Top Japan Stock Mutual Funds 2013

Top Japan Stock Mutual Funds 2013Japan stock mutual fund invests mainly in Japanese companies. As one of the largest market in the world, the Japanese stock fund has varied portfolios' holdings. Some stock mutual funds concentrate on Japan's larger companies, while others concentrate on the small capitalization companies. These portfolios invest >70% of total assets in equities and invest at least 75% of stock assets in Japan.

These top Japanese stock mutual funds are selected based on its expense ratio fee, turnover rate, management, fund performance, shares price or net asset value (NAV), etc. You can find the fund review and fund performance or return below.

The 9 best Japan stock mutual funds 2013 are:

- DFA Japanese Small Company I (DFJSX)

- Hennessy Select SPARX Japan Fund Original (SPXJX)

- Matthews Japan Investor (MJFOX)

- Henderson Japan Focus A (HFJAX)

- Nomura Partners The Japan A (NPJAX)

- Fidelity Japan Smaller Companies (FJSCX)

- Fidelity Japan Fund (FJPNX)

- T. Rowe Price Japan Fund (PRJPX)

- Commonwealth Japan Fund (CNJFX)

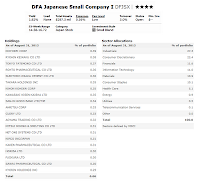

DFA Japanese Small Company I (DFJSX)

DFA Japanese Small Company I (DFJSX)The investment aim of DFA Japanese Small Company fund is to provide long-term capital growth. The mutual fund utilizes its assets to purchase stocks of the Japanese small companies. It may invest in the form of foreign depositary receipts, which may be listed or traded outside the companies domicile country.

Karen Umland is the fund manager since 1998. This international stock fund has total net assets of $281.33 million. The fund’s dividend yield is 1.82%. The last dividend was given on September 9, 2012 ($0.01). Its year-to-date return is -0.14%. It has returned 7.70% over the past 10-years and -4.77% over the past 1-year.

The top 5 stocks as of August 2012 are Nichirei Corp (0.39%), Ryohin Keikaku Co Ltd (0.38%), Tokyo Tatemono Co Ltd (0.37%), Rohto Pharmaceutical Co Ltd (0.36%) and Sumitomo Osaka Cement Co Ltd (0.36%). The top sectors are Industrials (27.3%) and Consumer Discretionary (22.4%).

Hennessy Select SPARX Japan Fund Original (SPXJX)

The Hennessy Select SPARX Japan Fund invests majority of its net assets (>80%) in stocks of Japanese companies. Its equity investments may comprise common stocks, initial public offerings (IPOs), preferred stocks, warrants and other rights, and convertible bonds. It may invest in Japan real estate investment trusts or funds (J-REITs) and Japan pooled investment vehicles. It invests in companies regardless of market capitalization.

Morningstar rated this Japan mutual fund with 4-stars rating. This best Japan stock mutual fund is managed by Shuhei Abe. The annual expense ratio is 1.86%. Based on the load adjusted return, it has returned 11.82% over the past 3-year and -2.19% over the past 5-year. The current shares price is $15.18 (as of 10/4/2012).

The top 10 holdings in its assets are Shimano Inc (7.8%), Keyence Corp (7.0%), Misumi Group Inc (7.0%), Ryohin Keikaku Co Ltd (6.9%), Rohto Pharmaceutical Co Ltd (6.1%), Kao Corp (5.7%), Mitsubishi Corp (5.5%), Asics Corp (5.0%) and Unicharm Corp (4.4%).

Matthews Japan Investor (MJFOX)

The Matthews Japan fund investment objective is to seek long-term capital appreciation. It uses its assets to buy the common and preferred stocks of companies located in Japan. These companies are selected based on their sustainable growth with great fundamentals. The management will select based on balance sheet information; number of employees; size and stability of cash flow; management’s depth, adaptability and integrity; product lines; marketing strategies; corporate governance; and financial health.

The Matthews Japan fund investment objective is to seek long-term capital appreciation. It uses its assets to buy the common and preferred stocks of companies located in Japan. These companies are selected based on their sustainable growth with great fundamentals. The management will select based on balance sheet information; number of employees; size and stability of cash flow; management’s depth, adaptability and integrity; product lines; marketing strategies; corporate governance; and financial health.Top China Region Mutual Funds

To buy this Matthews Asia fund, investors will need a minimum initial investment of $2,500 and minimum subsequent investment of $500. Morningstar analysts rate this best Japan stock mutual fund with Bronze and 4-stars rating. The fund has 1.87% dividend yield. The 5-year annualized return of this fund is -2.77%. The Institutional Class of this fund is MIJFX.

As of August 2012, the top 5 equities are ITOCHU Corp (4.7%), Toyota Motor Corp (4.5%), ORIX Corp (3.7%), Rakuten Inc (3.4%) and Nidec Corp. (3.3%).

Henderson Japan Focus A (HFJAX)

The Henderson Japan Focus fund invests > 80% of net assets in equity securities of companies economically tied to Japan. It may invest in common stocks, preferred stock, convertible securities and depositary receipts. It may invest < 15% of its net assets in illiquid securities. It may use derivative transactions and hedging techniques to enhance its assets

The current fund manager is Michael Wood-Martin. This best Japan stock mutual fund 2012 has small total assets, $24.09 million. It is available for purchase through 80 brokerages. Based on the load adjusted return, the fund has returned -9.39% over the past 1-year and -6.25% over the past 5-year. The other classes of this fund are HFJCX and HFJIX. The current shares price is $6.93.

The top holdings as of July 2012 are Mitsubishi UFJ Financial (6.2%), Yamada Denki (5.9%), Rakuten (4.9%), Sumitomo Mitsui Financial (4.7%), Daiwa Securities (4.5%), Mizuho Financial (4.3%), Keyence (4.1%), Canon (4.0%), Tokio Marine (3.8%) and Credit Saison (3.6%).

Nomura Partners The Japan A (NPJAX)

The Nomura Partners the Japan fund utilizes its assets to purchase Japanese equities and other investments that are tied economically to Japan. It will primarily invest in common stocks. It may invest in Japanese real estate investment trusts (J-REITs) and Japanese exchange traded funds (ETFs). It utilizes asset allocation based on categories: large cap value, large cap growth and small cap growth/value blend.

The Nomura Partners the Japan fund utilizes its assets to purchase Japanese equities and other investments that are tied economically to Japan. It will primarily invest in common stocks. It may invest in Japanese real estate investment trusts (J-REITs) and Japanese exchange traded funds (ETFs). It utilizes asset allocation based on categories: large cap value, large cap growth and small cap growth/value blend.Best No Load World Stock Mutual Funds

This top Japan stock mutual fund is ranked with 3-stars rating by Morningstar. It has 0.50% dividend yield. The annual holdings turnover as of September 5, 2012 is 54.00%. The annual expense ratio is 1.80%. The 5-year annualized return is -5.70%. The YTD return is 0.76%.

As second quarter of 2012, this equity fund has a total of 281 holdings. The top holdings are Mitsubishi UFJ Financials Group Inc (3.20%), Mitsubishi Heavy Industries Ltd (2.74%), Hitachi Ltd (2.66%), Sumitomo Mitsui Financial Group Inc (2.51%) and Nippon Telegraph and Telephone Corp (2.42%).

Fidelity Japan Smaller Companies (FJSCX)

The Fidelity Japan Smaller Companies fund invests mainly in securities of Japanese issuers with smaller market capitalizations. It uses the Russell/Nomura Mid-Small Cap Index or the Japanese Association of Securities Dealers Automated Quotations Index as its benchmark. It may invest in securities of Japanese issuers with larger market capitalizations. The fund’s NAV is $9.25.

This Japanese stock mutual fund has dividend yield of 0.86%. The expense ratio is 1.01% per year. The YTD return is 5.15% and the 5-year average return is -4.40%. This major market sectors are Information Technology (22.74%), Financials (18.24%), Consumer Discretionary (17.12%), Industrials (13.95%) and Health Care (11.35%).

The top holdings of this best mutual fund are Nintendo Co Ltd, Kakaku.com Inc, Pigeon Corp, Orix Corp, Takara Leben Co Ltd, Osaka Securities Exchange Co Ltd, Kubota Corp, Aeon Credit Service Ltd, Sosei Group Corp and Cyber Agent Inc. It has a total of 81 holdings.

Disclosure: No Position

Fund Performance

| No | Name | Ticker | 1 Year Return % | 3 Year Return % | 5 Year Return % | 10 Year Return % | Expense Ratio % |

|---|---|---|---|---|---|---|---|

| 1 | DFA Japanese Small Company I | DFJSX | -1.5 | 16.41 | -0.66 | 9.6 | 0.56 |

| 2 | Hennessy Select SPARX Japan Fd Original | SPXJX | 3.82 | 20.6 | -2.61 | — | 1.87 |

| 3 | Matthews Japan Investor | MJFOX | -6.92 | 17.3 | -4.6 | 5.03 | 1.3 |

| 4 | Henderson Japan Focus A | HFJAX | -4.63 | 15.57 | -4.63 | — | 1.79 |

| 5 | Nomura Partners The Japan A | NPJAX | -8.26 | 13.94 | -4.66 | 4.59 | 1.78 |

| 6 | Fidelity Japan Smaller Companies | FJSCX | -8.92 | 21.84 | -5.67 | 5.33 | 1.05 |

| 7 | Fidelity Japan | FJPNX | -12.92 | 14.87 | -6.17 | 4.1 | 0.86 |

| 8 | T. Rowe Price Japan | PRJPX | -6.7 | 13.94 | -6.19 | 3.9 | 1.12 |

| 9 | Commonwealth Japan | CNJFX | -9.57 | 8.25 | -6.91 | -1.16 | 3.94 |

No comments:

Post a Comment