Vanguard 500 Index Fund Investor Shares (VFINX)

|

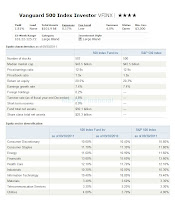

| Vanguard 500 Index fund details |

VFINX Fund Details

- Fund Inception Date: 08/31/1976

- Ticker Symbol: VFINX (Investor Shares)

- CUSIP: 922908108

- Beta (3yr): 1.00

- Rank in category (YTD): 18%

- Expense Fee: 0.14%

- Yield: 1.80%

- Total Assets: $316 billion

- Fund Manager: Donald M. Butler and Scott E. Geiger

- Min to Invest: $3,000

- Category: Large Blend

Michael H. Buek was the fund’s manager before. The fund has changed its managers recently. Buek is the Vanguard’s portfolio manager and has been in Vanguard since 1987. It currently has total net assets of $92.11 Billion. It also has a yield of 2.01%. This fund’s expense ratio is 0.17%. This fee is lower than the average category of 1.14%. There is no sales load for this Vanguard index mutual fund.

This large blend stock fund is rated with 4 stars rating by Morningstar. This fund is also featured in other financial magazine such as CNN Money, US News, and Smart Money. It has the best 1 year total return in 1997 with 33.19% and the worst 1 year total return in 2008 with -37.02%. This domestic US stock fund has returned 0.99% over the past 1 year, -1.26% over the past 5 year, and 2.71% over the past decade.

- Year 2017: 7.11% (YTD)

- Year 2016: 11.82%

- Year 2015: 1.25%

- Year 2014: 13.51%

- Year 2013: 32.18%

As of October 2011, this Top US Stock Fund holds a total of 503 stocks. The median market cap is $45.5 Billion. The turnover rate is 4.8%. The top 10 stock holdings are Apple Inc, Exxon Mobil Corp, International Business Machines Corp, Microsoft Corp, Chevron Corp, Johnson & Johnson, Procter & Gamble Co, AT&T Inc, General Electric Co, and Coca-Cola Co. The top 5 sectors are Information Technology , Financials, Health Care, Consumer Staples, and Energy.

Advantages and Disadvantages

Pros:- Low cost index mutual fund

- Good track record

Disclosure: No Position

Related US stock fund articles:

No comments:

Post a Comment