Putnam Convertible Securities A (PCONX)

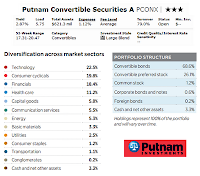

The investment aim of Putnam Convertible Securities fund is to provide current income and capital appreciation. It also has a secondary objective which is capital conservation. This mutual fund invests majority of assets in convertible securities of U.S. companies. Convertible securities mix the investment characteristics of bonds and common stocks.

Convertible securities may include bonds, preferred stocks and other instruments that can be converted into or exchanged for common stock. Many convertible securities are below-investment-grade. The convertible bonds typically have average maturities about three years or longer.

Fund Profile

- Fund Inception Date: June 28, 1972

- Ticker Symbol: PCONX

- CUSIP: 746476100

- Beta (3yr): 1.13

- Rank in category (YTD): 7%

- Category: Convertibles

- Distribution: 2.87%

- Capital Gains: 0%

- Expense Ratio: 1.12%

- Net Assets: $ 611.75 million

- Number of Years Up: 29 years

- Number of Years Down: 10 years

- Annual Turnover Rate: 79%