The market performance for the month of October has been outstanding. Most indices have produced double digits return whether it is international indices (DAX, Nikkei, FTSE 100, etc) or domestic indices (S&P 500, Nasdaq, NYSE, Dow Jones Industrial, Russell 2000, etc). On my previous article, I have provided the top performer mutual funds (leveraged version). This top performer list will only provide a list for non-leveraged mutual funds.

The 12 Monthly Top Performer Non Leveraged Mutual Funds of October 2011 are:

|

| Top Performer Mutual Funds 2011 (NL) |

- BlackRock Energy & Resources Inv A

- Integrity Williston Bsn/Md-N Amer Stk A

- Schneider Small Cap Value

- Pacific Advisors Small Cap Value A

- Oracle Mutual A

- Rydex Energy Services Inv

- Dreyfus Emerging Leaders

- Dreyfus Small Cap A

- Dreyfus Opportunistic Small Cap

- Pacific Advisors Mid Cap Value A

- Saratoga Energy & Basic Materials A

- Rydex Energy Inv

1. BlackRock Energy & Resources Inv A (MUTF: SSGRX)

|

| BlackRock Energy & Resources |

This Equity Energy fund is managed by Daniel J. Rice, III since 2005. It has total net assets of $1.49 Billion. The fund’s yield is 0.97%. The fund’s expense ratio fee is 1.35%. It also has a front end sales load of 5.25% and a 12b1 fee of 0.25%. The fund’s CUSIP number is 091937524. You can invest in this fund with $1,000 minimum initial investment.

The Morningstar has rated this top performer fund with 3 stars rating. The fund has its best 1 year total return in 2000 with 84.14% return. Based on load adjusted returns, the fund has returned 28.25% over the past 1 ywar, 3.3% over the past 5 year, and 17.47% over the past 10 year.

As of October 2011, the fund’s top 7 sectors are energy (90.4%), materials (6.7%), industrials (0.7%), consumer discretionary (0.4%), utilities (0.1%), financial (0.1%), and information technology (0.1%). The top 3 countries are United States (74.8%), Canada (20.2%), and Emerging Asia (3%). The top 5 stock holdings include Alpha Natural Resources Inc, Consol Energy Inc, Plains Exploration & Production Company, Halliburton Company, and Petrohawk Energy Corp.

2. Integrity Williston Bsn/Md-N Amer Stk A (Ticker: ICPAX)

|

| Integrity Williston Bsn/Md-N Amer Stk A |

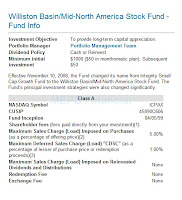

Note: The Integrity Williston Basin/Mid-North America Stock Fund is previously known as Integrity Small Cap Growth Fund.

The fund’s manager is Shannon D. Radke. The minimum investment is $1,000 for brokerage and $250 for IRA account. The expense ratio fee of this Intergity fund is 1.50%. There is no dividend yield for this fund (i.e. yield is 0%). The annual turnover rate is 35.44%. The total net assets are $322 Million. The fund’s CUSIP is 45890C606.

Morningstar has rated this ICPAX fund with only 3 stars. The fund’s performance over the long term period has been consistent. Based on load adjusted, this monthly top performing stock fund has returned 7.88% over the past 3 year, and 5.18% over the past 10 year. It has its best 1 year total return in 2010 with 47.43%.

As of October 2011, the top 10 stocks holding include Brigham Exploration Co, National Oilwell Varco Inc, Hess Corp, Baker Hughes Inc, CARBO Ceramics Inc, Oasis Petroleum, Halliburton Company, Kodiak Oil & Gas Corp, Lufkin Industries Inc, and Complete Production Services Inc.

3. Schneider Small Cap Value (SCMVX)

This Schneider Small Cap Value fund invests majority of net assets in undervalued small cap companies. It may also invest in convertibles bonds without regard to their credit rating. It may invest <20% of net assets in foreign stock (including ADRs).

Arnold C. Schneider III is the fund’s manager since 1998. This Schneider funds fund is rated with 1 star rating by Morningstar. The expense ratio fee of this SCMVX fund is 1.15%. For investing, you can buy this mutual fund with $20000 min for brokerage account. There is no sales load. The total net assets are $69 million.

In term of performance, this small value US stock fund has returned 11.73 over the past a year, and -1.29% over the past 5 year. The worst 1 year total return occurred in 2008 with -46.53%.

The fund’s top 5 sectors are: Financial Services, Technology, Basic Materials, Industrials, and Consumer Cyclical.

4. Pacific Advisors Small Cap Value A (PASMX)

Pacific Advisors Small Cap Value A fund’s objective is to seek capital appreciation. This Small Blend US Domestic stock fund invests most of assets in small capitalization companies stocks (i.e. market cap is less than $2 Billion). It may also invest in micro cap stocks (< $500 million). This fund will focus on 3-5 years long term market cycle with value based investment approach.

The fund’s manager is George A Henning since 1993. Henning is the portfolio manager with Pacific Global Investment Management Company. This PASMX fund has an expense ratio fee of 2.66%. This fee is higher than typical category average of 1.38%. The front end sales load is 5.75% and the 12b1 fee is 0.25%.

You can buy this fund from 45 brokerages such as Schwab, JPMorgan, Fidelity FundsNetwork, Scottrade Load, etc. This fund’s beta is 1.59 which is higher than average of 1.21.

5. Oracle Mutual A (ORGAX)

The investment objective of Oracle Mutual A fund is to provide long term appreciation of capital and secondarily striving for income (i.e. dividend). This world stock fund invests in US and foreign stocks. IT may invests <50% of assets in options for hedging purposes and income generation through covered calls.

Since 2011, Laurence I Balter is the lead fund’s manager. Mr. Balter is the CIO and founder of Oracle Investment Research. The fund expense ratio fee is 1.00% per year. It also has a front end sales load of 5.25%. You can buy this ORGAX fund from 8 brokerages. The minimum investment requirement of this ORGAX fund is $5000 for regular brokerage account and $2,500 for IRA account. This fund is rated with 2 stars rating by Morningstar.

Disclosure: No Position

Funds Information

Related Top Performer Funds Article:

No comments:

Post a Comment