Best Cheap Mutual Funds

Best Cheap Mutual Funds

Bond mutual funds can be divided into 2 main classes: taxable bond mutual funds, and municipal bond mutual funds. Taxable bond fund invests mainly in U.S. or foreign debts which provide interest for investors. The income from taxable bond fund is taxable by Federal income tax rate. The municipal bond fund uses its assets to purchase municipal debts issued by various U.S. states, municipalities, cities or localities. It provides tax free high income for investors.These lowest cost five star bond mutual funds are sorted based on its expense ratio and top star rating. You can invest the mutual funds in your brokerage account and retirement account (Roth IRA, traditional IRA or 401k). These best mutual funds may provide high yield income and high capital appreciation for investors.

Top lowest cost bond mutual funds for 2014 are:

- Nuveen Municipal Total Return Managed Accounts (NMTRX)

- Wells Fargo Advantage Core Builder Series M (WFCMX)

- State Farm Municipal Bond (SFBDX)

- Vanguard Ohio Long-Term Tax-Exempt (VOHIX)

- Vanguard High-Yield Tax-Exempt (VWAHX)

- Baird Core Plus Bond Institutional (BCOIX)

- Federated Intermediate Government/Corporate Institutional (FGCIX)

- American Independence US Inflation-Indexed I (FFIHX)

- Scout Core Bond I (SCCIX)

- Scout Core Plus Bond Institutional (SCPZX)

- Metropolitan West Intermediate Bond I (MWIIX)

- TCW Core Fixed-Income I (TGCFX)

- TCW Total Return Bond I (TGLMX)

- Delaware Pooled Core Plus Fixed Income (DCPFX)

- Fidelity GNMA Fund (FGMNX)

- PIMCO Short-Term Institutional (PTSHX)

- PIMCO Total Return Institutional (PTTRX)

- Western Asset Core Plus Bond I (WACPX)

- JPMorgan Government Bond Select (HLGAX)

- PIMCO Long-Term US Government Institutional (PGOVX)

- DoubleLine Total Return Bond I (DBLTX)

- Federated Institutional High Yield Bond Institutional (FIHBX)

- Wells Fargo Advantage Adjusted Rate Government I (EKIZX)

- American Century CA High-Yield Muni Investor (BCHYX)

- DoubleLine Core Fixed Income I (DBLFX)

- Frost Total Return Bond Institutional (FIJEX)

- Nuveen Intermediate Duration Muni Bond I (NUVBX)

- Payden GNMA (PYGNX)

- PIMCO Foreign Bond (USD-Hedged) I (PFORX)

- PIMCO GNMA Institutional (PDMIX)

Nuveen Municipal Total Return Managed Accounts Fund (NMTRX)

This Nuveen Municipal Total Return Managed Accounts fund seeks attractive total return and high current income exempt from regular federal income taxes. This muni bond mutual fund is currently managed by Martin J. Doyle. It has $303.1 million of total net assets. It has a high yield of 4.55%.This lowest cost best bond mutual fund is also ranked with 5-stars rating by Morningstar. The 5-year average return is 6.62%. This best fund has returned 5.91% over the past 3-year. It has YTD return of -5.90% as of August 1, 2013. You can buy this fund through online investing.

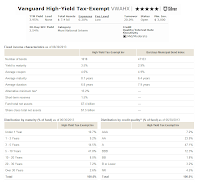

Vanguard High-Yield Tax-Exempt Fund (VWAHX)

This low-cost municipal bond fund objective is to provide a high level of federally tax-exempt income. It typically appeals to investors in higher tax brackets. Vanguard High-Yield Tax-Exempt Fund uses its assets to purchase low quality municipal bonds. It also provides high yield tax free income for investors.

This low-cost municipal bond fund objective is to provide a high level of federally tax-exempt income. It typically appeals to investors in higher tax brackets. Vanguard High-Yield Tax-Exempt Fund uses its assets to purchase low quality municipal bonds. It also provides high yield tax free income for investors.More: Top Vanguard Mutual Funds 2013

This top muni bond fund has 0.20% annual expense ratio which is 79% lower than the average ratio of funds with similar holdings. It has large assets of $7.4 billion. The dividend yield is 3.95%. It is managed by Mathew M. Kiselak.

The benchmark is Barclays Municipal Bond Index. It has average maturity of 8.1 years and average duration of 6.8 years. This fixed income fund has 27 years of positive return. It has its best 1 year total return in 2009 with 20.13%. Based on the load adjusted returns, it has returned 5.28% over the past 3-year and 4.54% over the past 10-year. It also has 5-stars and Silver rating from Morningstar.

Metropolitan West Intermediate Bond Fund (MWIIX)

The Metropolitan West Intermediate Bond Fund invests most of the net assets in fixed-income securities rated investment grade or unrated securities with similar quality. This bond fund was first introduced to public in June 2002. The total net assets are $346.1 million. It has a dividend yield of 3.19%. The annual expense ratio is 0.44%. The management teams are Tad Rivelle, Laird Landmann and Stephen M. Kane.Morningstar analysts rank this top lowest cost bond fund for 2014 with 5-stars rating. The best 1-year total return was achieved in 2009 with 14.51%. So far, this mutual fund has only one year of negative return, it was in 2009 with -2.13%. Based on the load adjusted returns, the fund has returned 7.49% over the past 5-year and 5.71% over the past decade. Barclays Capital International Government/ Credit Index is the fund’s benchmark.

More: Best Municipal Bond ETF Funds 2014

The top 3 sectors are Mortgage Backed (37.6%), Credit/ Corp (24.0%) and US Government (13.2%). The other class of this fund is M Class (MWIMX).

Top Funds Profile

| No | Fund Name | Ticker | Star Rating | Expense | Net Assets (Mil) | Yield |

|---|---|---|---|---|---|---|

| 1 | Nuveen Municipal Total Return Mgd Accts | NMTRX | 5 | 0.00% | $304.20 | 4.44% |

| 2 | Wells Fargo Advantage Core Builder Ser M | WFCMX | 5 | 0.00% | $77.40 | 3.56% |

| 3 | State Farm Municipal Bond | SFBDX | 5 | 0.15% | $655.60 | 3.55% |

| 4 | Vanguard OH Long-Term Tax-Exempt | VOHIX | 5 | 0.16% | $966.10 | 3.74% |

| 5 | Vanguard High-Yield Tax-Exempt | VWAHX | 5 | 0.20% | $7,400.00 | 3.87% |

| 6 | Baird Core Plus Bond Inst | BCOIX | 5 | 0.30% | $2,800.00 | 3.26% |

| 7 | Federated Interm Govt/Corp Instl | FGCIX | 5 | 0.30% | $145.40 | 1.73% |

| 8 | American Indep US Infl-Idx I | FFIHX | 5 | 0.32% | $345.70 | 0.39% |

| 9 | Scout Core Bond I | SCCIX | 5 | 0.40% | $262.30 | 1.31% |

| 10 | Scout Core Plus Bond Instl | SCPZX | 5 | 0.40% | $504.50 | 1.66% |

| 11 | Metropolitan West Intermediate Bond I | MWIIX | 5 | 0.44% | $346.30 | 3.29% |

| 12 | TCW Core Fixed-Income I | TGCFX | 5 | 0.44% | $1,300.00 | 2.00% |

| 13 | TCW Total Return Bond I | TGLMX | 5 | 0.44% | $8,300.00 | 5.28% |

| 14 | Delaware Pooled Core Plus Fixed Income | DCPFX | 5 | 0.45% | $52.20 | 3.86% |

| 15 | Fidelity GNMA Fund | FGMNX | 5 | 0.45% | $8,700.00 | 1.98% |

Top Fund Performance

| No | Fund Name | Ticker | YTD return | 1-Year Return | 3-Year Return | 5-Year Return | 10-Year Return |

|---|---|---|---|---|---|---|---|

| 1 | Nuveen Municipal Total Return Mgd Accts | NMTRX | -6.10% | -3.93% | 4.71% | 6.24% | N/A |

| 2 | Wells Fargo Advantage Core Builder Ser M | WFCMX | -2.54% | 1.28% | 7.29% | 9.02% | N/A |

| 3 | State Farm Municipal Bond | SFBDX | -2.74% | -1.44% | 3.29% | 4.75% | 4.33% |

| 4 | Vanguard OH Long-Term Tax-Exempt | VOHIX | -4.72% | -2.92% | 3.30% | 4.61% | 4.30% |

| 5 | Vanguard High-Yield Tax-Exempt | VWAHX | -4.11% | -2.01% | 4.41% | 5.27% | 4.66% |

| 6 | Baird Core Plus Bond Inst | BCOIX | -2.36% | -0.06% | 4.96% | 7.31% | 6.19% |

| 7 | Federated Interm Govt/Corp Instl | FGCIX | -1.23% | 0.20% | 2.93% | 5.00% | N/A |

| 8 | American Indep US Infl-Idx I | FFIHX | -6.98% | -5.87% | 4.85% | 4.99% | 5.97% |

| 9 | Scout Core Bond I | SCCIX | -1.81% | -0.11% | 4.24% | 7.57% | 6.09% |

| 10 | Scout Core Plus Bond Instl | SCPZX | -1.63% | 108.00% | 5.86% | 9.71% | 7.34% |

| 11 | Metropolitan West Intermediate Bond I | MWIIX | -0.11% | 3.15% | 5.55% | 7.78% | 5.90% |

| 12 | TCW Core Fixed-Income I | TGCFX | -2.20% | -0.02% | 4.51% | 8.01% | 6.21% |

| 13 | TCW Total Return Bond I | TGLMX | -0.64% | 4.66% | 6.57% | 9.23% | 6.92% |

| 14 | Delaware Pooled Core Plus Fixed Income | DCPFX | -2.16% | -1.09% | 4.50% | 7.95% | 6.26% |

| 15 | Fidelity GNMA Fund | FGMNX | -2.91% | -2.65% | 2.67% | 5.28% | 4.83% |

| 16 | PIMCO Short-Term Instl | PTSHX | 0.12% | 1.16% | 1.51% | 2.43% | 2.79% |

| 17 | PIMCO Total Return Instl | PTTRX | -2.65% | 0.05% | 4.28% | 7.38% | 6.31% |

| 18 | Western Asset Core Plus Bond I | WACPX | -2.03% | -0.12% | 4.96% | 8.72% | 6.24% |

| 19 | JPMorgan Government Bond Select | HLGAX | -2.89% | -2.70% | 3.44% | 5.50% | 5.07% |

| 20 | PIMCO Long-Term US Government Instl | PGOVX | -9.79% | -13.03% | 5.68% | 8.74% | 7.03% |

| 21 | DoubleLine Total Return Bond I | DBLTX | -0.52% | 2.47% | 8.00% | N/A | N/A |

| 22 | Federated Instl High Yield Bond Instl | FIHBX | 3.58% | 8.89% | 10.27% | 11.05% | 9.19% |

| 23 | Wells Fargo Advantage Adj Rate Govt I | EKIZX | 0.16% | 0.72% | 1.74% | 2.30% | 2.78% |

| 24 | American Century CA Hi-Yld Muni Inv | BCHYX | -4.32% | -1.79% | 5.02% | 5.29% | 4.90% |

| 25 | DoubleLine Core Fixed Income I | DBLFX | -1.63% | 0.35% | 7.26% | N/A | N/A |

| 26 | Frost Total Return Bond Inst | FIJEX | 1.96% | 5.54% | 6.85% | 8.55% | 6.02% |

| 27 | Nuveen Interm Duration Muni Bond I | NUVBX | -2.52% | -1.15% | 3.35% | 4.53% | 4.20% |

| 28 | Payden GNMA | PYGNX | -3.64% | -3.28% | 2.67% | 5.42% | 4.91% |

| 29 | PIMCO Foreign Bond (USD-Hedged) I | PFORX | -0.69% | 4.51% | 6.05% | 8.27% | 6.13% |

| 30 | PIMCO GNMA Instl | PDMIX | -3.16% | -2.79% | 2.73% | 5.70% | 5.34% |

No comments:

Post a Comment