Municipal bond mutual fund can be attractive if you are on higher income tax rate. The income from this fund is tax free from federal tax rate (possibly states tax and local tax). One of the popular muni bond funds is Vanguard Intermediate Term Tax Exempt Fund. Below is the fund’s review.

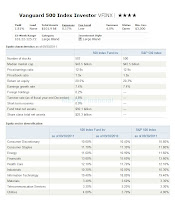

Vanguard Intermediate Term Tax Exempt Inv (MUTF: VWITX)

The Vanguard Intermediate Term Tax Exempt Fund invests mainly (>75% of assets) in investment grade rated municipal bonds. It may also small part of its assets (<25%) in high yield municipal bonds (junk rated). As any muni bond fund, this fund’s objective is to offer moderate and sustainable current income that is not subjected to federal personal income taxes.

|

| Vanguard Intermediate Term Tax Exempt |

VWITX Fund Details

- Fund Inception Date: 09/01/1977

- Ticker Symbol: VWITX (Investor Shares)

- CUSIP: 922907209

- Beta (3yr): 0.91

- Rank in category (YTD): 34%

- Category: Muni National Intermediate