Asset Allocation Funds

Asset Allocation Funds

Asset allocation mutual fund or balanced mutual fund invests mainly in a diversified portfolio of bonds, stocks and short term investment or cash. Depending upon its objective, it may invest more in stocks or more in bonds. Some funds may be more conservative or moderate than others funds.These balanced mutual funds are popular among retiree or investors near retirement. You can invest in your brokerage account, retirement account, and 401(k) account. For your retirement account, you can invest in your Roth IRA and traditional IRA. You can invest with as little as $500 initially.

Best Mutual Funds

These lowest cost five star asset allocation mutual funds are sorted based on its expense ratio and top ranked. These best mutual funds may provide capital appreciation and income for investors.Top lowest cost asset allocation mutual funds 2014 are:

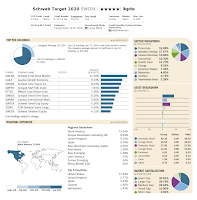

- Schwab Target 2020 (SWCRX)

- Schwab Target 2025 (SWHRX)

- Schwab Target 2030 (SWDRX)

- Schwab Target 2035 (SWIRX)

- Schwab Target 2040 (SWERX)

- GMO Strategic Opportunities Allocation III (GBATX)

- T. Rowe Price Retirement 2005 (TRRFX)

- T. Rowe Price Retirement 2055 (TRRNX)

- Vanguard Target Retirement 2015 Investor (VTXVX)

- TIAA-CREF Lifecycle Index 2010 Institutional (TLTIX)

- TIAA-CREF Lifecycle Index 2020 Institutional (TLWIX)

- TIAA-CREF Lifecycle Index 2030 Institutional (TLHIX)

- TIAA-CREF Lifecycle Index 2035 Institutional (TLYIX)

- TIAA-CREF Lifecycle Index 2040 Institutional (TLZIX)

- TIAA-CREF Lifecycle Index 2045 Institutional (TLXIX)

- TIAA-CREF Lifecycle Index 2050 Institutional (TLLIX)

- VALIC Company II Aggressive Growth Lifestyle (VAGLX)

- SAAT Moderate Strategy Allocation A (SXMAX)

- Vanguard Wellesley Income Investor (VWINX)

- Vanguard Wellington Investor (VWELX)

- Vantagepoint Milestone 2045 Investor M (VPRJX)

- GMO Benchmark-Free Allocation III (GBMFX)

- American Beacon Balanced Institutional (AADBX)

- Janus Aspen Balanced Institutional (JABLX)

- Berwyn Income (BERIX)

Schwab Target 2020 Fund (SWCRX)

As the top lowest cost asset allocation mutual fund, this Schwab fund seeks to provide capital appreciation and income consistent with its current asset allocation. It utilizes its assets to purchase a combination of other Schwab Funds and Laudus Funds. The total net assets are $372.5 million. This balanced fund is currently managed by Zifan Tang. The fund’s share price is $13.09. It also has an expense ratio of 0.67%.Morningstar analysts rank this Schwab Target 2020 fund with 5-stars and Negative rating. As of August 2013, it has YTD return of 9.54%. The fund has 6 years of positive return. Its best 1 year return was achieved in 2009 with 22.56%. Since its inception, this fund of funds has only returned negatively in 2008 (-26.62%). Its benchmark is S&P 500 TR USD.

The top 10 holdings as of June 2013 represent 71.34% of the total portfolio. They are Schwab Total Bond Market (11.39%), Laudus Growth Investors (9.19%), Schwab Core Equity Investor (8.64%) and Schwab S&P 500 Index (7.81%). The top sectors are Financials (19.08%) and Information Technology (17.67%).

T. Rowe Price Retirement 2005 Fund (TRRFX)

This T. Rowe Price Retirement 2005 fund is currently open to new retail investors. It also has higher bond portions than stock portion (i.e. conservative allocation fund). The total net assets are $1.4 billion. It has an annual expense ratio of 0.59%. The dividend yield is 2.19%. The latest distribution was given in December 2012 in the amount of $0.28. The annual holdings turnover as of July 29, 2013 is 15.70%.Low Cost Balanced Funds

Since the inception in 2004, this top performing mutual fund has recorded 7 years of positive return and only 1 year of negative return. The best 1-year total return was occurred in 2009 with 24.55%. Based on the load adjusted returns, this top balanced fund has returned 8.12% over the past 1-year and 5.65% over the past 5-year. It has 5-stars and Gold rating from Morningstar.

Since the inception in 2004, this top performing mutual fund has recorded 7 years of positive return and only 1 year of negative return. The best 1-year total return was occurred in 2009 with 24.55%. Based on the load adjusted returns, this top balanced fund has returned 8.12% over the past 1-year and 5.65% over the past 5-year. It has 5-stars and Gold rating from Morningstar.The second quarter-end top 5 funds in its holdings are T. Rowe Price Emerging Markets bond Fund, T. Rowe Price Emerging Markets Stock Fund, T. Rowe Price Equity Index 500 Fund, T. Rowe Price High Yield Fund and T. Rowe Price Inflation Focused Bond Fund. The top 10 holdings represent 92.64% of total net assets. The top asset allocations are Domestic Bond (42.9%) and Domestic Stock (30.3%).

Vanguard Target Retirement 2015 Fund (VTXVX)

The objective of this investor share fund is to provide capital appreciation and current income consistent with its current asset allocation. This Vanguard Target Retirement 2015 fund was first introduced to public in October 2003. As one of the Vanguard’s fund, it has large assets of $19.5 billion. The annual expense ratio is only 0.16%. The average ratio in the category is 0.48%. William H. Coleman is the current fund manager.As of August 1, 2013, the fund has YTD return of 7.47%. This top lowest cost asset allocation mutual fund is rated with 5-stars and Gold rating. For the past 3 years, it has managed to have positive returns. The best 1-year total return was occured in 2009 (21.30%). Based on the load adjusted returns, the fund has returned 10.55% over the past 3-year and 5.45% over the past 5-year.

This top lowest cost asset allocation mutual fund uses Target Retirement 2015 Composite Index and Dow Jones US Total Stock market Index as its benchmarks. The top asset allocation is Stocks (53.31%). The top allocations are Vanguard Total Stock Market Index Fund Investor Shares (37.8%) and Vanguard Total Bond Market II Index Fund Investors Shares (32.4%).

Top Funds Information

| No | Fund Description | Ticker | Star Rating | Expense Ratio | Net Assets (Mil) | Yield |

|---|---|---|---|---|---|---|

| 1 | GMO Strategic Opportunities Allc III | GBATX | 5 | 0.55% | $2,300.00 | 3.12% |

| 2 | Schwab Target 2020 | SWCRX | 5 | 0.67% | $372.50 | 2.01% |

| 3 | Schwab Target 2025 | SWHRX | 5 | 0.72% | $207.50 | 1.81% |

| 4 | Schwab Target 2030 | SWDRX | 5 | 0.75% | $543.80 | 1.77% |

| 5 | Schwab Target 2035 | SWIRX | 5 | 0.79% | $163.50 | 1.62% |

| 6 | Schwab Target 2040 | SWERX | 5 | 0.81% | $553.40 | 1.63% |

| 7 | T. Rowe Price Retirement 2005 | TRRFX | 5 | 0.59% | $1,400.00 | 2.19% |

| 8 | T. Rowe Price Retirement 2055 | TRRNX | 5 | 0.78% | $742.00 | 1.17% |

| 9 | Vanguard Target Retirement 2015 Inv | VTXVX | 5 | 0.16% | $19,500.00 | 2.08% |

| 10 | TIAA-CREF Lifecycle Index 2010 Inst | TLTIX | 5 | 0.17% | $123.00 | 1.65% |

| 11 | TIAA-CREF Lifecycle Index 2020 Inst | TLWIX | 5 | 0.17% | $305.10 | 1.58% |

| 12 | TIAA-CREF Lifecycle Index 2030 Inst | TLHIX | 5 | 0.17% | $310.10 | 1.59% |

| 13 | TIAA-CREF Lifecycle Index 2035 Inst | TLYIX | 5 | 0.17% | $301.30 | 1.59% |

| 14 | TIAA-CREF Lifecycle Index 2040 Inst | TLZIX | 5 | 0.17% | $363.70 | 1.67% |

| 15 | TIAA-CREF Lifecycle Index 2045 Inst | TLXIX | 5 | 0.17% | $145.50 | 1.60% |

Fund Performance

| No | Fund Description | Ticker | YTD Return | 1-Year Return | 3-Year Return | 5-Year Return |

|---|---|---|---|---|---|---|

| 1 | GMO Strategic Opportunities Allc III | GBATX | 11.52% | 18.86% | 12.67% | 7.65% |

| 2 | Schwab Target 2020 | SWCRX | 9.54% | 15.62% | 11.33% | 6.81% |

| 3 | Schwab Target 2025 | SWHRX | 11.54% | 18.50% | 12.60% | 7.84% |

| 4 | Schwab Target 2030 | SWDRX | 13.19% | 20.77% | 13.42% | 7.89% |

| 5 | Schwab Target 2035 | SWIRX | 14.71% | 23.08% | 14.34% | 8.53% |

| 6 | Schwab Target 2040 | SWERX | 15.81% | 24.58% | 14.94% | 8.49% |

| 7 | T. Rowe Price Retirement 2005 | TRRFX | 5.19% | 9.95% | 8.73% | 6.46% |

| 8 | T. Rowe Price Retirement 2055 | TRRNX | 14.61% | 23.94% | 14.57% | 7.69% |

| 9 | Vanguard Target Retirement 2015 Inv | VTXVX | 7.47% | 12.47% | 10.05% | 6.44% |

| 10 | TIAA-CREF Lifecycle Index 2010 Inst | TLTIX | 5.98% | 10.17% | 9.24% | N/A |

| 11 | TIAA-CREF Lifecycle Index 2020 Inst | TLWIX | 9.08% | 14.55% | 11.02% | N/A |

| 12 | TIAA-CREF Lifecycle Index 2030 Inst | TLHIX | 12.55% | 19.55% | 13.00% | N/A |

| 13 | TIAA-CREF Lifecycle Index 2035 Inst | TLYIX | 14.35% | 22.07% | 14.01% | N/A |

| 14 | TIAA-CREF Lifecycle Index 2040 Inst | TLZIX | 15.25% | 23.36% | 14.39% | N/A |

| 15 | TIAA-CREF Lifecycle Index 2045 Inst | TLXIX | 15.28% | 23.31% | 14.36% | N/A |

| 16 | TIAA-CREF Lifecycle Index 2050 Inst | TLLIX | 15.29% | 23.33% | 14.38% | N/A |

| 17 | VALIC Company II Agrsv Growth Lifestyle | VAGLX | 12.67% | 19.48% | 13.72% | 8.03% |

| 18 | SAAT Moderate Strategy Allc A | SXMAX | 15.61% | 20.89% | 15.90% | 8.19% |

| 19 | Vanguard Wellesley Income Inv | VWINX | 5.55% | 7.89% | 10.21% | 9.10% |

| 20 | Vanguard Wellington Inv | VWELX | 13.26% | 18.13% | 12.96% | 8.48% |

| 21 | Vantagepoint Milestone 2045 Inv M | VPRJX | 17.51% | 26.72% | 14.77% | N/A |

| 22 | GMO Benchmark-Free Allocation III | GBMFX | 6.80% | 11.34% | 9.08% | 7.65% |

| 23 | American Beacon Balanced Instl | AADBX | 15.27% | 21.44% | 13.27% | 8.58% |

| 24 | Janus Aspen Balanced Instl | JABLX | 11.90% | 17.10% | 11.63% | 9.15% |

| 25 | Berwyn Income | BERIX | 9.08% | 14.14% | 8.47% | 9.45% |

No comments:

Post a Comment