|

| Top Performer Funds |

Best Performing Target Date 2011-2015 Mutual Funds 2013

Target date 2011 2015 mutual funds invest mainly in diversified portfolio of stocks, bonds, and cash or money market fund. The portfolio is adjusted based on the retirement or another goal. It will adjust risk and return based on its target date, 2011-2015. People who retire around this target date should choose this balanced fund. Over time, the fund manager(s) will add more conservative assets such as cash or bonds.

From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its 1 year total return up to March 1, 2013.

The top performing target date 2011-2015 mutual funds March 2013 are:

- T. Rowe Price Retirement 2015 (TRRGX)

- JHancock2 Retire Living through 2015 A (JLBAX)

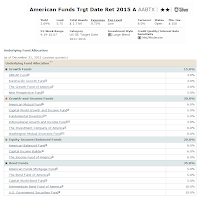

- American Funds Target Date Ret 2015 A (AABTX)

- MassMutual RetireSMART 2015 A (MMJAX)

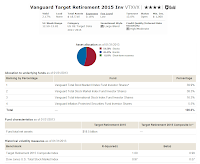

- Vanguard Target Retirement 2015 Investor (VTXVX)

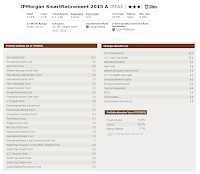

- JPMorgan SmartRetirement 2015 A (JSFAX)

- Harbor Target Retirement 2015 Investor (HARIX)

- Schwab Target 2015 (SWGRX)

- Nationwide Destination 2015 A (NWEAX)

- American Century LIVESTRONG 2015 Investor (ARFIX)

- BlackRock LifePath Active 2015 Investor A (BAPBX)

- Vantagepoint Milestone 2015 Investor M (VPRPX)

|

| T. Rowe Price Retirement 2015 Fund |

T. Rowe Price Retirement 2015 Fund (TRRGX)

This T. Rowe Price Retirement 2015 Fund objective is to provide highest total return over time through income and capital appreciation. It utilizes its assets to purchase other T. Rowe Price stock and bond funds that represent various asset classes and sectors. It has 0.66% annual expense ratio. This fee is slightly higher than the category average, 0.49%. The total net assets are $7.7 billion. It provides 2.04% of dividend yield. Jerome A. Clark is the current fund’s manager.

This top performing target date 2011-2015 mutual fund has 2.02% of YTD return. It has returned 4.83% over the past 5-years. Records have shown that the fund has 6 years of positive return and 2 years of negative return. The best achievement was achieved in 2009 with 31.35% and the worst in 2008 with -30.22%. The shares price is $13.29.

As of January 2013, the top 10 holdings of the fund represent 83.50% of the total net assets. They are T. Rowe Price Emerging Markets Bond Fund, T. Rowe Price Equity Index 500 Fund, T. Rowe Price Growth Stock Fund, T. Rowe Price High Yield Fund, T. Rowe Price Inflation Focused Bond Fund, etc. The top assets allocation is Domestic Stock (41.8%), Domestic Bond (27.8%) and Foreign Stock (19.3%).

American Funds Target Date Retirement 2015 Fund (AABTX)

|

| American Funds holdings |

Since its inception in 2007, the yearly performance of the fund is as below:

- Year 2008: -29.08% (lowest)

- Year 2009: 24.58% (highest)

- Year 2010: 9.86%

More: Best Performing Moderate Allocation Mutual Funds November 2012

The underlying fund allocation as of December 2012 is Bond Funds (35.0%), Growth-and-Income Funds (30.0%), Equity-Income/ Balanced Funds (20.0%) and Growth Fund (15.0%).

MassMutual RetireSMART 2015 Fund (MMJAX)

As part of the best performer Target Date 2011-2015 mutual fund, this MMJAX fund has a low of total net assets of $10.4 million only. The annual expense ratio is 1.12%. It also has 1.81% dividend yield. It is currently managed by Bruce Picard Jr. The fund has annual holdings turnover of 82% as of February 14, 2013. It uses its assets to purchase a combination of domestic and international mutual funds sponsored by MassMutual.

This best performing target date 2011-2015 mutual fund has recorded a return of -0.67% in 2011 and 12.46% for 2012. The year-to-date return of the fund is 1.86%. There is no Morningstar rating yet because the fund is still new.

Vanguard Target Retirement 2015 Fund (VTXVX)

|

| Vanguard Fund |

This balanced fund has 4-stars and Gold rating from Morningstar. It is also one of MEPB Financial best mutual funds for 2013. It invests mainly in Vanguard mutual funds according to an asset allocation strategy designed for investors planning to retire and leave the work force in or within a few years of 2015.

More: Best No Load Retirement Income Balanced Mutual Funds 2013

Since its inception in 2003, it has recorded a total of 8 years positive return. The only year it recorded in negative return was in 2008 with -24.06%. The fund has YTD return of 2.02%. Based on the load adjusted returns, this target date fund has returned 10.01% over the past 1-year and 4.51% over the past 5-year.

The top allocations to underlying funds as of January 2013 are Vanguard Total Bond Market II Index Fund Investor Shares (39.9%) and Vanguard Total Stock Market Index Fund Investor Shares (38.3%).

|

| JPMorgan fund details |

JPMorgan SmartRetirement 2015 Fund (JSFAX)

JPMorgan SmartRetirement 2015 Fund is managed by Patrik Jakobson since May 2006. It utilizes its assets to purchase other J.P. Morgan Funds (underlying funds), and is generally intended for investors expecting to retire around the year 2015. The fund has total net assets of $1.1 billion. It also has 3-stars rating and Silver rating from Morningstar. It has a decent yield of 2.31%. The expense fee is only 0.91% per year.

The best 1-year total return was recorded in 2009 with 26.46%. The worst was occurred in 2008 with -25.88%. It also has a year-to-date return of 1.18%. The fund’s benchmarks are S&P Target Date 2015 Index and Lipper Mixed-Asset Target 2015 Funds Index.

More: Top Performer Target Date Mutual Funds 2011

The top portfolio as of January 2013 is Core Bond Fund (33.1%), Disciplined Equity Fund (9.2%), High Yield Fund (8.5%) and Inflation Managed Bond Fund (4.2%). Based on strategic allocation, it is 34.7% in US Fixed Income and 20.8% in US Large Cap Equity.

Fund Information

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield | Net Assets (mil) | Min Invest |

|---|---|---|---|---|---|---|---|

| 1 | T. Rowe Price Retirement 2015 | TRRGX | 4 | 0.66 | 2.04 | 7,700 | 2,500 |

| 2 | JHancock2 Retire Living through 2015 A | JLBAX | 2 | 1.34 | 2.34 | 642 | 2,500 |

| 3 | American Funds Trgt Date Ret 2015 A | AABTX | 2 | 0.73 | 2.09 | 1,700 | 250 |

| 4 | MassMutual RetireSMART 2015 A | MMJAX | N/A | 1.12 | 1.81 | 10 | - |

| 5 | Vanguard Target Retirement 2015 Inv | VTXVX | 4 | 0.16 | 2.17 | 18,500 | 1,000 |

| 6 | JPMorgan SmartRetirement 2015 A | JSFAX | 3 | 0.91 | 2.31 | 1,100 | 500 |

| 7 | Harbor Target Retirement 2015 Inv | HARIX | 3 | 1.01 | 3.84 | 12 | 2,500 |

| 8 | Schwab Target 2015 | SWGRX | 3 | 0.63 | 2.02 | 76 | 100 |

| 9 | Nationwide Destination 2015 A | NWEAX | 2 | 0.92 | 1.29 | 153 | 2,000 |

| 10 | American Century LIVESTRONG 2015 Inv | ARFIX | 5 | 0.8 | 1.94 | 1,000 | 2,500 |

| 11 | BlackRock LifePath Active 2015 Inv A | BAPBX | 3 | 1.03 | 1.28 | 18 | 1,000 |

| 12 | Vantagepoint Milestone 2015 Inv M | VPRPX | 3 | 0.88 | 1.8 | 451 | - |

Fund Performance

| No | Fund Description | YTD return | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|

| 1 | T. Rowe Price Retirement 2015 | 2.02 | 7.56 | 9.89 | 4.83 | N/A |

| 2 | JHancock2 Retire Living through 2015 A | 2.11 | 7.81 | 8.94 | 3.54 | N/A |

| 3 | American Funds Trgt Date Ret 2015 A | 1.86 | 7.54 | 8.63 | 3.18 | N/A |

| 4 | MassMutual RetireSMART 2015 A | 2.1 | 6.58 | N/A | N/A | N/A |

| 5 | Vanguard Target Retirement 2015 Inv | 2.02 | 6.84 | 9.2 | 4.51 | N/A |

| 6 | JPMorgan SmartRetirement 2015 A | 1.18 | 6.6 | 9.12 | 4.62 | N/A |

| 7 | Harbor Target Retirement 2015 Inv | 1.25 | 7.26 | 8.6 | N/A | N/A |

| 8 | Schwab Target 2015 | 1.98 | 6.88 | 8.88 | N/A | N/A |

| 9 | Nationwide Destination 2015 A | 1.58 | 6.29 | 7.43 | 2.44 | N/A |

| 10 | American Century LIVESTRONG 2015 Inv | 1.62 | 6.45 | 8.82 | 4.54 | N/A |

| 11 | BlackRock LifePath Active 2015 Inv A | 1.34 | 6.46 | 8.85 | 4.24 | N/A |

| 12 | Vantagepoint Milestone 2015 Inv M | 2.12 | 6.2 | 7.93 | 3.7 | N/A |

No comments:

Post a Comment