Who is Taylor Larimore?

Taylor Larimore was labeled by MONEY magazine as "The Dean of the Vanguard Diehards." Jack Bogle, founder of Vanguard Group, calls Taylor "King of the Bogleheads." Taylor is extraordinarily well-versed after having spent most of his 83 years in the real world of finance and investmentsRules of Taylor Larimore’s Three-Fund Portfolio

The rules of Taylor Larimore’s Three-Fund Portfolio is simple. It invests its 60% allocation to world-wide stocks (42% in US stocks and 18% in international stocks) and 40% to bonds. It mainly invest in US, international stock, and bond market.

The rules of Taylor Larimore’s Three-Fund Portfolio is simple. It invests its 60% allocation to world-wide stocks (42% in US stocks and 18% in international stocks) and 40% to bonds. It mainly invest in US, international stock, and bond market.This portfolio is well like by followers in Bogleheads.

How to Invest

You can invest in this Taylor Larimore’s Three-Fund Portfolio through mutual funds or Exchange Traded Funds (ETFs).Below are the list. You can buy these investment funds through your brokerage.

Vanguard Mutual Funds

- Vanguard Total Bond Market Index Fund (VBTLX)

- Vanguard Total Stock Market Index Fund (VTSMX)

- Vanguard Total International Stock Index Fund (VGTSX)

Vanguard ETFs

- Vanguard Total Bond Market ETF (BND)

- Vanguard Total Stock Market ETF (VTI)

- Vanguard Total International Stock Index Fund (VXUS)

Performance Overview

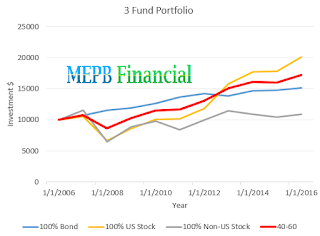

The 60/40 stock/bond portfolio is a well-balanced investment portfolio. It is often used as a simple benchmark for a balanced asset allocation. Traditionally, this portfolio mix has been shown to offer solid returns with a nice risk profile over the long-term.This Taylor Larimore’s Three-Fund portfolio has returned 4.54 percent over the three years, and 8.26 percent over the past five years. The past 5 years performance is as follows:

- Year 2016: 7.72%

- Year 2015: -0.38%

- Year 2014: 6.74%

- Year 2013: 15.84%

- Year 2012: 11.81%

| Year | 100% Bond | 100% US Stock | 100% Non-US Stock | 3-Fund |

|---|---|---|---|---|

| 2007 | 6.97% | 5.37% | 15.52% | 7.84% |

| 2008 | 7.66% | -36.98% | -44.10% | -20.41% |

| 2009 | 3.33% | 28.89% | 36.73% | 20.08% |

| 2010 | 6.20% | 17.42% | 11.12% | 11.80% |

| 2011 | 7.92% | 0.97% | -14.57% | 0.95% |

| 2012 | 3.89% | 16.45% | 18.61% | 11.81% |

| 2013 | -2.10% | 33.45% | 14.61% | 15.84% |

| 2014 | 5.82% | 12.54% | -4.74% | 6.74% |

| 2015 | 0.56% | 0.36% | -4.19% | -0.38% |

| 2016 | 2.53% | 12.83% | 4.81% | 7.27% |

Pros and Cons of Taylor Larimore’s Three-Fund portfolio

Pros:- The fund has lower risk than 100% stock funds.

- The investment portfolio has generate consistent returns for the past decade.

- It may not as diversified as other balanced funds.

No comments:

Post a Comment