Popular BlackRock Mutual Funds

Popular BlackRock Mutual Funds

BlackRock is not only famous for its iShares ETFs. It is one of the world’s biggest asset management firms. It currently has more than $3.6 trillion of assets in its management. It offers services in >60 countries to individuals, corporations, and governments around the world. Larry Fink is the current BlackRock CEO.These best BlackRock mutual funds for 2013 are selected based on its performance history. The class A funds do have sales load. You might want to select other classes which don’t have any sales load and lower expense ratio fee. The funds are ranked with 3 star rating or higher by Morningstar. You may find the fund review below and other fund information. I also have selected my favorite funds below.

The 20 best BlackRock mutual funds for 2013 are:

- BlackRock US Mortgage Portfolio Fund

- BlackRock Equity Dividend Fund

- BlackRock High Yield Bond Fund

- BlackRock National Municipal Fund

- BlackRock Health Sciences Opportunities Fund

- BlackRock Multi-Asset Income Fund

- BlackRock Global Dividend Income Fund

- BlackRock GNMA Fund

- BlackRock PA Municipal Bond Fund

- BlackRock Global Allocation Fund

- BlackRock Capital Appreciation Fund

- BlackRock Strategic Income Opportunities Fund

- BlackRock S&P 500 Index Fund

- BlackRock International Opportunities Fund

- BlackRock US Opportunities Fund

- BlackRock Floating Rate Income Fund

- BlackRock Large Cap Growth Fund

- BlackRock Managed Volatility Fund

- BlackRock Small Cap Growth Equity Fund

- BlackRock Long-Horizon Equity Fund

Top Bond Fund

BlackRock US Mortgage Portfolio Fund (BMPAX)The BlackRock US Mortgage Portfolio Fund is the only 5-star BlackRock mutual fund. It utilizes its assets to purchase mortgage-backed securities located in United States. The fund’s yield is 3.37%. The fund’s shares price is currently $10.28. Its expense ratio is 0.92%. This short term bond fund is managed by Akiva Dickstein and Matthew Kraeger.

More: Best PIMCO Mutual Funds for 2013

As one of the best BlackRock mutual funds for 2013, it has returned 6.46% over the past 1 year, 7.45% over the past 3 year, and 7.29% over the past 5 year. The past 4 year performance is listed below:

- Year 2012: 7.91%

- Year 2011: 4.79%

- Year 2010: 11.84%

- Year 2009: 13.71%

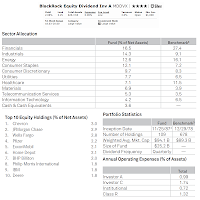

BlackRock Equity Dividend Fund aim is to provide long term total return. This large value fund has total net assets of $26.3 billion. The best fund provides 2.08% dividend yield. The most recent distribution was given in Dec 11, 2012 ($0.13). Morningstar ranks this fund with 4-stars and Silver rating. It also has annual expense ratio of 0.98%.

BlackRock Equity Dividend Fund aim is to provide long term total return. This large value fund has total net assets of $26.3 billion. The best fund provides 2.08% dividend yield. The most recent distribution was given in Dec 11, 2012 ($0.13). Morningstar ranks this fund with 4-stars and Silver rating. It also has annual expense ratio of 0.98%.In 2013, this best fund has YTD return of 5.18%. Since its inception, it has 15 years of positive return and only 3 years of negative return. The best 1-year total return was recorded in 2003 with 25.93%. Russell 1000 Value and S&P 500 are the fund’s benchmarks. The shares price is $20.83 (2/8/2013).

The top 6 equity holdings as of 4th quarter of 2012 are Chevron (3.0%), JP Morgan Chase (2.9%), Wells Fargo (2.8%), Pfizer (2.2%), ExxonMobil (2.1%) and Home Depot (2.1%). The top sector allocation is Financials (16.5%) and Industrials (14.3%).

BlackRock High Yield Bond Fund (BHYAX)

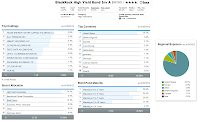

BlackRock High Yield Bond Fund invests mainly in non-investment grade corporate bonds. The management team of this High Yield bond fund consists of James Keenan, Derek Schoenhofen, Mitchell Garfin and Charlie McCarthy. It has total net assets of $10.2 billion. The minimum initial investment is $1,000. The dividend yield is 5.87% which is distributed on daily basis. The most recent dividend was distributed on December 31, 2012. Since its inception, this best BlackRock mutual fund 2013 has recorded 12 years of positive return and 2 years of negative return. It has 1.54% YTD return. The fund’s benchmark is Barclays US Corp HY 2% Iss Cap. The fund has modified duration of 3.57 years.

Since its inception, this best BlackRock mutual fund 2013 has recorded 12 years of positive return and 2 years of negative return. It has 1.54% YTD return. The fund’s benchmark is Barclays US Corp HY 2% Iss Cap. The fund has modified duration of 3.57 years.As of December 2012, the top 5 industries are Independent Energy (8.4%), Health Care (7.2%), Technology (6.0%), Electric (5.8%) and Non-Captive Diversified (5.7%). The top holdings as of September 2012 are Texas Energy Future Capital Holdings LLC (2.6%), Ally Financial Inc (2.4%) and Hamlet Holdings LLC (2.4%).

BlackRock Inflation Protected Bond Fund (BPRAX)

Morningstar analysts rank this fund with 2-stars and Bronze rating. It has 1.68% dividend yield and annual expense ratio of 0.76%. This best inflation-protected bond fund has $5.3 billion of total net assets. The annual holdings turnover as of January 10, 2013 is 120.00%, which is quite high compared to the average in the category (67.72%).

More: Best Fidelity Mutual Funds 2013

Based on the load adjusted return, the fixed income fund has returned 2.35% over the past 1-year and 5.92% over the past 5-year. It has managed to have positive returns since its inception in 2004. The best achievement was in 2007 with 11.83% and the lowest was in 2008 with 0.23%. It has effective duration of 8.13 years. The fund is currently managed by Brian Weinstein and Martin Hegarty.

BlackRock Global Dividend Income Fund (BABDX)

As part of best BlackRock mutual funds, this BABDX fund has $1.3 billion of total net assets. This best world stock mutual fund has 1.11% of annual expense ratio. It has 2.33% dividend yield. The fund’s CUSIP is 09256H385. It focuses its investment in dividend-paying equity securities.In 2013, the year-to-date return is 4.16%. Based on the load adjusted returns, this fund has returned 4.28% over the past year and 6.97% over the past 3-year. Since its inception in 2008, it has always contributed positive return so far, with its best 1-year total return in 2009 (22.93%).

The top 5 stocks as of December 2012 are Pfizer (3.2%), Imperial Tobacco Group (3.1%), Roche (3.0%), Novartis (2.8%), Sanofi (2.8%) and Johnson & Johnson (2.8%). The top geographic allocation is Developed Europe (46.1%) and United States (36.5%).

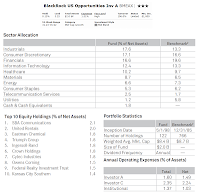

BlackRock US Opportunities Fund (BMEAX)

BlackRock US Opportunities Fund (BMEAX)This BlackRock US Opportunities Fund uses its assets to purchase U.S. emerging capitalization companies with relatively attractive earnings growth potential and valuation. Jean Rosenbaum and Thomas Callan are the fund managers. This BMEAX fund has $2.0 billion of total net assets. The annual expense ratio rate is 1.51% which is a little bit higher than category average, 1.36%. This fund is currently closed to new investors.

The minimum initial investment for brokerage or IRA account is $1,000. There is 0.25% 12b1 fee and 5.25% front-end sales load fee. The fund has 5.40% YTD return. Based on the load adjusted returns, it has returned 5.52% over the past 3-year and 11.31% over the past decade.

The top equity holdings as of December 2012 are SBA Communications (2.1%), United Rentals (2.0%), Eastman Chemical (1.8%), Triumph Group (1.8%), Ingersoll-Rand (1.8%), Crown Holdings (1.8%) and Cytec Industries (1.8%). Industrials and Consumer Discretionary are the top sector allocations.

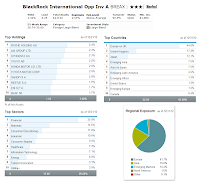

BlackRock International Opportunities Fund (BREAX)

This BREAX fund is part of Foreign Large Blend mutual fund. It has $1.8 billion of total net assets. The 12-month dividend yield is 1.42% and is distributed quarterly. Investors of this fund have just received its last dividend in December 2012 ($0.47). It also has 1.57% annual expense ratio. The annual holdings turnover as per January 10, 2013 is 99.00%.

This BREAX fund is part of Foreign Large Blend mutual fund. It has $1.8 billion of total net assets. The 12-month dividend yield is 1.42% and is distributed quarterly. Investors of this fund have just received its last dividend in December 2012 ($0.47). It also has 1.57% annual expense ratio. The annual holdings turnover as per January 10, 2013 is 99.00%.This best BlackRock mutual fund for 2013 has 3-stars and Neutral rating from Morningstar. It has its best 1-year total return in 1999 with 150.50%. The worst 1-year total return was occurred in 2008 with -43.34%. The current YTD return of this fund is 2.20%. The benchmark of this fund is MSCI All Country World ex-US.

As of December 2012, the top equity holdings are Roche (2.4%), AIA Group (2.3%), Syngenta (2.3%) and Volvo (2.2%). The top geographic allocation is Developed Europe (61.7%) and Japan (12.1%).

Disclosure: No position

Fund Information

| No | Fund Description | Category | Rating | Assets (M) |

|---|---|---|---|---|

| 1 | BlackRock US Mortgage Portfolio A | Short-Term Bond | 5 | 25.36 |

| 2 | BlackRock Equity Dividend Inv A | Large Value | 4 | 9641.3 |

| 3 | BlackRock High Yield Bond Inv A | High Yield Bond | 4 | 3646.09 |

| 4 | BlackRock National Municipal Inv A | Muni National Long | 4 | 2158.86 |

| 5 | BlackRock Health Sciences Opps Inv A | Health | 4 | 1118.76 |

| 6 | BlackRock Multi-Asset Income Investor A | Conservative Allocation | 4 | 630.71 |

| 7 | BlackRock Global Dividend Income Inv A | World Stock | 4 | 466.06 |

| 8 | BlackRock GNMA Inv A | Intermediate Government | 4 | 444.33 |

| 9 | BlackRock PA Municipal Bond Inv A | Muni Pennsylvania | 4 | 58.21 |

| 10 | BlackRock Global Allocation Inv A | World Allocation | 3 | 17705.88 |

| 11 | BlackRock Capital Appreciation Inv A | Large Growth | 3 | 1855.01 |

| 12 | BlackRock Strategic Income Opps Inv A | Nontraditional Bond | 3 | 1231.35 |

| 13 | BlackRock S&P 500 Index A | Large Blend | 3 | 820.84 |

| 14 | BlackRock International Opp Inv A | Foreign Large Blend | 3 | 726.47 |

| 15 | BlackRock US Opportunities Inv A | Mid-Cap Growth | 3 | 555.74 |

| 16 | BlackRock Floating Rate Income Inv A | Bank Loan | 3 | 521.38 |

| 17 | BlackRock Large Cap Growth Inv A | Large Growth | 3 | 407.31 |

| 18 | BlackRock Managed Volatility Inv A | Moderate Allocation | 3 | 389.58 |

| 19 | BlackRock Small Cap Growth Equity Inv A | Small Growth | 3 | 355.68 |

| 20 | BlackRock Long-Horizon Equity Inv A | World Stock | 3 | 352.22 |

Fund Performance

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield | 1 Year Return % | 5 Year Return % |

|---|---|---|---|---|---|---|---|

| 1 | BlackRock Equity Dividend Inv A | MDDVX | 4 | 0.98 | 2.08 | 2.11 | 2.39 |

| 2 | BlackRock US Opportunities Inv A | BMEAX | 3 | 1.51 | 0.15 | 3.32 | 3.5 |

| 3 | BlackRock International Opp Inv A | BREAX | 3 | 1.57 | 1.42 | 0.95 | -2.12 |

| 4 | BlackRock Global Dividend Income Inv A | BABDX | 4 | 1.11 | 2.33 | 1.06 | N/A |

| 5 | BlackRock High Yield Bond Inv A | BHYAX | 4 | 0.92 | 5.87 | 1.11 | 9.94 |

| 6 | BlackRock Inflation Protected Bond Inv A | BPRAX | 2 | 0.76 | 1.68 | -0.17 | 6.39 |

| 7 | BlackRock National Municipal Inv A | MDNLX | 4 | 0.72 | 3.7 | 0.52 | 6.03 |

| 8 | BlackRock Total Return Inv A | MDHQX | 2 | 1 | 3.55 | 0.25 | 5.02 |

| 9 | BlackRock Multi-Asset Income Investor A | BAICX | 4 | 0.8 | 4.09 | 1.09 | N/A |

| 10 | BlackRock Global Allocation Inv A | MDLOX | 3 | 1.07 | 1.17 | 1.11 | 2.54 |

| 11 | BlackRock Latin America Inv A | MDLTX | 3 | 1.53 | 1.43 | 2.09 | 0.49 |

| 12 | BlackRock LifePath Retirement Investor A | LPRAX | 3 | 1.1 | 1.71 | 0.55 | 4.39 |

| 13 | BlackRock Health Sciences Opps Inv A | SHSAX | 4 | 1.28 | 0.3 | 4.46 | 7.02 |

No comments:

Post a Comment