|

| Top ETFs for 2013 |

Exchange traded funds, ETFs, are becoming popular investment vehicle for individual and institutional investors. There are more than 1,000 ETFs in the marketplace. For regular investors, it may be difficult to pick the right one or the best choice for future. ETFs are traded like stock; they provide investors a great opportunity to diversify.

These best ETFs for 2013 are selected based several things such as future performance, low cost, and growth opportunity. The funds are ranked with among the best in its category. You may find the fund review below and other fund information. If you are interested in top mutual funds, you can check my previous article, Best Mutual Funds for 2013.

The followings are my ways to choose good ETFs for investment are:

- Choose the low expense ratio fund for higher long term returns

- Buy exchange traded fund that invests in broad market (i.e. diversified)

- Buy active funds if they are managed by great manager(s)

- Don’t invest in single sectors or single country fund

- PIMCO Total Return Exchange-Traded Fund (BOND)

- Schwab Large-Cap Core (SCHX)

- iShares S&P National Municipal Bond Fund (MUB)

- Vanguard MSCI EAFE ETF (VEA)

- Market Vectors Emerging Markets Local Currency Bond ETF (EMLC)

- SPDR DB International Government Inflation-Protected Bond ETF (WIP)

- Vanguard MSCI Emerging Markets ETF (VWO)

- iShares Dow Jones US Real Estate Index Fund (IYR)

Note: This list is possibly the top ETFs for 2014 and 2015 as well. I'll review the fund list when it is near the end of year 2013 and 2014.

|

| PIMCO Total Return ETF |

PIMCO Total Return Exchange-Traded Fund is an actively managed bond mutual fund. It utilizes its assets to purchase a diversified portfolio of investment grade bonds. Although this PIMCO ETF has just been introduced to public in February 2012, it is considered one of the best ETFs for 2013. The fund has $4.15 billion of total net assets and is currently traded at -0.08% discount from its NAV. The annual expense ratio is 0.55%. It is in the Intermediate-Term Bond category. The well-known fund manager, Bill Gross, is managing this bond ETF.

More: Top Performer High Yield Bond ETFs July 2012

This fixed income fund has YTD return of 0.40%. Barclays US Aggregated TR USD is the fund’s benchmark. It also has 7.37 years of effective maturity and 4.70% of effective duration. This fund doesn’t use a derivative or option in its investment. You can also choose the mutual fund, PIMCO Total Return Fund (PTTAX), as your investment.

The top holdings as of February 15, 2013 are US Treasury Inflate Prot Bd (6.86%), FNMA TBA 3.5% (5.78%), FNCL 4.0% (4.17%), FNMA TBA 3.0% (3.87%) and US Treasury Note (3.46%).

|

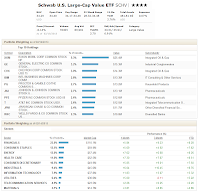

| Schwab Large-Cap Core |

Ranked with 4 stars, this Schwab Large-Cap Core fund uses its assets to purchase equities of big companies in the U.S. This ETF has been introduced to public since 2009. It has a SEC Yield of 2.70%. The annual expense ratio is quite low, only 0.07%. This Large Value fund is currently traded at -0.14% discount from its NAV. The total net assets are quite small compared to the other funds mentioned here $481.81 million. The previous dividend payment was in the amount of $0.2966.

The top 5 sectors of this fund are Financials (23.0%), Consumer Staples (12.5%), Energy (12.0%), Health Care (11.0%) and Consumer Discretionary (11.0%). The top holdings are Exxon Mobil Corp (5.3%), General Electric Co (3.2%), Chevron Corp (3.0%), International Business Machines Corp (2.8%), Procter & Gamble Co (2.7%) and Johnson & Johnson (2.7%).

If you are interested in investing in larger ETFs, you can invest in SPDR S&P 500 ETF (SPY), Vanguard Large-Cap ETF (VV), Vanguard Total Stock Market ETF (VTI), or iShares S&P 500 Index (IVV).

iShares S&P National Municipal Bond Fund (MUB)

This iShares S&P National Municipal Bond Fund invests mainly in high quality municipal debts in U.S. This best performer ETF has total net assets of $3.60 billion. It is offered at 0.5% premium from its NAV. The 12-month yield of the fund is 2.87% and the annual expense ratio is 0.25%. The current ETF’s shares price is $111.59.

More: Top 40 ETFs 2011

Morningstar ranks this municipal bond fund with 3-stars rating for its performance. This BlackRock ETF has returned 5.96% over the past 3-year and 5.44% over the past 5-year. The year-to-date return of this best ETF is 0.65%. The weighted average maturity is 5.92 years.

The top states as of February 14, 2013 are California (22.23%) and New York (18.62%). The top holdings are Blackrock Liquid Fund Munifund (0.70%), California St (0.55%), North Tex Twy Authority (0.31%) and Puerto Rico Sales Tax Fing Corp SA (0.29%).

Vanguard MSCI EAFE ETF (VEA)

This Vanguard MSCI EAFE ETF invests primarily in large companies located in developed countries except U.S. It invests in companies located in Great Britain (UK), Germany, France, Italy, Spain, Japan, Switzerland, etc. I like this Vanguard ETF hence it has low expense ratio of 0.12% per year. It has $12.04 billion of total net assets. The fund is currently traded at 0.35% premium from its NAV. It is in the Foreign Large Blend category.

This Vanguard MSCI EAFE ETF invests primarily in large companies located in developed countries except U.S. It invests in companies located in Great Britain (UK), Germany, France, Italy, Spain, Japan, Switzerland, etc. I like this Vanguard ETF hence it has low expense ratio of 0.12% per year. It has $12.04 billion of total net assets. The fund is currently traded at 0.35% premium from its NAV. It is in the Foreign Large Blend category.MSCI EAFE Index and MSCI All Country World Index ex USA are the fund’s benchmarks. The largest 5 stocks in its holdings as of January 2013 are Royal Dutch Shell plc, Nestle SA, HSBC Holdings plc, BHP Billiton Ltd and Novartis AG.

Market Vectors Emerging Markets Local Currency Bond ETF (EMLC)

|

| Fund Holdings |

Categorized as the Emerging Markets Bond, it has no Morningstar rating yet. It has a high dividend yield of 4.08%. The dividend is distributed monthly and the capital gains are given annually. The fund’s total net assets are $1.51 billion. It is traded at 1.13% discount from its NAV. It also has 0.47% annual expense ratio.

As one of the best funds, It has some top holdings such as Chile Government International Bond (2.97%), Rushydro Jsc Via Rushydro Finance Ltd (2.68%), Banco Safra Sa (2.15%), Eskom Holdings Ltd (1.96%) and Colombia Government International Bond (1.67%).

SPDR DB International Government Inflation-Protected Bond ETF (WIP)

Morningstar analysts rank this World Bond ETF with 4-stars rating. This SPDR DB International Government Inflation-Protected Bond ETF distributes 2.48% of dividend to its investors. It invests in mainly in government bonds around the world. It has total assets of $1.70 billion with 0.50% annual expense ratio. The CUSIP of the fund is 78464A490.

As one of these best ETFs for 2013, it has 2.69% average coupon and 0.54% yield to maturity. The year-to-date return is -0.94%. It has 7.95% total return over the past 1-year and 8.35% over the past 3-year. The fund’s benchmark is DB Global Government ex-US Inflation-Linked Bond Capped Index.

As of February 15, 2013, the fund has a total of 105 holdings. The top holdings are Government of France 2.25 (3.56%), TSY (2.92%), Japan Government (2.79%), Government of France 1 (2.67%) and Poland Government Bond (2.50%).

Vanguard MSCI Emerging Markets ETF (VWO)

As part of Vanguard fund, it has large net assets of $61.37 billion. Vanguard MSCI Emerging Markets ETF also has 2.19% dividend yield. The fund has 0.20% annual expense ratio which is lower compared to the average ratio in the Diversified Emerging Markets category (0.64%). It has 3-stars rating from Morningstar. Spliced Emerging Markets Index is this fund’s benchmark.

The month-end largest holdings of this exchange traded fund are Samsung Electronics Co Ltd, Taiwan Semiconductor Manufacturing Co Ltd, Petroleo Brasileiro SA, Vale SA, China Construction Bank Corp and China Mobile Ltd. The top country diversification is China (18.7%), Brazil (13.7%), Korea (11.8%) and Taiwan (10.3%).

iShares Dow Jones US Real Estate Index Fund (IYR)

|

| iShares Fund holdings |

More: Best Performing ETFs September 2012

As of February 15, 2013, the top 5 holdings are Simon Property Group Inc (8.74%), American Tower Corp (5.26%), Public Storage (3.85%), HCP Inc (3.82%) and Ventas Inc (3.63%). The current shares price is $68.15.

Fund Performance

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield | Net Assets (bil) | YTD return % | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | PIMCO Total Return ETF | BOND | N/A | 0.55 | 0 | $4.15 | 0.4 | - | - | - | - |

| 2 | iShares S&P National AMT-Free Muni Bd | MUB | 3 | 0.25 | 2.87 | $3.60 | 0.65 | 4.24 | 5.96 | 5.44 | - |

| 3 | Market Vectors EM Local Curr Bond ETF | EMLC | N/A | 0.47 | 4.08 | $1.51 | 1.3 | 8.11 | - | - | - |

| 4 | SPDR DB Intl Govt Infl-Protected Bond | WIP | 4 | 0.5 | 2.48 | $1.70 | -0.94 | 7.95 | 8.35 | - | - |

| 5 | Schwab U.S. Large-Cap ETF | SCHX | 4 | 0.04 | 2.07 | $1.24 | 7.02 | 15.5 | 14.67 | - | - |

| 6 | Vanguard FTSE Emerging Markets ETF | VWO | 3 | 0.2 | 2.19 | $61.37 | 0.23 | 3.74 | 7.19 | 0.95 | - |

| 7 | Vanguard MSCI EAFE ETF | VEA | 3 | 0.12 | 2.86 | $12.04 | 3.37 | 12.64 | 7.52 | -0.44 | - |

| 8 | iShares Dow Jones US Real Estate | IYR | 3 | 0.47 | 3.56 | $5.07 | 5.41 | 17.11 | 20.96 | 6.2 | 11.33 |

No comments:

Post a Comment