Vanguard Inflation-Protected Securities Investor (VIPSX)

The Vanguard Inflation Protected Securities fund objective is to provide inflation protection and income consistent with investment in inflation-indexed securities. This Vanguard fund invests majority of assets (>80%) in inflation-indexed bonds issued by the U.S. government, its agencies and instrumentalities, and corporations. It may invest in bonds of any maturity, typically its dollar-weighted average maturity is in the range of 7 to 20 years. This fund will invest in investment grade bonds.

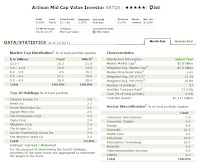

Fund Details

- Fund Inception Date: June 29, 2000

- Ticker Symbol: VIPSX

- CUSIP: 922031869

- Beta (3yr): 1.16

- Rank in category (YTD): 45%

- Category: Inflation-Protected Bond

- Yield: 3.61%

- Capital Gains: 0%

- Expense Ratio: 0.20%

- Net Assets: $ 41.80 billion

- Number of Years Up: 10 years

- Number of Years Down: 1 year

- Annual Turnover Rate: 28%

updated on 5/23/2012