|

| Top Performers |

Intermediate term bond mutual fund is part of taxable bond mutual fund. It invests mainly in investment grade government or corporate bonds with durations of 3 to 6 years. The average maturity of bonds in its holdings may vary from 4 to 10 years. This bond fund is less sensitive to interest rates than long duration fund. The yield is higher than short duration bond fund.

This top performer bond mutual fund list is sorted based on its 1 year total return performance up to March 9th, 2013. You can find the fund review, expense ratio, yield, ranking, share price, management, top holdings, credit rating, etc.

The top performing intermediate term bond mutual funds march 2013 are:

- Principal Preferred Securities A (PPSAX)

- GMO Domestic Bond III (GMDBX)

- PIMCO Investment Grade Corporate Bond A (PBDAX)

- Guggenheim Total Return Bond A (GIBAX)

- TCW Total Return Bond N (TGMNX)

- Delaware Corporate Bond A (DGCAX)

- Nuveen Strategic Income A (FCDDX)

- Leader Total Return Investor (LCTRX)

- PIMCO Fundamental Advantage Total Return Strategy A (PTFAX)

- Putnam Income A (PINCX)

- Oppenheimer Corporate Bond A (OFIAX)

- Lord Abbett Income A (LAGVX)

- Cavanal Hill Intermediate Bond Investor (APFBX)

- Metropolitan West Total Return Bond M (MWTRX)

- USAA Intermediate-Term Bond (USIBX)

|

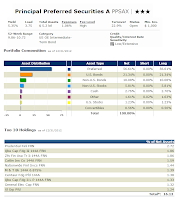

| PPSAX fund details |

Principal Preferred Securities Fund invests mainly in preferred securities. Its aim is to provide current income. This best performer in Intermediate Term Bond category has $5.2 billion total net assets. The fund offers quite high dividend yield of 5.35%. Investors of the fund have just received their dividend in January 2013 with $0.05. As of February 14, 2013, the annual holdings turnover of this fund is 22.90%. The current fund manager is L. Jacoby IV.

More: Top Diversified Bond Mutual Funds 2012

As one of the top performing intermediate term bond funds, it has 1.67% of year-to-date return. The fund has 3-stars rating from Morningstar. The yearly performance of the fund since its inception is as below:

- Year 2006: 6.67%

- Year 2007: -8.29%

- Year 2008: -22.42%

- Year 2009: 46.15%

- Year 2010: 16.04%

GMO Domestic Bond Fund (GMDBX)

The GMO Domestic Bond Fund utilizes its assets to purchase bonds tied economically to the U.S. This intermediate term bond fund has very high yield of 64.68%. It distributed $1.31 of dividend in January 2013. This fixed income fund also has a low expense ratio of 0.20% per year. This no load fund is managed by Thomas F. Cooper since its inception in 1994.

This GMDBX fund has recorded a total of 15 years of positive return and 3 years of negative return. The best 1-year total return was occurred in 2009 with 19.83%. Morningstar gives 3-stars rating for this fund. Based on the load adjusted returns, the fund has returned 12.99% over the past 1-year and 4.95% over the past decade.

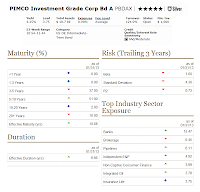

PIMCO Investment Grade Corporate Bond Fund (PBDAX)

|

| PIMCO fund details |

For its fine performance, Morningstar ranks this best performing mutual fund with 5-stars and Silver rating. It has always recorded in positive return since its inception in 2004. The best was in 2009 with 18.29% and the worst in 2008 with 1.47%. The minimum initial investment for the brokerage account is $1,000.

The top industry sector exposure as of January 2013 is Banks (15.47%), Brokerages (6.45%) and Pipelines (6.11%). It has 6.66 years of effective duration.

Guggenheim Total Return Bond Fund (GIBAX)

Guggenheim Total Return Bond Fund focuses its assets in debt securities listed, traded or dealt in developed markets, and emerging markets. This GIBAX fund has 1.44% of YTD return. The total assets are 163 million. It shares a 12-month dividend yield of 4.40%. The most recent distribution was provided in January 2013 in the amount of $0.09. The current shares price is $27.13.

Being one of the top performer intermediate term bond mutual funds, it has 69.00% of annual holdings turnover as of February 14, 2013. The fund has just been introduced to public in November 2011, so there is no rating from Morningstar yet. It returned 12.57% in 2012.

The top holdings as of February 26, 2012 are FGLMC 4.5% (23.99%), FG G07229 (17.96%), US Treasury (11.81%), FGLMC 5.50% (10.27%) and Freddie Mac (8.94%).

TCW Total Return Bond Fund (TGMNX)

|

| TCW fund details |

This intermediate term bond mutual fund has a year-to-date return of 0.59%. Since its inception in 1999, the fund has always recorded 13 years of positive return. The best achievement was in 2009 with 19.50% and the lowest in 2008 with 0.90%. It has 5-year annualized return of 8.92%. Barclays US Aggregate Bond Index is the fund’s benchmark.

This bond fund has an average duration of 3.1 years and an average maturity of 5.2 years. The top sectors are Mortgage-Backed (76.98%), US Government (12.90%), Commercial MBS (6.96%) and Asset-Backed (4.32%). Tad Rivelle and Mitch Flack are the current fund managers.

Delaware Corporate Bond Fund (DGCAX)

Delaware Corporate Bond Fund aim is to provide interest income to investors. It invests mainly in high quality of corporate bonds. The fund’s CUSIP is 245908785. It was incepted in September 1998. The dividend is 4.11% and is paid out on monthly basis. The annual expense ratio is 0.94%. It is slightly higher than the category‘s average, 0.88%. It is managed by a team of fund managers; consist of Thomas H. Chow, Paul A. Matlack, Craig C. Dembek, John P. McCarthy and Roger A. Early.

Based on the load adjusted returns, this top performing intermediate term bond mutual fund has returned 8.89% over the past 5-year and 7.48% over the past 10-year. It has 0.27% of YTD return. The other classes of this fund are Class C (DGCCX), Institutional Class (DGCIX) and Class R (DGCRX). The fund can be purchased with a minimum of $1,000 for brokerage account.

The top holdings as of January 2013 are Talisman Energy Inc (0.9%), Georgia-Pacific LLC (0.9%), Blackstone Holdings Finance Co LLC (0.9%) and Electricite de France SA (0.9%). The top sectors are Financial Institutions (28.5%), Utility (16.5%) and Communications (10.5%).

Fund Information

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield | Net Assets (mil) | Min Invest |

|---|---|---|---|---|---|---|---|

| 1 | Principal Preferred Securities A | PPSAX | 3 | 1.06 | 5.35 | $5,200 | $1,000 |

| 2 | GMO Domestic Bond III | GMDBX | 3 | 0.2 | 64.68 | $219 | $10 |

| 3 | PIMCO Investment Grade Corp Bd A | PBDAX | 5 | 0.9 | 4.25 | $10,700 | $1,000 |

| 4 | Guggenheim Total Return Bond A | GIBAX | N/A | 0.82 | 4.4 | $163 | $100 |

| 5 | TCW Total Return Bond N | TGMNX | 5 | 0.73 | 5.59 | $9,000 | $2,000 |

| 6 | Delaware Corporate Bond A | DGCAX | 5 | 0.94 | 4.11 | $1,700 | $1,000 |

| 7 | Nuveen Strategic Income A | FCDDX | 4 | 0.85 | 4 | $649 | $3,000 |

| 8 | Leader Total Return Investor | LCTRX | N/A | 1.85 | 5.34 | $19 | $2,500 |

| 9 | PIMCO Fundamental Advtg Ttl Ret Strat A | PTFAX | 2 | 1.29 | 0.15 | $3,400 | $1,000 |

| 10 | Putnam Income A | PINCX | 3 | 0.86 | 2.8 | $1,400 | $- |

| 11 | Oppenheimer Corporate Bond A | OFIAX | N/A | 0.89 | 3.25 | $103 | $1,000 |

| 12 | Lord Abbett Income A | LAGVX | 5 | 0.8 | 4.82 | $2,200 | $1,500 |

| 13 | Cavanal Hill Intermediate Bd Inv | APFBX | 3 | 0.89 | 2.9 | $27 | $1,000 |

| 14 | Metropolitan West Total Return Bond M | MWTRX | 5 | 0.63 | 3.59 | $25,100 | $5,000 |

| 15 | USAA Intermediate-Term Bond | USIBX | 5 | 0.65 | 4.6 | $2,800 | $3,000 |

Fund Performance

| No | Fund Description | YTD return | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|

| 1 | Principal Preferred Securities A | 1.67 | 14.69 | 11.47 | 8.58 | 6.12 |

| 2 | GMO Domestic Bond III | 2.43 | 13.51 | 7 | 6.45 | 5.15 |

| 3 | PIMCO Investment Grade Corp Bd A | 0.05 | 11.39 | 10.24 | 10.21 | 7.74 |

| 4 | Guggenheim Total Return Bond A | 1.44 | 11.2 | N/A | N/A | N/A |

| 5 | TCW Total Return Bond N | 0.59 | 10.77 | 8.72 | 9.13 | 6.81 |

| 6 | Delaware Corporate Bond A | 0.27 | 10.87 | 10.49 | 10.28 | 7.91 |

| 7 | Nuveen Strategic Income A | 0.79 | 10.88 | 8.66 | 8.57 | 6.75 |

| 8 | Leader Total Return Investor | 1.73 | 11.74 | N/A | N/A | N/A |

| 9 | PIMCO Fundamental Advtg Ttl Ret Strat A | 1.62 | 10.48 | 6.07 | N/A | N/A |

| 10 | Putnam Income A | 0.63 | 9.66 | 7.43 | 8.02 | 5.96 |

| 11 | Oppenheimer Corporate Bond A | -0.22 | 9.66 | N/A | N/A | N/A |

| 12 | Lord Abbett Income A | 0.34 | 9.76 | 9.61 | 9.34 | 6.32 |

| 13 | Cavanal Hill Intermediate Bd Inv | 0.81 | 9.38 | 9.24 | 4.67 | 4.31 |

| 14 | Metropolitan West Total Return Bond M | 0.2 | 9.5 | 8.54 | 8.52 | 7.74 |

| 15 | USAA Intermediate-Term Bond | 0.51 | 9.34 | 9.5 | 8.67 | 6.26 |

No comments:

Post a Comment