Best Performing Bond Mutual Funds

Best Performing Bond Mutual Funds

Short government bond mutual fund is part of taxable bond mutual fund. It invests mainly in debts backed by U.S. government or its agency. This fixed income fund has shorter durations between 1 and 3.5 years. This short government mutual fund is relatively less sensitive to interest rates, and has low risk potential. It also has lower yield for income.These top performing mutual funds are sorted based on its 1 year total return up to August, 1 2013. You may find other fund review information: expense ratio fee, management, objective, yield, top holdings, etc.

Top performing short government mutual funds August 2013 are:

- Homestead Short-Term Government Fund (HOSGX)

- LWAS/DFA Two-Year Government Portfolio Fund (DFYGX)

- Loomis Sayles Ltd Term Government and Agency Fund (NEFLX)

- USFS Funds Limited Duration Government Fund (USLDX)

- GMO US Treasury Fund (GUSTX)

- American Century Zero Coupon 2015 Fund (BTFTX)

- Franklin Adjustable US Government Securities Fund (FISAX)

- Vanguard Short-Term Treasury Fund (VFISX)

- Wells Fargo Advantage Short Duration Government Bond Fund (MSDAX)

- Oppenheimer Limited-Term Government Fund (OPGVX)

- Goldman Sachs Short Duration Government Fund (GSSDX)

- Invesco Limited Maturity Treasury Fund (SHTIX)

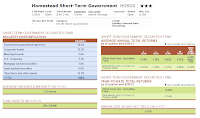

Homestead Short-Term Government Fund (HOSGX)

This top performer mutual fund in Short Government category seeks to earn a competitive level of interest income, consistent with a low level of share-price volatility. The total net assets are $89.3 million. It has annual expense ratio of 0.69%. It is currently managed by Doug Kern. The dividend yield is 1.06%. Morningstar analysts rank this Homestead Short-Term Government fund with 3-stars rating. Since the inception in 1995, the fund has always returned in positive returns. The highest return so far was in 2000 with 7.04% and the lowest in 2004 with 1.03%. Based on the load adjusted returns, the fund has returned 2.48% over the past 5-year and 2.69% in 10-year. The fund uses BofA Merrill Lynch 1-5 Year US Treasury Index as its benchmark.

Morningstar analysts rank this Homestead Short-Term Government fund with 3-stars rating. Since the inception in 1995, the fund has always returned in positive returns. The highest return so far was in 2000 with 7.04% and the lowest in 2004 with 1.03%. Based on the load adjusted returns, the fund has returned 2.48% over the past 5-year and 2.69% in 10-year. The fund uses BofA Merrill Lynch 1-5 Year US Treasury Index as its benchmark.The top security diversifications as of June 2013 are Government-guaranteed agencies (60.4%), Corporate Bonds (12.2%), Municipal Bonds (5.6%) and US Treasuries (5.1%). It has average weighted maturity of 2.93 years.

Loomis Sayles Limited Term Government and Agency Fund (NEFLX)

The objective of this Loomis Sayles Limited Term Government and Agency fund is to get high current return consistent with preservation of capital. It uses its assets to purchase investments issued or guaranteed by the U.S. government. The CUSIP is 543487359. It has $692.1 million of total net assets. The 12-month dividend yield is 2.21%. The most recent distribution was in June 2013 in the amount of $0.02. The expense ratio is 0.85% per year.More: Best Performing Intermediate Government Mutual Funds February 2013

AS one of the top performer short government mutual fund, it is managed by Clifton V. Rowe, Kurt L. Wagner and Christopher T. Harms. Ranked with 4-stars rating by Morningstar, this fixed income fund has 21 years of positive return. Its best 1-year total return was achieved in 2000 with 8.31%. The worst 1-year total return was occurred in 1999 with -0.71%.

The top 2 sector breakdowns as of March 2013 are MBS (73.69%) and CMBS (14.68%). It has effective duration of 2.23 years and average maturity of 3.55 years.

American Century Zero Coupon 2015 Fund (BTFTX)

This American Century Zero Coupon 2015 Fund invests mainly in US Treasury securities especially zero-coupon securities. The expense ratio is 0.55%. Its yield is 2.31%. The total assets are $208.7 million. According to the fund’s website, as of March 2013, the fund is closed to all investments, except reinvested distributions and capital gains distributions. The fund managers are G. David MacEwen, Robert V. Gahagan, Brain Howell and Jim Platz.

This American Century Zero Coupon 2015 Fund invests mainly in US Treasury securities especially zero-coupon securities. The expense ratio is 0.55%. Its yield is 2.31%. The total assets are $208.7 million. According to the fund’s website, as of March 2013, the fund is closed to all investments, except reinvested distributions and capital gains distributions. The fund managers are G. David MacEwen, Robert V. Gahagan, Brain Howell and Jim Platz.More: Best Ultrashort Bond Mutual Funds 2013

As of July 18, 2013, this short government mutual fund has YTD return of -0.09%. It has 5-year average return of 5.19%. The fund was first introduced to public in 1986. It is ranked with 5-stars by Morningstar analysts. The best total return within 20 years of positive return was in 2000 with 26.59%. The top portfolio investment blend is Treasury (67.58%).

Mutual Fund Returns

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield | YTD Return % | 1-Year Return % | 3-Year Return % |

|---|---|---|---|---|---|---|---|---|

| 1 | Homestead Short-Term Government | HOSGX | 3 | 0.69% | 1.06% | -0.41% | 0.19% | 1.22% |

| 2 | LWAS/DFA Two-Year Government Portfolio | DFYGX | 3 | 0.28% | 0.11% | 0.11% | 0.19% | 0.66% |

| 3 | Loomis Sayles Ltd Term Govt and Agency A | NEFLX | 4 | 0.85% | 2.21% | -1.02% | 0.17% | 1.93% |

| 4 | USFS Funds Limited Duration Govt | USLDX | 2 | 0.75% | 0.59% | -0.22% | 0.17% | 0.45% |

| 5 | GMO US Treasury | GUSTX | 2 | 0.00% | 0.10% | 0.10% | 0.16% | 0.11% |

| 6 | American Century Zero Coupon 2015 Inv | BTFTX | 5 | 0.55% | 2.31% | -0.09% | 0.13% | 3.14% |

| 7 | Franklin Adjustable US Govt Secs A | FISAX | 2 | 0.87% | 1.53% | -0.09% | 0.05% | 1.24% |

| 8 | Vanguard Short-Term Treasury Inv | VFISX | 4 | 0.20% | 0.30% | -0.28% | 0.00% | 0.96% |

| 9 | Wells Fargo Advantage Sh Dur Govt Bd A | MSDAX | 4 | 0.83% | 1.98% | -0.44% | 0.00% | 1.48% |

| 10 | Oppenheimer Limited-Term Government A | OPGVX | 2 | 0.80% | 2.09% | -0.79% | 0.00% | 1.48% |

| 11 | Goldman Sachs Short Dur Govt A | GSSDX | 3 | 0.81% | 0.65% | -0.26% | -0.10% | 0.49% |

| 12 | Invesco Limited Maturity Treasury A2 | SHTIX | 2 | 0.46% | 0.03% | -0.17% | -0.17% | 0.26% |

No comments:

Post a Comment