Growth Investor (HFCGX)

- Mairs & Power Small Cap (MSCFX)

- PIMCO Small Cap StocksPLUS TR A (PCKAX)

- Cortina Small Cap Value (CRSVX)

- Vulcan Value Partners Small Cap (VVPSX)

- Bogle Small Cap Growth Investor (BOGLX)

- RBC Enterprise A (TETAX)

- Keeley Small Cap Value A (KSCVX)

- Touchstone Small Cap Core A (TSFAX)

- Brown Advisory Small-Cap Fundamental Val Investor (BIAUX)

- Fidelity Small Cap Discovery (FSCRX)

- Olstein Strategic Opportunities A (OFSAX)

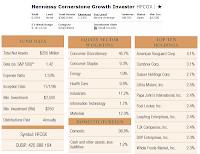

Hennessy Cornerstone Growth Fund (Ticker: HFCGX)

Hennessy Cornerstone Growth Fund (Ticker: HFCGX)Hennessy Cornerstone Growth Fund objective is to provide long term capital appreciation. It utilizes its assets to purchase growth-oriented common stocks using the Cornerstone Growth Strategy. The total net assets are $308.84 million. Neil J. Hennessy and Brian E. Peery are the fund managers. The annual expense ratio is 1.33%. This fund has a portfolio turnover of 106%.

This top performer small blend mutual fund has been in the market for 16 years. It ranks with 1-star rating by Morningstar. Its best 1-year total return was achieved in 2003 with 45.82% and the worst was occurred in 2008 with -43.69%. Based on the load adjusted returns, the fund has returned 30.27% over the past 1-year and 4.50% over the past 10-year. The YTD return is 29.17%.

Previous: Best Small Cap Mutual Funds 2012

As of September 2012, the top 5 stock holdings are American Vanguard Corp (4.1%), Cambrex Corp (3.1%), Susser Holdings Corp (2.7%), Lithia Motors Inc (2.5%) and Papa John’s International Inc (2.4%). The top equity sector weighting is Consumer Discretionary (46.7%).

Mairs & Power Small Cap (MUTF: MSCFX)

Mairs & Power Small Cap fund invests most of its assets in common stocks issued by small cap companies located in the Upper Midwest region. Since its inception in August 2011, Andrew R. Adams has managed this small cap mutual fund. It has small net assets of $31.94 million. The expense ratio is 1.25%. There is no sales load fee for investing in this fund.

You can buy this fund with only a minimum of $2,500 initial investment for brokerage account. The fund has returned 25.92% over the past 1-year. It has YTD return of 28.46%. This best performing small blend fund has shares price of $14.56 (12/23/2014).

Top Performer Small Value Mutual Funds December 2012

The top common stock holdings are Allete Inc (3.6%), MDU Resources Group Inc (3.6%), Associated Banc-Corp (3.5%), Hub Group Inc (3.4%) and Snap-On Incorporated (3.1%). The top portfolio diversification is 17.7% in capital goods, 15.0% in financial, 13.3% in basic industries and 12.1% in consumer cyclical.

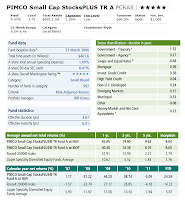

PIMCO Small Cap StocksPLUS Trust Fund (PCKAX)

PIMCO Small Cap StocksPLUS TR fund aim is to provide total return which exceeds that of the Russell 2000 Index. This small blend mutual fund is managed by the well-known experienced Bill Gross. The fund has $490.25 million of total net assets. It distributes a 12-month dividend yield of 4.47%. It also has expense ratio of 1.09%. There is 0.25% 12b1 fee and 3.75% front-end sales load fee for investing in this fund.

PIMCO Small Cap StocksPLUS TR fund aim is to provide total return which exceeds that of the Russell 2000 Index. This small blend mutual fund is managed by the well-known experienced Bill Gross. The fund has $490.25 million of total net assets. It distributes a 12-month dividend yield of 4.47%. It also has expense ratio of 1.09%. There is 0.25% 12b1 fee and 3.75% front-end sales load fee for investing in this fund.Morningstar ranks this best performing small blend mutual fund with 5-stars rating. The fund has YTD return of 25.96%. It also has 5-year annualized return of 10.05%. The yearly performance since its inception is as below:

- Year 2007: 1.17%

- Year 2008: -31.21% (lowest)

- Year 2009: 44.20% (highest)

- Year 2010: 38.73%

Cortina Small Cap Value Fund (Ticker: CRSVX)

The Cortina Small Cap Value Fund has very small assets of $2.71 million. For 2012, its year-to-date return is 25.86%. The annual expense ratio is 1.10%, which is a little bit lower compared to the average in the Small Blend category (1.35%). The annual holdings turnover as of November 12, 2012 is 146.00%. This domestic stock fund has no Morningstar rating yet, because it is still new. Russell 2000 Value Index is the fund’s benchmark.

As per 2012 third quarter report, it has 63 holdings. The top equity holdings are Proassurance Corp (2.6%), CNO Financial Group Inc (2.5%), Ocwen Financial Corp (2.5%), Graphic Packaging Holding Co (2.4%), Logitech International (2.3%) and Cabelas Inc (2.3%). The fund’s NAV is $13.05.

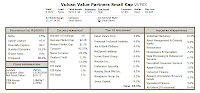

Vulcan Value Partners Small Cap Fund (VVPSX)

Vulcan Value Partners Small Cap fund uses its assets to buy equities of publicly traded small-cap companies the adviser believes to be both undervalued and possessing a sustainable competitive advantage. The portfolio managers are C.T. Firzpatrick (founder), R. Bruce Donnellan (principal), Hampton McFadden (principal), Allen Cox (analyst) and McGavock Dunbar (analyst). The total net assets are $144.79 million. It also has annual expense ratio of 1.50%.

Vulcan Value Partners Small Cap fund uses its assets to buy equities of publicly traded small-cap companies the adviser believes to be both undervalued and possessing a sustainable competitive advantage. The portfolio managers are C.T. Firzpatrick (founder), R. Bruce Donnellan (principal), Hampton McFadden (principal), Allen Cox (analyst) and McGavock Dunbar (analyst). The total net assets are $144.79 million. It also has annual expense ratio of 1.50%.This best performing small blend mutual fund has no Morningstar rating yet. It has YTD return of 23.86%. In 2011, the fund returned 1.48% and 28.96% in 2010. Based on load adjusted returns, it has returned 24.91% over the past 1-year. The current shares price is $14.67.

The 10 Best Small Cap Stock ETFs 2012

The top holdings out of a total of 28 holdings per September 2012, are Eaton Vance Corp (4.9%), Universal Technical Institute (4.9%), Jos A Bank Clothiers (4.7%), NetSpend Holdings (4.6%), Iconix Brand Group (4.4%) and Neustar Inc (4.4%). The top industry is Industrial Machinery (14.3%).

Disclosure: No Position

Fund Performance

| No | Fund Description | Ticker | YTD return % | Expense Ratio % | Rating | Assets (mil) |

|---|---|---|---|---|---|---|

| 1 | Hennessy Cornerstone Growth Investor | HFCGX | 29.17 | 1.33 | 1 | 306 |

| 2 | Mairs & Power Small Cap | MSCFx | 28.46 | 1.25 | N/A | 37 |

| 3 | PIMCO Small Cap StocksPLUS TR A | PCKAX | 25.96 | 1.09 | 5 | 490 |

| 4 | Cortina Small Cap Value | CRSVX | 25.86 | 1.1 | N/A | 3 |

| 5 | Vulcan Value Partners Small Cap | VVPSX | 23.86 | 1.5 | N/A | 194 |

| 6 | Bogle Small Cap Growth Inv | BOGLX | 23.07 | 1.35 | 3 | 114 |

| 7 | RBC Enterprise A | TETAX | 21.77 | 1.33 | 2 | 109 |

| 8 | Keeley Small Cap Value A | KSCVX | 21.12 | 1.39 | 2 | 2546 |

| 9 | Touchstone Small Cap Core A | TSFAX | 20.91 | 1.34 | 5 | 559 |

| 10 | Brown Advisory Sm-Cp Fundamental Val Inv | BIAUX | 20.83 | 1.19 | 5 | 233 |

| 11 | Fidelity Small Cap Discovery | FSCRX | 20.73 | 1.07 | 5 | 3480 |

| 12 | Olstein Strategic Opportunities A | OFSAX | 20.04 | 1.6 | 2 | 33 |

No comments:

Post a Comment