Top Performer Moderate Allocation Balanced Funds

Top Performer Moderate Allocation Balanced FundsModerate allocation mutual fund is suitable for investors who have balanced investment approach. This moderate allocation fund invests in stocks (equities), bonds (fixed incomes), money market or cash. It may have slightly higher stock portion (60%-80%) than bond portion (20%-40%). It may provide regular dividend or income through capital gain and yield.

Best Mutual Funds for 2013

From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, management, fund’s NAV or share price, and yield or dividend from the table below. The list is sorted based on its year to date performance in 2012 (up to October 1, 2012).

The 10 best performing moderate allocation mutual funds 2012 are:

- Putnam Capital Spectrum A (PVSAX)

- Fairholme Allocation (FAAFX)

- Dodge & Cox Balanced (DODBX)

- Mairs & Power Balanced Investor (MAPOX)

- Villere Balanced Investor (VILLX)

- Camelot Premium Return A (CPRFX)

- AllianceBern Balanced Shares A (CABNX)

- JHancock Balanced A (SVBAX)

- Hotchkis and Wiley Capital Income A (HWIAX)

- Disciplined Growth Investors (DGIFX)

Putnam Capital Spectrum Fund (PVSAX)

Putnam Capital Spectrum Fund (PVSAX)The Putnam Capital Spectrum Fund objective is to provide total return. It uses its assets to purchase portfolio of equity and fixed income securities. It may include floating and fixed rate bank loans and both growth and value stocks, of leveraged small and midsize U.S. companies with potential. David Glancy is the fund manager since 2009.

The total net assets of this top performer in Moderate Allocation are $1.45 billion. Ranked with 5 stars by Morningstar, it has a YTD return of 16.50%. The 12-month dividend yield is 1.17%. The latest dividend was distributed in December 2011 ($0.31). The fund’s NAV is $26.93 (as of November 11, 2012). It also has an annual expense ratio of 1.30%.

Best No Load Moderate Allocation Mutual Funds 2012

Since its inception in 2009, this best fund has returned in 21.64% in 2010 and 8.77% in 2011. The top holdings are DISH Network, EchoStar, L-3 Communications Holdings, Japan Airlines, Capital One Financial, Cubist Pharmaceuticals, Jazz Pharmaceuticals, United Continental Holdings, Chesapeake Energy and Citigroup.

Fairholme Allocation Fund (FAAFX)

As a new fund, the Fairholme Allocation fund has managed to outperform other balanced fund in moderate allocation category in 2012. It invests most of its assets in in the equity, fixed-income, and cash. It may invest in any, all or none of the targeted asset classes at any given time. The current fund manager is Bruce R. Berkowitz. This is a no load fund. It has 0.75% expense ratio. The CUSIP number is 304871403.

The year-to-date return is 12.79%. Based on the load adjusted returns, this balanced fund has returned 31.97% over the past 1-year. Last year in 2011, the fund 1-year total return was -14.00%. The benchmarks are US AGG Bond Index and S&P 500 Index. The current fund shares price is $9.49.

The top 2 categories as of May 2012 are Surety Insurance (29.3%) and Multi-Line Insurance (20.9%). The top 10 holdings represent 88.7% of the total net assets. They are MBIA nc, American International Group, Inc, Sears Holdings Corp, Bank of America Corp, Jefferies Group Inc, Leucadia National Corp, Wells Fargo & Co, Emigrant Bancorp Inc, JP Morgan Chase & Co and The Hartford Financial Services Group Inc.

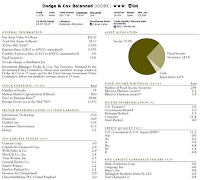

Dodge & Cox Balanced Fund (DODBX)

Dodge & Cox Balanced fund has huge total assets of $12.48 billion. Its investment aim is to provide regular income, conservation of principal, and long-term growth opportunity (principal and income). It utilizes its assets to purchase a diversified portfolio of common stocks, preferred stocks, and fixed income securities. The expense ratio is 0.53%. The 12-month yield is 2.22% and the 30-day SEC Yield is 1.85%.

Dodge & Cox Balanced fund has huge total assets of $12.48 billion. Its investment aim is to provide regular income, conservation of principal, and long-term growth opportunity (principal and income). It utilizes its assets to purchase a diversified portfolio of common stocks, preferred stocks, and fixed income securities. The expense ratio is 0.53%. The 12-month yield is 2.22% and the 30-day SEC Yield is 1.85%.The minimum initial investment is $2,500. There is no management fee and no front-end-sales-load fee. The fund has recorded 41 years of positive return since its inception in 1931. The 5-year average return is 1.11%. The effective maturity is 7.1 years and the effective duration is 3.5 years.

The largest stocks as of September 30, 2012 are Comcast Corp (3.0%), Capital One Financial Corp (2.9%), Wells Fargo & Co (2.9%), Merck & Co, Inc (2.4%), Time Warner Inc (2.3%) and General Electric Co (2.3%). The top 2 sectors are Information Technology (15.0%) and Financials (14.9%).

Mairs & Power Balanced Fund (MAPOX)

This Mairs & Power Balanced Investor Fund is ranked with 3 stars and Gold rating by Morningstar analysts. The expense ratio is 0.79% per year. This fund offers 2.62% dividend income which is distributed quarterly. The fund’s net asset value is $69.57. It is managed by William B. Frels and Ronald L. Kaliebe.

The best 1-year total return was achieved in 1997 with 28.04%. It also has 42 years of positive return. This moderate allocation mutual fund has a 5-year annualized return of 4.84%. Most of the portfolio is allocated in common stocks (59.6%) and fixed income securities (33.3%). The top common stock holdings are 3M Co (2.7%), Valspar Corp (2.6%), Emerson Electric Co (2.3%) and Schlumberger Ltd (2.3%).

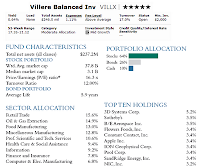

Villere Balanced Fund (VILLX)

Morningstar rated this best performing moderate allocation mutual fund with 5-stars rating. It has 40.00% annual holdings turnover as of October 25, 2012. It also has 1.11% annual expense ratio. The 3-year beta risk is 1.32.

Morningstar rated this best performing moderate allocation mutual fund with 5-stars rating. It has 40.00% annual holdings turnover as of October 25, 2012. It also has 1.11% annual expense ratio. The 3-year beta risk is 1.32.Top Convertible Securities Mutual Funds

This moderate allocation mutual fund has its worst 1-year total return in 2008 with -27.85%. Based on the load adjusted returns, it has returned 9.95% over the past 10-year. Lipper Balanced Fund Index and S&P 500 Index are the benchmarks. The average life is 5.9 years. The fund’s shares price is $20.29.

The top sector allocations are Retail Trade (15.6%), Oil & Gas Extraction (14.9%), Food Manufacturing (13.0%) and Miscellaneous Manufacturing (12.8%).

Disclosure: No Position

Fund Performance

| No | Fund Description | Ticker | Rating | YTD Return % | Expense Ratio | Asset (Million) |

|---|---|---|---|---|---|---|

| 1 | Putnam Capital Spectrum A | PVSAX | 5 | 21.86 | 1.3 | 1450 |

| 2 | Fairholme Allocation | FAAFX | N/A | 15.81 | 0.75 | 271 |

| 3 | Dodge & Cox Balanced | DODBX | 3 | 15.68 | 0.53 | 12680 |

| 4 | Mairs & Power Balanced In | MAPOX | 5 | 15.2 | 0.79 | 255 |

| 5 | Villere Balanced Inv | VILLX | 5 | 14.51 | 1.11 | 246 |

| 6 | Camelot Premium Return A | CPRFX | N/A | 14.5 | 1.78 | 21 |

| 7 | AllianceBern Balanced Shares A | CABNX | 3 | 14.27 | 1.08 | 551 |

| 8 | JHancock Balanced A | SVBAX | 3 | 14.19 | 1.16 | 983 |

| 9 | Hotchkis and Wiley Capital Income A | HWIAX | N/A | 14.15 | 1.05 | 15 |

| 10 | Disciplined Growth Investors | DGIFX | N/A | 14.11 | 0.77 | 46 |

Note: Other balanced funds are conservative allocation fund, aggressive allocation fund, world allocation fund, and target date fund.

No comments:

Post a Comment