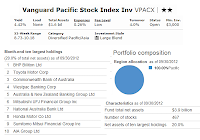

Vanguard Pacific Stock Index Fund (MUTF: VPACX)

The Vanguard Pacific Stock Index Fund objective is to track the performance of the MSCI Pacific Index, a benchmark index. The index comprises of stocks issued by companies located in the major markets of the Pacific region. The MSCI Pacific Index consists of approximately 470 common stocks of companies located in Japan, Australia, Hong Kong, Singapore, and New Zealand.

Fund Details

- Fund Inception Date: 06/17/1990

- Ticker Symbol: VPACX

- CUSIP: 922042106

- Beta (3yr): 0.77

- Rank in category (YTD): 83%

- Category: Diversified Pacific/ Asia

- Distribution: 4.42%

- Capital Gains: 0%

- Expense Ratio: 0.26%

- Net Assets: $ 3.91 billion

- Number of Years Up: 13 years

- Number of Years Down: 8 years

- Annual Turnover Rate: 4.00%