US stock investment can be done through mutual funds. One of the best U.S. Stock Funds is Sequoia fund. This domestic equity fund is rated 5 stars by Morningstar and is one of the oldest mutual fund. Details about the fund’s review can be found below.

Sequoia (MUTF: SEQUX)

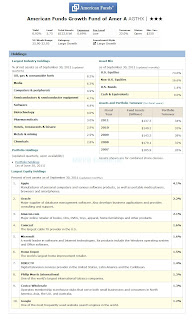

This Sequoia fund is seeking long-term growth of capital. This large blend stock fund invests primarily on undervalued common stocks with potential for growth. While the fund typically invests in U.S. companies, it also may invest in foreign securities. It may invest in securities of issuers with any market capitalization. The fund is non-diversified.

SEQUX Fund Details

Sequoia (MUTF: SEQUX)

This Sequoia fund is seeking long-term growth of capital. This large blend stock fund invests primarily on undervalued common stocks with potential for growth. While the fund typically invests in U.S. companies, it also may invest in foreign securities. It may invest in securities of issuers with any market capitalization. The fund is non-diversified.

SEQUX Fund Details

|

| Sequoia fund details |

- Fund Inception Date: July 15, 1970

- Ticker Symbol: SEQUX

- CUSIP: 817418106

- Beta (3yr): 0.78

- Rank in category (YTD): 1

- Category: Large Blend

- Distribution Rate: 0.22%

- Net Assets: $ 4.38 billion

- Sales Load: 0.0%

- Expense Ratio: 1.00%

- Capital Gains: N/A

- Number of Years Up: 34 years

- Number of Years Down: 6 years