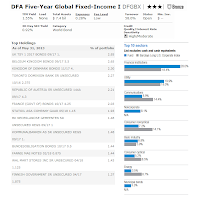

DFA Bond Mutual Fund

The DFA Five-Year Global Fixed-Income Fund objective is to achieve a market rate of return for a fixed income portfolio with low relative volatility of returns. The mutual fund utilizes its assets to purchase a diverse portfolio of U.S. and foreign debt securities maturing in five years or less.This bond fund invests in obligations issued or guaranteed by the U.S. and foreign governments, their agencies and instrumentalities, corporate debt obligations, bank obligations, commercial paper, repurchase agreements, obligations of other domestic and foreign issuers, securities of domestic or foreign issuers denominated in U.S. dollars but not trading in the United States, and obligations of supranational organizations.

DFA Five-Year Global Fixed-Income Fund Details

- Fund Inception Date: 11/5/1990

- Ticker Symbol: DFGBX

- CUSIP: 233-203-884

- Beta (3yr): 0.79

- Rank in category (YTD): 11%

- Category: World Bond

- Distribution: 1.55%

- Capital Gains: 0%

- Expense Ratio: 0.28%

- Net Assets: $ 7.4 billion

- Number of Years Up: 21 years

- Number of Years Down: 1 year

- Average Duration: 4.05 years

- Average Maturity: 3.85 years

- Annual Turnover Rate: 58%