DFA Bond Mutual Fund

The DFA Five-Year Global Fixed-Income Fund objective is to achieve a market rate of return for a fixed income portfolio with low relative volatility of returns. The mutual fund utilizes its assets to purchase a diverse portfolio of U.S. and foreign debt securities maturing in five years or less.This bond fund invests in obligations issued or guaranteed by the U.S. and foreign governments, their agencies and instrumentalities, corporate debt obligations, bank obligations, commercial paper, repurchase agreements, obligations of other domestic and foreign issuers, securities of domestic or foreign issuers denominated in U.S. dollars but not trading in the United States, and obligations of supranational organizations.

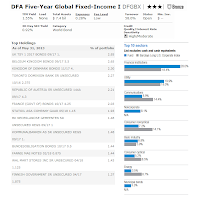

DFA Five-Year Global Fixed-Income Fund Details

- Fund Inception Date: 11/5/1990

- Ticker Symbol: DFGBX

- CUSIP: 233-203-884

- Beta (3yr): 0.79

- Rank in category (YTD): 11%

- Category: World Bond

- Distribution: 1.55%

- Capital Gains: 0%

- Expense Ratio: 0.28%

- Net Assets: $ 7.4 billion

- Number of Years Up: 21 years

- Number of Years Down: 1 year

- Average Duration: 4.05 years

- Average Maturity: 3.85 years

- Annual Turnover Rate: 58%

David A. Plecha and Joseph F. Kolerich are the current fund managers. This top world bond fund has large total net assets of $7.4 billion. It also has low annual expense ratio of 0.28%. The average expense fee ratio in the World Bond category is 1.10%. The yield is 1.55%. The most recent distribution was given in June 2013 in the amount of $0.04.

World Bond Mutual Fund

Morningstar analysts rank this world bond fund with 3-stars and Bronze rating. This bond fund uses Citigroup World Government Bond Index 1-5 Years as the fund’s benchmark. Since the inception in 1990, this fund has returned in 21 years of positive return. It has its best 1-year total return in 2002 (10.39%). So far it has only 1 year of negative return which was happened in 2005 with 1.72%. Based on the load adjusted returns, it has returned 3.44% over the past decade and 3.12% over the past 3-year.This no-load fund is available for purchase through 37 brokerages, such as Scottrade Load, Invest n Retire, Schwab Institutional, TD Ameritrade Institutional, Matrix Financial Solutions, etc.

The top holdings as of May 2013 are UK TSY (2.85%), Belgium Kingdom Bonds (2.65%), Kingdom of Denmark Bods (2.30%), Toronto Dominion Bank (2.27%), Republic of Austria (2.21%), Government of France Bonds (2.03%), Statoil ASA Company (1.93%), BK Nederlandse Gemeenten (1.48%), Kommunalbanken AS (1.48%), Bundesobligation Bonds (1.44%) and Fannie Mae Notes (1.44%).

According to the fund’s website, the principal risks of investing in this DFGBX fund are market risk, foreign securities and currencies risk, foreign government debt risk, interest rate risk, credit risk, risks of banking concentration, income risk and derivatives risk.

Disclosure: No Position

No comments:

Post a Comment