401k Plan

Finding the right mutual funds for your 401k account is important. Many funds charge high fees, underperform the bond or stock market, no growth, and little yield for appreciation. The mutual funds offered to investors in 401(k) plans or accounts can be worse than regular brokerage account or traditional IRA or Roth IRA. |

| Best Mutual Funds for 401(k) |

Best Mutual Funds

Another best option is choosing a low cost index fund. This fund has low expense fee and there is no sales load. The following are some of the best mutual funds for your 401(k) account. You can find the fund review in details below. I have included the shares price, yield, expense fee, return, top holdings, etc.Note: There are two type of 401k accounts: Roth 401k and traditional 401k.

The 10 great 401k mutual funds for 2013 & 2014 are:

- Vanguard Total Stock Market Index Fund (VTSMX)

- PIMCO Total Return Fund (PTTAX)

- Vanguard 500 Index Fund (VFINX)

- DoubleLine Total Return Bond Fund (DLTNX)

- American Funds EuroPacific Growth Fund (AEPGX)

- Fidelity Contrafund (FCNTX)

- Vanguard Total International Stock Index Fund (VGTSX)

- Franklin Income Fund (FKINX)

- Templeton Global Bond Fund (TPINX)

- Vanguard Wellington Fund (VWELX)

Vanguard Total Stock Market Index Fund (VTSMX)

As part of Vanguard fund, this Vanguard Total Stock Market Index fund has $27.7 billion of total net assets. It utilizes its assets to purchase stocks of U.S. large companies. This index fund has a decent dividend yield of 1.91%. It also has a low expense ratio of 0.17%. This fee is considered lower than the average in the Large Blend category which is 1.12%. Gerard C. O’Reilly is the fund manager.More: Best Mutual Funds for 2013

Based on the load adjusted returns, the fund’s performance is as below:

- 1-year: 16.72%

- 3-year: 14.53%

- 5-year: 4.58%

- 10-year: 8.69%

The top 5 stocks in its portfolio are Apple Inc, Exxon Mobil Corp, General Electric Co, Chevron Corp and IBM Corp. The top equity sector diversification is Information Technology (17.90%), Financials (16.70%) and, Consumer Discretionary (12.40%).

PIMCO Total Return Fund (PTTAX)

PIMCO Total Return Fund is the most popular fund for 401(k) account. It has big total net assets of $285.6 billion. Morningstar analysts rank this fixed income fund with 4-stars and Silver rating. This fund invests mainly in high quality bonds including government, corporate and international bonds. It may use future, derivative, and options to enhance its returns. The fund’s fee level is below average with 0.85% annual expense ratio. The dividend is distributed monthly to the investors out of 3.65% 12-month dividend yield.

PIMCO Total Return Fund is the most popular fund for 401(k) account. It has big total net assets of $285.6 billion. Morningstar analysts rank this fixed income fund with 4-stars and Silver rating. This fund invests mainly in high quality bonds including government, corporate and international bonds. It may use future, derivative, and options to enhance its returns. The fund’s fee level is below average with 0.85% annual expense ratio. The dividend is distributed monthly to the investors out of 3.65% 12-month dividend yield.William H. Gross is the current fund manager. Bill Gross is also one of the top and popular bond managers. The fund has -0.21% year-to-date return. Since inception, it has only 1 year of negative return in 1999 with -0.75%. The best 1-year total return within 14 years was in 2009 with 13.33%.

Top 401k Funds

This best mutual fund can be purchased with minimum initial investment of $1,000 through 130 brokerages. In 401(k) account, you may find other classes of this fund such as Institutional class (PTTRX), Admin Class (PTRAX), Class P (PTTPX), and Class R (PTRRX). It has an effective duration of 4.77 years and an effective maturity of 6.09 years. The average turnover rate as of January 2013 is 584%.Vanguard 500 Index Fund (VFINX)

Vanguard 500 Index Fund is one of the largest index mutual funds. It invests mainly in equities of U.S. companies. This equity fund has 1.95% of dividend yield. It also has an annual expense ratio of 0.17%. This fee is 85% lower than the average expense ratio of funds with similar holdings. It is currently managed by Michael H. Buek.This great 401k mutual fund has 4-stars rating from Morningstar for its performance of 29 years of positive return and 7 years of negative return. It has 6.84% of YTD return. The best 1-year total return was in 1998 with 28.62%. S&P 500 Index is this VFINX fund’s benchmark.

The top ten holdings represent 18.7% of total net assets. Some of them are Apple Inc, Exxon Mobil Corp, General Electric Co, Chevron Corp and IBM Corp. The top equity sector diversification is Information Technology (18.40%), Financials (15.80%) and Health Care (12.30%).

DoubleLine Total Return Bond Fund (DLTNX)

DoubleLine Total Return Bond Fund is another great 401k mutual fund. Jeffrey Gundlach and Philip Barach are the fund managers. Jeff Gundlach is another famous bond manager with great performance. He used to manage the TCW Total Return Fund (TGLMX). Since this fund has just been incepted in 2010, it has no Morningstar rating, yet only neutral rating.

DoubleLine Total Return Bond Fund is another great 401k mutual fund. Jeffrey Gundlach and Philip Barach are the fund managers. Jeff Gundlach is another famous bond manager with great performance. He used to manage the TCW Total Return Fund (TGLMX). Since this fund has just been incepted in 2010, it has no Morningstar rating, yet only neutral rating.This best retirement mutual fund has $38.8 billion of total assets. It also has a high yield of 5.63%. The annual holdings turnover rate is also very low, only 15%. The category average holdings turnover rate is 152.84% in the Intermediate-Term Bond category. Another class of this fund is DBLTX (Class I).

The YTD return of this DLTNX fund is 0.56%. The fund returned 9.16% in 2011 and 9.00% in 2012. The fund uses Barclays US Aggregate Bond Index as its benchmark. The top sector breakdowns are Agency Passthroughs (29.4%), Non-Agency Residential MBS (28.1%), Cash (18.9%) and Agency CMO (18.3%).

American Funds EuroPacific Growth Fund (AEPGX)

This American Funds EuroPacific Growth Fund is a popular international stock mutual fund for 401(k). It has consistent returns for the past 10 years. Managed by a team of managers including Stephen B. Bepler, it has 4-stars and Gold rating from Morningstar.More: Best American Funds for 2013

This top mutual fund for 401(k) account invests mainly in common stocks of companies in Europe and the Pacific Basin with growth potential. The fund’s assets are totaling $108 billion. The investors got their 1.62% annual dividend paid in December every year. Last December 2012, they received $0.69. It also has 0.84% of annual expense ratio. The CUSIP of this fund is 298706102.

This top mutual fund for 401(k) account invests mainly in common stocks of companies in Europe and the Pacific Basin with growth potential. The fund’s assets are totaling $108 billion. The investors got their 1.62% annual dividend paid in December every year. Last December 2012, they received $0.69. It also has 0.84% of annual expense ratio. The CUSIP of this fund is 298706102.Based on the load adjusted returns, this foreign large blend mutual fund has returned 12.36% over the past 1-year and 9.39% over the past decade. It has its best return within 22 years of positive return in 1999 with 56.97%. The year-to-date return is 2.96%.

The largest industry holdings are Commercial Banks (9.7%) and Pharmaceuticals (9.6%). The 5 largest equity holdings as of January 2013 are Novo Nordisk (3.9%), Samsung Electronics (2.3%), Novartis (2.0%), Softbank (1.8%) and Bayer (1.8%).

Fidelity Contrafund (FCNTX)

The investment objective of Fidelity Contrafund is to provide capital appreciation. It uses its assets to buy undervalue common stocks. This top performer 401k mutual fund has been in the market since 1967. William Danoff has managed it since 1990. It has annual expense ratio of 0.81%. The total asses are $88.1 billion.This great fund also has 4-stars rating from Morningstar. It has 33 years of positive return and 12 years of negative return. The best achievement was recorded in 1998 with 31.57%. Currently it has 5.51% of year-to-date return.

The top 10 stocks in its portfolio are Apple Inc, Google Inc A, Berkshire Hathaway Inc Class A, Wells Fargo & Co, Coca Cola Co, Walt Disney Co, Noble Energy Inc, Visa Inc Class A, TJX Companies Inc New and Amazon.com Inc. They represent 30.7% of total portfolio.

Vanguard Total International Stock Index Fund (VGTSX)

Vanguard Total International Stock Index Fund invests majority of assets in stocks issued by companies located in developed and emerging markets, excluding the United States. Ranked with 4-stars and Gold rating, it has $1.4 billion total net assets. It shares 2.82% dividend yield to the investors.The minimum initial investment needed for brokerage account is $3,000. The other classes of this fund include admiral shares (VTIAX), ETF class (VXUS), Institutional Plus Class (VTPSX), Institutional Class (VTSNX), and Signal Class (VTSGX).

In 2013, this international stock fund has year-to-date return of 2.67%. The annual expense ratio is 0.22%, quite low compared to the average in the Foreign Large Blend category (1.30%). The best 1-year returns as recorded in 2003 with 40.34%. The current fund’s NAV is $15.34.

More: Top 8 Exchange Traded Funds 2013

Depending upon your company 401(k) account, you can also choose other classes of this fund. The other classes are Admiral Shares (VTIAX), Institutional Plus Class (VTPSX), Institutional Class (VTSNX), Signal Shares (VTSGX) and ETF Class (VXUS).

The top region allocation is 44.50% in Europe, 27.20% in Pacific and 19.80% in Emerging Markets. The 5 largest holdings are Royal Dutch Shell plc, Nestle SA, HSBC Holdings plc, BHP Billiton Ltd and Samsung Electronics Co Ltd.

Franklin Income Fund (FKINX)

Franklin Income Fund invests most of its assets in a diversified portfolio of debt and equity securities. This Franklin fund is currently managed by an investment team of Edward D. Perks, Matthew Quinlan, Alex W. Peters and Charles B. Johnson. Investors will receive a dividend yield of 6.00% per year. In January 2013, they get $0.01. It also has $73.2 billion of total net assets.

Franklin Income Fund invests most of its assets in a diversified portfolio of debt and equity securities. This Franklin fund is currently managed by an investment team of Edward D. Perks, Matthew Quinlan, Alex W. Peters and Charles B. Johnson. Investors will receive a dividend yield of 6.00% per year. In January 2013, they get $0.01. It also has $73.2 billion of total net assets.This great 401k mutual fund for 2014 is ranked with 4-stars and Bronze rating by Morningstar. Since 1948, the fund has recorded 52 years of positive return and 12 years of negative return. Based on load adjusted returns, it has returned 9.39% over the past 3-year and 8.60% over the past 10 years.

The top 5 bond holdings as of December 2012 are First Data Corp (4.67%), Energy Future Holdings Corp (3.02%), Chesapeake Energy Corp (1.86%), Sprint Nextel Corp (1.57%) and CC Media Holdings Inc (1.47%).

Templeton Global Bond Fund (TPINX)

Templeton Global Bond Fund is one of the top and best international bond mutual funds. Morningstar analysts rank this fixed income fund with the highest rating. It has 5-stars and Gold rating. The fund has 5.64% dividend yield. The annual expense ratio is 0.89%. It has 41.70% annual holdings turnover as of January 2013.Investors can start investing in a discount brokerage account with a minimum initial investment of $1,000. In your 401(k) account or retirement account, you may have other selection of fund’s classes. The other classes include Class Advisor (TGBAX), Class C (TEGBX), and Class R (FGBRX).

The top holdings as of January 2013 are Government of Ireland (3.02%), Korea Treasury Bond 3.00% (2.30%), Korea Treasury Bond 3.75% (2.06%), Kommuninvest I Sverige AB (1.91%) and New South Wales Treasury Corp (1.61%). The geographic breakdown is 39.11% in Europe/ Africa and 32.82% in Asia.

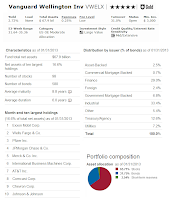

Vanguard Wellington Fund (VWELX)

The Vanguard Wellington Fund is a top moderate allocation mutual fund. It invests in stocks, bonds, and money market funds. It has total assets of $67.9 billion. It has been in the market since 1929. It is Vanguard’s oldest mutual fund and the nation’s oldest balanced fund. Morningstar ranks it with 5-stars and Gold rating. It has 0.25% of annual expense ratio.

The Vanguard Wellington Fund is a top moderate allocation mutual fund. It invests in stocks, bonds, and money market funds. It has total assets of $67.9 billion. It has been in the market since 1929. It is Vanguard’s oldest mutual fund and the nation’s oldest balanced fund. Morningstar ranks it with 5-stars and Gold rating. It has 0.25% of annual expense ratio.The average maturity of the fund is 8.8 years and the average duration is 6.0 years. It has a total of 98 stocks and 580 bonds. The YTD return is 4.40%. The shares price is $35.32. As one of the best retirement mutual funds, the shares price is $35.88.

As of January 2013, the largest holdings are Exxon Mobil Corp, Wells Fargo & Co, Pfizer Inc, JPMorgan Chase & Co and Merck & Co Inc.

Disclosure: No Position

401(k) providers

Depending on your company 401(k) set up, you might invest through the following brokerages:- Vanguard – It provides variety of great 401(k) mutual funds selection

- Fidelity – Fidelity also offers a lot of choices, sometimes you might have a choice to invest in PIMCO or Vanguard mutual funds.

- Prudential – It may offer sales load mutual funds. This load fund may reduce your long term performance. Try to choose an index fund.

- T. Rowe Price – There are wide selection of mutual funds to choose from. There are lot of high ranks mutual funds.

Fund Information

| No | Fund Description | Ticker | Rating | Yield % | Expense Ratio % | Net Assets (Bil) | Min Investment |

|---|---|---|---|---|---|---|---|

| 1 | PIMCO Total Return A | PTTAX | 4 | 3.65 | 0.85 | $285.60 | $1,000 |

| 2 | Vanguard Total Stock Mkt Idx Inv | VTSMX | 4 | 1.91 | 0.17 | $27.70 | $3,000 |

| 3 | DoubleLine Total Return Bond N | DLTNX | N/A | 5.63 | 0.74 | $38.80 | $2,000 |

| 4 | Vanguard 500 Index Inv | VFINX | 4 | 1.95 | 0.17 | $8.00 | $3,000 |

| 5 | American Funds EuroPacific Gr A | AEPGX | 4 | 1.62 | 0.84 | $108.00 | $250 |

| 6 | Fidelity Contrafund | FCNTX | 4 | 0.26 | 0.81 | $88.10 | $2,500 |

| 7 | Vanguard Total Intl Stock Index Inv | VGTSX | 4 | 2.82 | 0.22 | $1.40 | $3,000 |

| 8 | Franklin Income A | FKINX | 4 | 6 | 0.64 | $73.20 | $1,000 |

| 9 | Templeton Global Bond A | TPINX | 5 | 5.64 | 0.89 | $68.40 | $1,000 |

| 10 | Vanguard Wellington Inv | VWELX | 5 | 2.72 | 0.25 | $67.90 | $3,000 |

Fund Performance

| No | Fund Description | Ticker | YTD Return % | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|---|

| 1 | PIMCO Total Return Fund | PTTAX | -0.21 | 6.76 | 6.7 | 7.27 | 6.25 |

| 2 | Vanguard Total Stock Market Index Fund | VTSMX | 7.27 | 15.54 | 14.95 | 5.3 | 9.17 |

| 3 | DoubleLine Total Return Bond Fund | DLTNX | 0.56 | 7.32 | N/A | N/A | N/A |

| 4 | Vanguard 500 Index Fund | VFINX | 6.84 | 15.57 | 14.47 | 4.62 | 8.24 |

| 5 | American Funds EuroPacific Growth Fund | AEPGX | 2.96 | 11.63 | 7.72 | 1.05 | 10.99 |

| 6 | Fidelity Contrafund | FCNTX | 5.51 | 13.17 | 14.16 | 5.32 | 10.89 |

| 7 | Vanguard Total International Stock Index Fund | VGTSX | 2.67 | 9.93 | 7.17 | -0.42 | 10.24 |

| 8 | Franklin Income Fund | FKINX | 3.25 | 13.41 | 11.89 | 5.83 | 9.34 |

| 9 | Templeton Global Bond fund | TPINX | 1.35 | 9.82 | 8.42 | 9.51 | 10.34 |

| 10 | Vanguard Wellington Fund | VWELX | 4.4 | 12.4 | 11.46 | 5.99 | 9.09 |

No comments:

Post a Comment