Introduction

IntroductionThe three top mutual fund families are Vanguard, American Funds and Fidelity. The Vanguard mutual funds are popular among cost conscious investors. The funds provide low expense ratio and no sales load.

The funds also provide diversification hence mutual fund holds more bonds or stocks than anyone could ever buy. Investors can buy and sell these funds easily on any business day for easy access to their money.

Vanguard provides actively managed mutual funds and passively managed index mutual funds. These funds can be classified into variety categories. These categories are U.S. domestic stock, international stock, emerging markets stock, diversified bond, tax free municipal bond, and balanced fund.

New: Best Vanguard Mutual Funds for 2013

Best Vanguard Mutual Funds

These best Vanguard mutual funds are selected based on the following criteria:

- It has no transaction fees or sales load

- It has great long track record

- It has low minimum initial investment requirement of $3,000

- It provides diversification into variety of asset allocation

Top 10 Best Vanguard Mutual Funds of 2012 are:

- Vanguard Total Stock Market Index (VTSMX)

- Vanguard Small-Cap Index (NAESX)

- Vanguard Total International Stock Index (VGTSX)

- Vanguard Emerging Markets Stock Index (VEIEX)

- Vanguard REIT Index Fund Investor Shares (VGSIX)

- Vanguard Total Bond Market Index (VBMFX)

- Vanguard Inflation-Protected Securities (VIPSX)

- Vanguard Intermediate-Term Tax-Exempt (VWITX)

- Vanguard Balanced Index (VBINX)

- Vanguard Wellesley Income (VWINX)

The Vanguard Total Stock Market Index fund objective is to track the performance of the benchmark index of the overall stock market. It uses the MSCI US Broad Market Index as its benchmark. This index fund is passively managed by Gerard C. O'Reilly.

This large blend stock fund has no sales load and an expense ratio of 0.17%. Its dividend yield is 1.64% per year. This best Vanguard fund has $191 billion of total assets. This fund has a 10 year annualized return of 4.74%. Morningstar rates it with 4 stars and gold rating.

This large blend stock fund has no sales load and an expense ratio of 0.17%. Its dividend yield is 1.64% per year. This best Vanguard fund has $191 billion of total assets. This fund has a 10 year annualized return of 4.74%. Morningstar rates it with 4 stars and gold rating.As of May 2012, this stock fund has 3284 holdings. The top 3 equity sector diversifications are information technology, financials, and consumer discretionary. The top 5 stocks include Apple Inc, Exxon Mobil Corp, International Business Machines Corp, Microsoft Corp, and Chevron Corp.

Another alternative is Vanguard 500 Index fund (VFINX).

Note: You can get lower expense ratio with different classes such as Admiral shares (VTSAX) and exchange traded fund (Ticker: VTI).

2. Vanguard Small-Cap Index (Ticker: NAESX)

This Vanguard Small-Cap Index fund is gold rated equity mutual fund. This fund invests most of assets to track the performance of the MSCI US Small Cap 1750 Index. This index tracks stocks of smaller U.S. companies. Michael H. Buek is the fund manager. The total net assets are $26 billion. Its annual portfolio turnover rate is only 17%.

The minimum initial investment is $3,000 for regular brokerages account and IRA account. This small blend stock fund has returned 20.55% over the past 3 year, and 6.95% over the past decade. The best 1 year total return was achieved in 2003 with 45.63%.

3. Vanguard Total International Stock Index (VGTSX)

The Vanguard Total International Stock Index fund uses its assets to purchase stocks of companies located in developed and emerging markets, excluding the United States. This fund tracks the performance of the MSCI All Country World ex USA Investable Market Index. It is managed by Michael Perre.

Rated with 4 stars, this international stock fund has an average 3 year return of 5.5%. The worst 1 year total return was occurred in 2008 with -44.10%. It also has a dividend yield of 2.79%. Its expense ratio fee is only 0.22%. This equity fund can be purchased from 78 brokerages.

As of May 2012, the median market cap of this foreign large blend fund is $21.2 billion. The top 5 countries are United Kingdom (14.6%), Japan (13.5%), Canada (8.4%), Australia (6.1%), and France (6.7%). The top 3 holdings are Royal Dutch Shell Plc, Nestle SA, and BHP Billiton Ltd.

4. Vanguard Emerging Markets Stock Index (VEIEX)

This Vanguard Emerging Markets Stock Index fund is a no load index fund invests in equities of companies located in emerging market countries around the world. It has 1.96% yield. The annual portfolio turnover rate is only 10%. It opens to new investors. You can buy this fund with $3,000 initial funding. Redemption fee is 2% if the fund is being held less than 2 months.

This diversified emerging markets fund has silver rating from Morningstar. Its 5 year annualized return is 3.2%. The top 4 country diversifications are China (17.2%), Korea (14.9%), Brazil (15.6%), and South Africa (11.2%). The top 2 stocks are Samsung Electronics Co Ltd, and Petroleo Brasileiro SA.

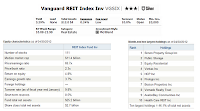

5. Vanguard REIT Index Fund Investor Shares (VGSIX)

The investment objective of Vanguard REIT Index Fund is to provide a high income level and moderate long term capital growth. This index fund tracks the performance of the MSCI US REIT Index. It also has $25.2 billion of total assets. Its dividend yield is 3.14%. There is no sales load and no 12b1 fee. The annual expense ratio fee of this Vanguard fund is 0.24%.

The investment objective of Vanguard REIT Index Fund is to provide a high income level and moderate long term capital growth. This index fund tracks the performance of the MSCI US REIT Index. It also has $25.2 billion of total assets. Its dividend yield is 3.14%. There is no sales load and no 12b1 fee. The annual expense ratio fee of this Vanguard fund is 0.24%.The 3 year beta of this real estate fund is 0.95. It has returned 32.06% over the past 3 year and 10.70% over the past decade. This REIT fund can be purchased from 88 brokerages. Some of the brokerages are Northwestern Mutual Investment Service, E*Trade, TD Ameritrade, JPMorgan, Raymond James, etc.

As of May 2012, the top 2 sectors are retail REITs and specialized REITs. The top 3 stocks in its assets are Simon Property Group Inc, Public Storage, and Equity Residential.

6. Vanguard Total Bond Market Index (MUTF: VBMFX)

The Vanguard Total Bond Market Index fund uses an indexing investment approach to track the performance of the Barclays Capital U.S. Aggregate Float Adjusted Index. This diversified bond mutual fund is passively managed by Kenneth Volpert. It has a yield of 2.92%. The expense ratio is 0.22% per year.

This intermediate term bond fund has a year to date return of 1.38%. The 5 year annualized return is 6.25%. The average effective duration is 5.11 years and average effective maturity is 7.2 years. The average credit quality is AA.

As of May 2012, the top 4 sectors are U.S. Treasury or agency (43.1%), government mortgage-backed (27.20%), industrial (11.8%), and finance (7.4%).

7. Vanguard Inflation-Protected Securities (VIPSX)

The investment aim of Vanguard Inflation-Protected Securities fund is to provide inflation protection and income. It invests majority of assets in inflation-indexed bonds issued by the U.S. government & agencies, and corporation. This best fund is managed by Gemma Wright-Casparius since 2011. Its yield is 3.61%.

This inflation protected bond fund has returned 11.43% over the past year, and 9.85% over the past 3 year. It is rated with gold rating. The best 1 year return is achieved in 2002 with 16.61%. You can buy this taxable bond fund with $3,000 initial funding.

If you are seeking a high yield mutual fund, you can choose Vanguard High-Yield Corporate Fund (VWEHX). This high yield bond fund provide higher yield for income. It also has higher risks due to credit risk and interest rate risk.

8. Vanguard Intermediate-Term Tax-Exempt (VWITX)

This Vanguard Intermediate-Term Tax-Exempt fund utilizes its assets to buy a diversified portfolio of investment grade municipal bonds which provide tax free income to investors. There is no sales load and no management fee. The expense ratio of this best fund is 0.20%. It also has a dividend yield of 3.35% (after tax).

This silver-rated municipal bond fund has an average effective duration of 5.2 years and an average effective maturity of 5.5 years. The average credit quality is A rating. Its yield to maturity is 2.0%. The 5 year average return is 5.43%.

9. Vanguard Balanced Index (VBINX)

As a no load fund, the Vanguard Balanced Index fund objective is to provide exposure to stocks and bonds through indexing approach. It typically invests 60% of assets in the MSCI US Broad Market Index and 40% of assets in the Barclays Capital U.S. Aggregate Float Adjusted Index. The current yield is 2.01%. Its total net assets are $16 billion.

This moderate allocation balanced fund is ranked with gold rating by Morningstar. This best Vanguard fund has returned 13.34% over the past 3 year, and 2.95% over the past 5 year.

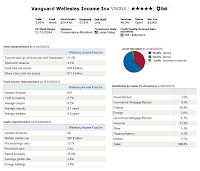

10. Vanguard Wellesley Income (VWINX)

As actively managed fund, this Vanguard Wellesley Income fund invests in investment grade corporate, U.S. Treasury, government agency bonds, mortgage backed securities, and common stocks. The fund managers are John C. Keogh and W. Michael Reckmeyer III. The annual expense ratio fee is 0.25%. Its total net assets are $29.4 billion.

As actively managed fund, this Vanguard Wellesley Income fund invests in investment grade corporate, U.S. Treasury, government agency bonds, mortgage backed securities, and common stocks. The fund managers are John C. Keogh and W. Michael Reckmeyer III. The annual expense ratio fee is 0.25%. Its total net assets are $29.4 billion.This conservative allocation fund has a minimum initial investment of $3,000. It is rated with 5 stars and gold rating. The fund uses an investment style of large value. The 5 year annualized return is 5.81%.

Disclosure: No Position

Fund Information

| No | Fund Description | Ticker | Expense Ratio | Yield | Rating | 5 Year Return % | 10 Year Return % |

|---|---|---|---|---|---|---|---|

| 1 | Vanguard Total Stock Mkt Idx Inv | VTSMX | 0.17% | 1.75% | 4 | -1.16% | 4.55% |

| 2 | Vanguard Small Cap Index Inv | NAESX | 0.24% | 1% | 3 | -0.25% | 6.66% |

| 3 | Vanguard Total Intl Stock Index Inv | VGTSX | 0.22% | 3.13% | 4 | -6.53% | 5.04% |

| 4 | Vanguard Emerging Mkts Stock Idx | VEIEX | 0.33% | 2.20% | 3 | -1.17% | 11.95% |

| 5 | Vanguard REIT Index Inv | VGSIX | 0.24% | 3.29% | 3 | -0.54% | 9.76% |

| 6 | Vanguard Total Bond Market Index Inv | VBMFX | 0.22% | 2.86% | 3 | 7.29% | 5.50% |

| 7 | Vanguard Inflation-Protected Secs Inv | VIPSX | 0.20% | 3.55% | 3 | 8.40% | 7.26% |

| 8 | Vanguard Interm-Term Tx-Ex Inv | VWITX | 0.20% | 3.30% | 4 | 5.56% | 4.67% |

| 9 | Vanguard Balanced Index Inv | VBINX | 0.24% | 2.08% | 4 | 2.46% | 5.36% |

| 10 | Vanguard Wellesley Income Inv | VWINX | 0.25% | 3.49% | 5 | 5.78% | 6.52% |

No comments:

Post a Comment