Most people or investors like tax-deferred retirement account such as 401(k) plan. They can set up automatic payroll deductions at the companies for financial investment; most of the companies also offer matching contributions. Some companies may provide 50% match up to the first 6%, and some may offer 100% match up to the first 10%, etc.

With higher costs in healthcare and portfolio lowered due to economy, these plans alone may not be enough for their retirement.

According to recent studies, future retiree may need 80% of their pre-retirement income per year to maintain current standard of living. To increase their

retirement income, it is advisable to add additional saving plans with individual retirement accounts or IRAs.

IRA Types

IRA Types

There two main types of individual retirement accounts such as traditional IRA and Roth IRA. Both may have each own benefits and disadvantages. Traditional IRA permits retirement contributions to grow tax-deferred until it was withdrawn. This may increase their growth potential. Investors may claim income tax deduction on their IRA contributions.

On the other hand, Roth IRA offers tax-free growth because the contributions are done with already-taxed income. There is no income tax deduction, but contributions (minus earnings) can be withdrawn without tax or penalty. It is popular for investors for college or education and retirement saving.

The eligibility to contribute to an IRA phases out above certain income level. Please check with IRS or

your financial advisor for details about the eligibility. The current annual limit per Internal Revenue Services on total IRA contributions as of 2013 is $5,500 ($6,500 for anyone 50 or older currently).

As you probably know, there is also a limit to invest in your 401(k) plan. Using IRA, you may increase your retirement saving for your future income. Currently the contribution limit to a tax deferred retirement plan is $17,500 per year. If you have reached the limit for your 401(k) contribution, investing in Roth IRA or traditional IRA is not a bad idea after all.

Top Retirement Income Funds

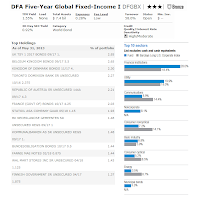

Some of these best funds are suitable for your investments in your retirement account:

- PIMCO Total Return Fund (PTTDX)

- Vanguard Total Stock Market Index Fund (VTSMX)

- DoubleLine Total Return Bond Fund (DLTNX)

- Vanguard Target Retirement 2015 Fund (VTXVX)

- Dodge & Cox International Stock Fund (DODFX)

- Vanguard Wellington Fund (VWENX)

Best Brokerage to Invest

Choosing a

brokerage for individual retirement account (IRA) is another challenging topic. I have listed the following top fund brokers for your selection. These online brokerages are suitable for your traditional IRA or Roth IRA.

If you want to invest for your retirement account, you can choose online or discount brokerage. Some of these brokerages are:

- Vanguard – It provides wide selection of investment funds including index fund

- Fidelity – It provides financial services and top fund picks, you can trade stocks or bonds

- Charles Schwab – There is no maintenance fee, you can choose low cost Schwab funds

- Scottrade – There is low initial balance requirement, only $500 to start. There are wide selection of funds to choose from.

Best Cheap Sector Stock Mutual Funds

Best Cheap Sector Stock Mutual Funds