May 28, 2017

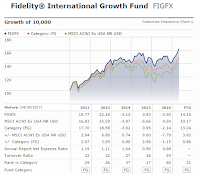

Fidelity International Growth Fund (FIGFX)

Fidelity International Growth Fund (FIGFX) is a popular international stock mutual fund. This mutual fund is provide a decent dividend yield to investors.

May 24, 2017

Taylor Larimore’s Three-Fund Portfolio: 60/40

Taylor Larimore’s Three-Fund Portfolio is a well-known 3-fund investment portfolio. This 3 fund portfolio is introduced by Taylor Larimore. Taylor Larimore is well known professional investor among Boglehead.

The rules of Taylor Larimore’s Three-Fund Portfolio is simple. It invests its 60% allocation to world-wide stocks (42% in US stocks and 18% in international stocks) and 40% to bonds. It mainly invest in US, international stock, and bond market.

The rules of Taylor Larimore’s Three-Fund Portfolio is simple. It invests its 60% allocation to world-wide stocks (42% in US stocks and 18% in international stocks) and 40% to bonds. It mainly invest in US, international stock, and bond market.

This portfolio is well like by followers in Bogleheads.

Who is Taylor Larimore?

Taylor Larimore was labeled by MONEY magazine as "The Dean of the Vanguard Diehards." Jack Bogle, founder of Vanguard Group, calls Taylor "King of the Bogleheads." Taylor is extraordinarily well-versed after having spent most of his 83 years in the real world of finance and investmentsRules of Taylor Larimore’s Three-Fund Portfolio

The rules of Taylor Larimore’s Three-Fund Portfolio is simple. It invests its 60% allocation to world-wide stocks (42% in US stocks and 18% in international stocks) and 40% to bonds. It mainly invest in US, international stock, and bond market.

The rules of Taylor Larimore’s Three-Fund Portfolio is simple. It invests its 60% allocation to world-wide stocks (42% in US stocks and 18% in international stocks) and 40% to bonds. It mainly invest in US, international stock, and bond market.This portfolio is well like by followers in Bogleheads.

How to Invest

You can invest in this Taylor Larimore’s Three-Fund Portfolio through mutual funds or Exchange Traded Funds (ETFs).May 23, 2017

Popular Mutual Funds in 2017

Find the popular mutual funds in 2017. This mutual fund include stock, bond, and hybrid funds.

Index funds are popular funds in 401k plan or retirement account (IRA). Some of the best index mutual funds are provided by Vanguard & Fidelity.

Index funds are popular funds in 401k plan or retirement account (IRA). Some of the best index mutual funds are provided by Vanguard & Fidelity.

Pros:

Invest in Popular Mutual Funds

As a prospective investor, you need to ask whether you should invest in the biggest and most popular mutual funds. Can you get the extra return with these popular mutual funds? You can find many companies which provide ratings on mutual funds including Morningstar, US News, Lipper, Forbes, Money, Kiplinger, etc.Index Funds

Index funds are popular funds in 401k plan or retirement account (IRA). Some of the best index mutual funds are provided by Vanguard & Fidelity.

Index funds are popular funds in 401k plan or retirement account (IRA). Some of the best index mutual funds are provided by Vanguard & Fidelity.Pros:

- Index funds are cheaper than actively managed stock funds in term of expenses.

- The funds may provide diverse selection of US companies than funds tracking the index such as S&P 500, etc.

May 21, 2017

Baron Emerging Markets Fund (BEXFX)

Baron Emerging Markets Fund (BEXFX) is one of the best emerging markets stock mutual funds. This mutual fund is popular among investors.

The majority of investments are in companies domiciled in developing countries, and the Fund may invest up to 20% in companies in developed and frontier countries. It is a diversified mutual fund.

Baron Emerging Markets Fund (BEXFX) Profile

This Baron Emerging Markets Fund objective is to provide long-term capital appreciation. This mutual fund invests mainly in non-U.S. companies of all sizes with significant growth potential.The majority of investments are in companies domiciled in developing countries, and the Fund may invest up to 20% in companies in developed and frontier countries. It is a diversified mutual fund.

BEXFX Profile

May 18, 2017

Rick Ferri’s 60/40 Portfolio: Two Fund Portfolio

Rick Ferri’s 60/40 Portfolio is a well-known 2 fund portfolio. This 2 fund portfolio is a well-known lazy portfolio. Rick Ferri is well known investor professional among Boglehead.

This portfolio is well like by followers in Bogleheads.

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.

Who is Rick Ferri?

Rick Ferri, also known as Richard Ferri, is a financial analyst, author, speaker, former adviser, and founder of Portfolio Solutions, LLC. He has written various financial articles.Rules of Rick Ferri’s 60/40 Portfolio

The rules of Rick Ferri’s 60/40 Portfolio is simple. It invests its 60% allocation to world-wide stocks and 40% to bonds. It mainly invest in US, international stock, and bond market.This portfolio is well like by followers in Bogleheads.

How to Invest

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.Vanguard Mutual Funds

- Vanguard Total Bond Market Index Fund (VBMFX)

May 15, 2017

T. Rowe Price QM U.S. Small-Cap Growth Equity Fund (PRDSX)

T. Rowe Price QM U.S. Small-Cap Growth Equity Fund (PRDSX) is one of top rated US stock mutual fund. It invests mainly in small growth companies.

This T. Rowe Price fund seeks to invest in a broadly diversified portfolio of securities to minimize the effects of individual security selection on fund performance.

T. Rowe Price QM U.S. Small-Cap Growth Equity Fund (PRDSX) Profile

This T. Rowe Price QM U.S. Small-Cap Growth Equity Fund objective is to provide long-term growth of capital by investing primarily in common stocks of small growth companies. This stock fund invests most of its assets in equity securities issued by small-cap U.S. growth companies.This T. Rowe Price fund seeks to invest in a broadly diversified portfolio of securities to minimize the effects of individual security selection on fund performance.

PRDSX Fund Profile

May 12, 2017

Bogle’s 50-50 Portfolio

Bogle’s 50-50 Portfolio is popularized by Jack Bogle. Jack is the 88-year old founder of Vanguard Group. Vanguard is one of the world's largest mutual fund companies.

This portfolio is well like by Bogle followers in Bogleheads. Some people may consider this type of investment portfolio as moderate allocation portfolio.

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.

Note: The performance may be slightly different due to expense fee, tracking error, active management funds, etc.

Rules of Bogle’s 50-50 Portfolio

The rules of Bogle’s 50-50 Portfolio is simple. This two funds portfolio invests its 50% allocation to U.S. stocks and 50% to bonds via index funds. It mainly invest in US stock only and US bond market only. This means he doesn’t invest in international stocks. Bogle also doesn’t invest in currency and other asset classes such as international stocks, and international bonds.This portfolio is well like by Bogle followers in Bogleheads. Some people may consider this type of investment portfolio as moderate allocation portfolio.

How to Invest

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.Note: The performance may be slightly different due to expense fee, tracking error, active management funds, etc.

Mutual Funds

Vanguard Mutual Funds

- Vanguard Total Bond Market Index Fund Investor Shares (VBMFX)

Subscribe to:

Comments (Atom)

The Importance of Diversification in Investing

Diversification is a key principle in investing, and it's especially important in today's uncertain economic climate. By spreading y...

-

Municipal bond investment can be done through variety of investment funds. One of them is using Closed End Funds or CEFs. These muni bond cl...

-

Fidelity Contrafund (FCNTX) Fund is a popular stock mutual fund. It invests mainly in US companies. This next fund, Fidelity Contrafund, i...

-

Hard assets are essential during this economic uncertainty period. Investing in gold and silver can provide a tools for investor to combat i...