Top Consumer Defensive Mutual Funds

Top Consumer Defensive Mutual FundsThe consumer defensive mutual fund is part of domestic stock mutual fund. This sector stock fund utilizes its assets to purchase stocks of companies that are engaged in manufacturing, sales or distribution of customer staples. The consumer staples company products are food, beverages, tobacco, and household items. It may invest in U.S. companies or non-U.S. companies. This stock fund is considered as non-cyclical stock fund.

These top consumer defensive mutual funds are selected based on its expense ratio fee, turnover rate, management, fund performance, etc. You can find the fund review and fund performance or return below.

The 4 best consumer defensive mutual funds 2013 are:

- Fidelity Select Consumer Staples (FDFAX)

- Vanguard Consumer Staples Index Adm (VCSAX)

- Rydex Consumer Products Investor (RYCIX)

- ICON Consumer Staples A (ICRAX)

Fidelity Select Consumer Staples Fund (FDFAX)

Fidelity Select Consumer Staples Fund (FDFAX)The investment objective of Fidelity Select Consumer Staples fund is to seek capital appreciation. The fund invests >80% of assets in stocks of companies that are engaged in the manufacture, sale, or distribution of consumer staples. It may invest in domestic and foreign equities especially common stocks. The current fund’s NAV is $80.25 (11/12/2012).

This consumer defensive mutual fund has total net assets of $2.01 billion. It has 0.82% expense ratio Investors may receive a dividend yield of 1.48%. The most recent dividend distribution was given in April 2012 ($0.15). The fund has 5-year annualized return of 7.83%. Based on the load adjusted returns, the fund has returned 16.80% over the past 1-year and 9.95% over the past 10-year.

The top major market sector is 92.96% (Consumer Staples). The top 5 stocks as of June 2012 are Procter & Gamble Co, British American Tobacco PLC ADR, Coca Cola Co, CVS Caremark Corp and Altria Group Inc.

Vanguard Consumer Staples Index Fund (Ticker: VCSAX)

As part of Vanguard mutual fund, this Vanguard Consumer Staples Index fund has total net assets of $ 1.25 billion. The fund manager is Michael A. Johnson since 2010. It has 12-month dividend yield of 2.09% and is distributed annually. The expense ratio is 0.14% per year. This expense fee is lower than the average ratio in the Consumer Defensive category (1.38%). Morningstar rated this fund with 4-stars rating.

Best Vanguard Mutual Funds 2013

Since its inception in 2004, this VCSAX fund has achieved a total of 6 years of positive return. The best 1-year total return was achieved in 2009 with 16.95%. The only year it has negative return was in 2008 with -17.00%. It has YTD return of 11.31% and 5-year annualized return of 7.25%. The 3-year beta risk is 0.45. The yearly performance of this fund since its inception, is as below:

- Year 2005: 3.90%

- Year 2006: 15.77%

- Year 2007: 12.87%

- Year 2008: -17.00% (lowest)

- Year 2009: 16.95% (highest)

- Year 2010: 14.43%

Rydex Consumer Products Fund (RYCIX)

The Rydex Consumer Products fund objective is to provide capital growth. The fund uses its assets to buy equity securities of Consumer Products Companies that are traded in the United States. It may invest in derivatives such as futures contracts and options on securities, futures contracts, and stock indices. It will invest to a significant extent in small to mid-sized capitalization companies. The fund is non-diversified.

The Rydex Consumer Products fund objective is to provide capital growth. The fund uses its assets to buy equity securities of Consumer Products Companies that are traded in the United States. It may invest in derivatives such as futures contracts and options on securities, futures contracts, and stock indices. It will invest to a significant extent in small to mid-sized capitalization companies. The fund is non-diversified.Top Utilities Mutual Funds

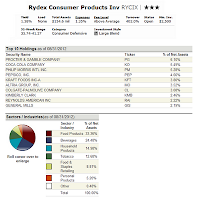

Morningstar gave this top equity fund a 3-star rating for its performance. The YTD return of this fund is 7.29%. It has 5-year annualized return of 7.10%. The total expense ratio of this RYCIX fund is 1.35%. The minimum initial investment for this fund is $1,000.

The top sectors/ industries as of August 2012 are Food Products (33.36%), Beverages (24.48%), Household Products (14.98%) and Tobacco (12.68%). The top holdings are Procter & Gamble Company (6.10%), Coca Cola Company (5.49%), Philip Morris International Inc (5.28%), Pepsico Inc (4.66%) and Kraft Foods Inc A (3.80%).

ICON Consumer Staples Fund (ICRAX)

The ICON Consumer Staples fund invests most of its net assets (>80%) stock of companies in the Consumer Staples sector. Equity securities in which the fund may invest include common stocks and preferred stocks of companies of any market capitalization. It is non-diversified.

Best Consumer Cyclical Mutual Funds

As of July 2012, the top 10 stocks in its portfolio are Wal-Mart Stores Inc (11.85%), Philip Morris International Inc (8.22%), Procter & Gamble Co (7.83%), Kimberly-Clark Corp (5.94%), CVS Caremark Corp (5.92%), Coca Cola Co (5.86%), Costco Wholesale Corp (5.13%), Altria Group Inc (4.83%), Lorilard Inc (4.55%) and Reynolds American Inc (4.01%).

Disclosure: No Position

Fund Performance

| No | Fund Description | Ticker | 1 Year Return % | 3 Year Return % | 5 Year Return % | 10 Year Return % | Expense Ratio |

|---|---|---|---|---|---|---|---|

| 1 | Fidelity Select Consumer Staples | FDFAX | 15.3 | 22.66 | 8.24 | 8.51 | 0.86 |

| 2 | Vanguard Consumer Staples Index Adm | VCSAX | 15.27 | 22.05 | 7.74 | — | 0.19 |

| 3 | Rydex Consumer Products Inv | RYCIX | 15.21 | 24.18 | 7.07 | 7.68 | 1.38 |

| 4 | ICON Consumer Staples A | ICRAX | 9.24 | 27.98 | 3.4 | 4.09 | 1.75 |

No comments:

Post a Comment