Choosing the right brokerage account is essential for traders or investors. Lightspeed brokerage is one of the top rated discount brokerage account for you. More brokerage review can be found below.

|

| Lightspeed Brokerage |

Intro

With current trading and/or investing situation, finding a good online discount brokerage to buy stock online or build investment portfolio is important. The process of choosing the right brokerage can be a headache. One of my regular discount brokerage I have been using is Lightspeed Web Trader. In this article, I’ll describe my knowledge using Lightspeed Web Trader. I have been using this trading platform for the past 2 months.

One of the reasons I choose Lightspeed trading is their low commission for trading as well as their low balance requirement. It only costs $0.0045/share with $1.00 minimum per trade (i.e. 100 shares or less = $1.00) for trading. Lightspeed Trading offers several trading platforms for trading stock, buying option or buying future contract as well as Forex such as:

- Lightspeed Trader – This is a software trading platform for mainly active trader

- Lightspeed Gateway – This is their algorithmic-based or Automated Trading platform for high frequency trading strategies

- Lightspeed Web Trader – Web browser based trading platform. I’ll provide this web based review.

- Lightspeed Forex – This is another software trading platform for forex trader through FOREXTrader Pro

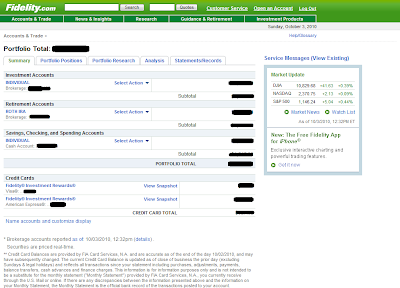

Note: I also have used other discount online brokers such as Zecco, Just2trade, Fidelity, and Vanguard brokerage (VBS)

Compare to other brokerages such as TradeKing, Scottrade, etrade & optionsXpress, lightspeed trading is very competitive.

Products and Services

Lightspeed web trader offers product such as stocks and options. Lightspeed Web Trader has similar platform as Noble Trading web platform since Lightspeed acquired Noble Trading early this year. Minimum balance to open an account for web trader is $1,000 for cash account and $2,000 for margin account. There is no inactivity fee. For foreigner (non US citizen), you can open lightspeed account as well by submitting paper application. Lightspeed provides accounts to individuals, joint holders, retirement accounts (Traditional IRA, Roth, Rollover) etc.

- Products Offering: Stocks, Options, Future (separate account), Forex (Separate account)

- Market Orders: $3.00 per trade

- Limit Orders: $3.00 per trade

- OTCBB and PINK sheet Stocks: $10 (up to 20,000 shares)

- Options: $0.60/contract ($3.00 min)

- Futures: $0.60/contract

- Phone Order: $20 per order

- Minimum fund to Open: $1,000 (Cash) & $2,000 (Margin)

- Account Inactivity Fee: $0.00

- Other Fees: Wire Fee: $20.00 (domestic) ACAT Out: $50.00.

- Maximum Margin Rate: Please refer to lightspeed trading website

Note: There is no Market Center fee for Web Trader users.

New Pricing on 1/15/2012

There will be new commission schedule for Lightspeed WebTrader user on 1/15/2012.

- Lightspeed will eliminate the per-share rate plan. Any customer on per-share rate will be switched to the new per-trade plan.

- Lightspeed will reduce the current per-trade plan from $4.50 per trade to $3.00 per trade.

The new commission will be:

- For equities, $3.00 per trade with 50,000 share maximum order size

- For options, $0.60 per contract ($3.00 minimum commission)