Who is Rick Ferri?

Rick Ferri, also known as Richard Ferri, is a financial analyst, author, speaker, former adviser, and founder of Portfolio Solutions, LLC. He has written various financial articles.Rules of Rick Ferri’s 60/40 Portfolio

The rules of Rick Ferri’s 60/40 Portfolio is simple. It invests its 60% allocation to world-wide stocks and 40% to bonds. It mainly invest in US, international stock, and bond market.This portfolio is well like by followers in Bogleheads.

How to Invest

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.

You can invest in this Bogle’s 50-50 Portfolio through mutual funds or Exchange Traded Funds (ETFs). Below are the list. You can buy these investment funds through your brokerage.Vanguard Mutual Funds

Vanguard ETFs

- Vanguard Total Bond Market ETF (BND)

- Vanguard Total World Stock Index Fund (VT)

Performance overview

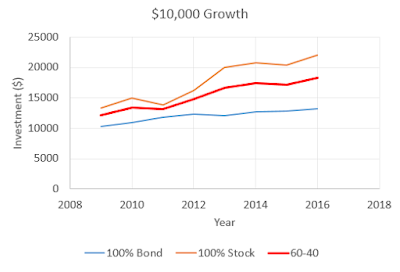

The 60/40 stock/bond portfolio is a well-balanced investment portfolio. It is often used as a simple benchmark for a balanced asset allocation. Traditionally, this portfolio mix has been shown to offer solid returns with a nice risk profile over the long-term.This Ferri’s 60/40 Portfolio has returned 3.32 percent over the three years, and 7.76 percent over the past five years. The past 5 years performance is as follows:

- Year 2016: 6.12%

- Year 2015: -0.89%

- Year 2014: 4.53%

- Year 2013: 12.93%

- Year 2012: 11.83%

| Year | 100% Bond | 100% Stock | 60-40 |

|---|---|---|---|

| 2009 | 3.33% | 32.65% | 20.92% |

| 2010 | 6.20% | 13.08% | 10.33% |

| 2011 | 7.92% | -7.50% | -1.33% |

| 2012 | 3.89% | 17.12% | 11.83% |

| 2013 | -2.10% | 22.95% | 12.93% |

| 2014 | 5.82% | 3.67% | 4.53% |

| 2015 | 0.56% | -1.86% | -0.89% |

| 2016 | 2.53% | 8.51% | 6.12% |

Pros and Cons of Ferri’s 60/40 Portfolio

Pros:- The fund has lower risk than 100% stock funds.

- The investment portfolio has generate consistent returns for the past decade.

- It may not as diversified as other funds.

No comments:

Post a Comment