Investing in commodities mutual funds has gained national news media. This article will look into the top performer commodities broad basket mutual funds. The top performing funds include: Direxion Monthly Commodity Bull 2x, PIMCO CommoditiesPLUS Strategy A, Arrow Commodity Strategy A, etc.

Commodities investment is gaining popularity nowadays. Often referred to as an alternative asset class, commodities are now becoming mainstream investment. Investing in broad basket commodities can be done through various ways such as mutual fund, exchange traded fund (ETF), and closed end fund (CEF).

Several experts have recommended investing in commodities for portfolio asset diversification. About 0%-5% of total asset should be invested in commodities. Some may even recommended 10% of assets to be invested in this asset class.

updated on July 19th, 2011

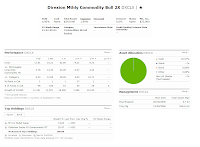

This Direxion Monthly Commodity Bull 2x fund is a leveraged index mutual fund. Long term investment is not recommended for any investors. The Direxion Monthly Commodity Bull 2x fund objective is to provide monthly investment results, before fees and expenses, of 200% of the Morgan Stanley Commodity Related Index monthly price performance. This DXCLX fund typically invests >80% of net assets in the equity securities that comprise the index and/or financial instruments that, in combination, provide leveraged exposure to the index with the fund creating long positions. This Direxion fund is considered as a non-diversified leveraged mutual fund.

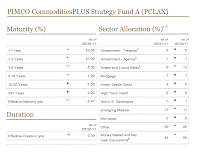

This PIMCO fund has been managed by Nicholas Johnson since May 2010. The fund annual expense ratio is 1.24%. It also has 0.25% 12b1 fee and 5.50% front end sales load. This fund’s yield is 0.12% for the past 12 months. This dividend is paid quarterly. There is still no Morningstar Rating for this fund currently. The fund has year to date return of 10.36%. For the past 1 year, this fund has returned 38.34%. This fund has total net assets of $1.4 billion.

Robert B. Hyman has managed this fund since its inception in June 2010. This JCRAX fund has 0.25% management fee and 5.50% front-end sales load. The minimum initial investment is $2,500 for brokerage account and $500 for IRA account. The dividend is distributed quarterly. The net expense ratio of this fund is 1.45%.

As part of the Kip 25 best fund, the Harbor Commodity Real Return Strategy investment seeks maximum real return, consistent with prudent investment management. The fund invests in commodity-linked derivative instruments backed by a portfolio of inflation-indexed securities and other fixed-income instruments. It also may invest in common and preferred stocks as well as convertible securities of issuers in commodity-related industries.

The fund may invest up to 30% of total assets in securities denominated in foreign currencies and may invest beyond this limit in U.S. dollar denominated securities of foreign issuers. This fund is among my preferred fund to invest in commodity mutual fund. This fund is very similar to PIMCO Commodity Real Return Strategy fund, but this Harbor fund doesn't have any sales load.

The PIMCO Commodity Real Return Strategy fund objective is to achieve maximum real return. The fund normally invests in commodity-linked derivative instruments backed by a portfolio of inflation-indexed securities and other fixed-income instruments. It seeks to gain exposure to the commodity markets primarily through investments in leveraged or unleveraged commodity index-linked notes. The fund may also invest up to 10% of total assets in preferred stocks. It is non-diversified.

The Van Eck CM Commodity Index fund is seeking to track the UBS Bloomberg Constant Maturity Commodity Total Return Index performance before fees and expenses. This Van Eck fund invests in commodity-linked derivative instruments, including notes, swap agreements, commodity futures contracts, and options on futures contracts. This fund will try to provide economic exposure to the investment returns of the commodities markets, as represented by the CMCI and its constituents. The average duration of the portfolio of Fixed Income Instruments will vary based on interest rates and, under normal market conditions, is not expected to exceed 5 years.

Investing in Commodity

|

| Broad Basket Commodities Fund |

Several experts have recommended investing in commodities for portfolio asset diversification. About 0%-5% of total asset should be invested in commodities. Some may even recommended 10% of assets to be invested in this asset class.

Some of the main reasons investors or traders are investing in commodities are:

- Commodities can provide diversification from stocks or equities and bonds or fixed incomes

- Commodities don’t have direct correlation with traditional assets

- Commodities can provide a tool for hedging against the risk of inflation

- Investors can participate in global growth and emerging economies

- Over the long-term period, commodities have strong performance track record

Top Broad Basket Commodities Funds

- Direxion Monthly Commodity Bull 2x (DXCLX)

- PIMCO CommoditiesPLUS Strategy A (PCLAX)

- Arrow Commodity Strategy A (CSFFX)

- Jefferies Asset Management Commodity Strategy Allocation A (JCRAX)

- Goldman Sachs Commodity Strategy A (GSCAX)

- Harbor Commodity Real Return Strategy Institutional (HACMX)

- PIMCO Commodity Real Return Strategy A (PCRAX)

- Van Eck CM Commodity Index A (CMCAX)

- Rydex Commodities Strategy A (RYMEX)

- Oppenheimer Commodity Strategy Total Return A (QRAAX)

note: The following fund is sorted based on its performance up until July 17, 2011.

| No | Name | Ticker | Rating | Yield | Expense Ratio | Load | Net Assets (mil) | Min to Invest |

|---|---|---|---|---|---|---|---|---|

| 1 | Direxion Monthly Commodity Bull 2x | DXCLX | 1 | 0.00% | 1.90% | 0.00% | $40 | $25,000 |

| 2 | PIMCO CommoditiesPLUS Strategy A | PCLAX | NR | 7.43% | 1.24% | 5.50% | $1,400 | $1,000 |

| 3 | Arrow Commodity Strategy A | CSFFX | NR | -- | 1.49% | 5.75% | $14 | $5,000 |

| 4 | Jefferies Asset Mgmt Cmdty Strat Allc A | JCRAX | NR | 7.98% | 1.45% | 5.50% | $127 | $2,500 |

| 5 | Goldman Sachs Commodity Strategy A | GSCAX | 2 | 9.08% | 0.92% | 4.50% | $982 | $1,000 |

| 6 | Harbor Commodity Real Return ST Instl | HACMX | NR | 7.99% | 0.94% | 0.00% | $290 | $1,000 |

| 7 | PIMCO Commodity Real Ret Strat A | PCRAX | 3 | 13.01% | 1.24% | 5.50% | $25,100 | $1,000 |

| 8 | Van Eck CM Commodity Index A | CMCAX | NR | -- | 0.95% | 5.75% | $32 | $1,000 |

| 9 | Rydex Commodities Strategy A | RYMEX | 2 | 0.00% | 1.56% | 4.75% | $41 | $2,500 |

| 10 | Oppenheimer Commodity Strat Total Ret A | QRAAX | 1 | 1.46% | 1.19% | 5.75% | $1,900 | $1,000 |

1. Direxion Monthly Commodity Bull 2x (MUTF: DXCLX)

|

| Direxion Monthly Commodity Bull 2x |

This fund also has an expense ratio of 1.90% per year. It doesn’t have any yield currently. The fund’s lead manager is Tony Ng since December 2006. Tony is a portfolio manager and joined Rafferty in April 2006. The fund is a no load fund (i.e. there is no sales load). To invest in this fund, investor needs a minimum initial investment of $25,000. Morningstar has rated this fund with 1 stars rating.

The fund target index sectors are as follows: Materials (45.16%), Energy (35.15%), Consumer Staples (15.08%), and Financials (4.62%). The fund’s total net assets are about $40 million.

Note: Leveraged fund is very volatile, long term investment is not recommended in this fund.

2. PIMCO CommoditiesPLUS Strategy A (MUTF: PCLAX)

PIMCO CommoditiesPLUS Strategy fund seeks total return which exceeds that of benchmark. This PIMCO fund invests in commodity-linked derivative instruments (including swap agreements, futures, options on futures, commodity index-linked notes and commodity options) backed by an actively managed, low volatility Fixed-Income Instruments portfolio. This PCLAX fund is a non-diversified mutual fund.

|

| PIMCO CommoditiesPLUS Strategy fund |

You can invest in this top commodities mutual fund with $1,000 initial balance for regular brokerage account. Investor also can select other classes for this fund such as Class C (PCPCX), Class D (PCLDX), Institutional Class (PCLIX), Class P (PCLPX), and Class R (PCPRX). The PCLIX fund only has 0.74% annual expense ratio and there is no sales load for this fund’s class. PCLAX can be purchased from 16 brokerages. Please check with your brokerage for details.

As of July 2011, the top sectors of this fund are Cash (60%), Other (25%), emerging markets (11%), investment grade credit (8%), mortgage (7%), government agency (1%), non US developed (1%), and Swaps & Liquid Rates (-13%). The fund’s effective maturity is 0.47 years. The fund’s effective duration is 0.39 years.

3. Arrow Commodity Strategy A (MUTF: CSFFX)

The Arrow Commodity Strategy A fund is seeking to provide investment results that correlate to the performance of the commodities benchmark. This Arrow fund invests mainly in the securities and derivatives combination that are expected to produce returns that track those of commodity market benchmark. It currently uses the Longview Extended Commodity Index as its commodity index benchmark. This index is a composite index of commodity sector returns, representing an unleveraged long-only investment in commodity futures that is broadly diversified across the commodities spectrum. The fund may invest <25% of total assets in a wholly-owned and controlled subsidiary.

This fund currently has a net expense ratio of 1.49% per year. It also has a front end sales load of 5.75%. This Arrow Commodity Strategy fund’s lead manager is William E. Flaig Jr since 2010. As a new fund, Morningstar hasn’t rated this fund just yet. The fund CUSIP number is 66537X605. This fund is the smallest fund in this Top Performer list with $14 million assets.

The LEX index is based on 6 major sectors with 16 components such as

- Energy: Heating Oil, Natural Gas, Gasoline, Light Crude Oil

- Livestock: Hogs, Cattle

- Grains: Corn, Soybeans, Wheat

- Softs: Cocoa, Coffee, Cotton, Sugar

- Precious Metals: Gold, Silver

- Industrials Metals: High Grade Copper

The fund benchmark target weights are Energy (30.99%), Precious Metals (25.97%), Softs (17.64%), Grains (10.28%),, Industrials Metals (8.59%), and Livestock (6.52%).

4. Jefferies Asset Management Commodity Strategy Allocation A (JCRAX)

The Jefferies Asset Management Commodity Strategy Allocation investment objective is to maximize real returns, consistent with prudent investment management. The fund usually invests directly or indirectly in a combination of commodity-related equity securities, futures, and derivative instruments to obtain exposure to the commodities markets. It invests some of total assets (<25%) in the subsidiary designed to boost the ability of the fund to obtain exposure to the commodities market through Commodity futures-linked investments. The fund is considered as a non-diversified commodity mutual fund.

|

| Jefferies Asset Mgmt Cmdty Strat Allc |

Since this fund is new, there is no Morningstar rating yet. The YTD return was 9.76%. This Jeffries fund has achieved 10% rank in the year to date category. The other class of this fund is Class C (JCRCX) and Class I (JCRIX).

As of March 2011, the portfolio allocations are 60.50% in Commodity Futures & Related Investments, 35.24% in Commodity Equities, 3.98% in Physical Metals ETFs and 0.27% in Cash. And the top sector allocations are Agriculture (39.7%), Energy (39.1%), Industrials Metals (13.2%) and Precious Metals (8.1%).

5. Goldman Sachs Commodity Strategy A (GSCAX)

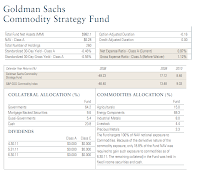

The Goldman Sachs Commodity Strategy fund seeks long-term total return. This Goldman Sachs fund seeks to maintain substantial economic exposure to the performance of the commodities markets. It mainly gains exposure to the commodities markets by investing in a wholly-owned subsidiary of the fund organized as a company under the laws of the Cayman Islands. The fund seeks to provide exposure to the commodities markets and returns that correspond to the performance of the S&P GSCI Commodity Index or other similar indices by investing, through the Subsidiary, in commodity-linked investments.

This GSCAX fund has 5.37% YTD return. The performances of this fund since its inception in 2007 are:

- Year 2008: -49.32%

- Year 2009: 17.12%

- Year 2010: 8.46%

The lead managers of this GS fund are Stephen Lucas and Michael Johnson. This fund has total net assets of $982.07 million. This fund can be purchased from 64 brokerages such JP Morgan, Scottrade Load, Schwab, etc. The minimum initial investment for the brokerage account is $1,000 with $50 minimum subsequent investment. The other classes of this fund are Class Institutional (GCCIX), Class C (GSCCX) and Class R (GCCRX). The GSCAX fund has 0.92% of annual expense ratio.

As of June 2011, this fund has 260 holdings. The top commodities allocations are Energy Components (69.3%), Agricultural (15.0%), Industrial Metals (8.0%), Livestock (4.4%) and Precious Metals (3.3%). The collateral allocations are Governments (64.2%), Cash (20.8%), Mortgage Backed Securities (9.6%) and Quasi-Governments (5.4%).

6. Harbor Commodity Real Return Strategy Institutional (HACMX)

|

| HACMX fund |

The fund may invest up to 30% of total assets in securities denominated in foreign currencies and may invest beyond this limit in U.S. dollar denominated securities of foreign issuers. This fund is among my preferred fund to invest in commodity mutual fund. This fund is very similar to PIMCO Commodity Real Return Strategy fund, but this Harbor fund doesn't have any sales load.

This HACMX fund was introduced to the public in September 2008. Mr. Mihir Worah has managed this fund since its inception. The minimum initial investment for either brokerage or IRA account is $1,000 with no minimum subsequent investment. Currently, this fund can be purchased from a limited of 28 brokerages.

The annual expense ratio of this fund is 0.94%. This is a no load fund, there is no 12b1 fee and no front-end sales load fee as well. The annual holdings turnover for this HACMX fund is 390% which is quite high compared to the average for category (124.53%).

The performances of this fund since its inception are 30.59% in 2009 and 23.53% in 2010. This fund hasn’t got any rating from Morningstar yet. The other class of this fund is the Administrative Class. The CUSIP of this fund is 411511397.

The top economic sectors of this Harbor fund are U.S. Government Obligations, Corporate Bonds & Notes and Asset-Backed Securities. There are 125 bonds in this fund. The average maturity of this fund is 4.31 years and the average duration is 2.27 years.

7. PIMCO Commodity Real Return Strategy A (PCRAX)

|

| PIMCO PCRAX fund |

This PCRAX fund is categorized in Commodities Broad Basket fund. It has total net assets of $25.14 billion. It distributes 13.01% yield. The last dividend was distributed in June 2011 (0.46%). This fund has returned 26.67% over the past year and 2.21% over the past five years. It has 3.37% of 5-year average return.

This PIMCO fund’s annual expense ratio is 1.24%. PCRAX has 0.25% management fee and 5.50% of front-end sales load fee. This fund is currently only available for brokerage account with minimum initial investment of $1,000. There are 99 brokerages where the purchase of this fund can be made.

This fund is available in many other classes, such as:

- Admin Class: PCRRX

- B Class: PCRBX

- C Class: PCRCX

- D Class: PCRDX

- Institutional Class: PCRIX

- P Class: PCRPX

- R Class: PCSRX

The top sectors of this PIMCO fund are Energy (34%), Grains (18%), Industrial Metals (17%) and Precious Metals (15%). The main country of the inflation-linked bonds is in United States.

8. Van Eck CM Commodity Index A (CMCAX)

|

| Van Eck CMCAX fund details |

This Van Eck fund has been managed by Michael F. Mazier since its inception in December 2010. Since this fund is new, it hasn’t gotten any rank from Morningstar yet. But it has a 5.07% YTD return. This fund is currently only available in brokerage account. The minimum initial investment needed is $1,000 with $100 for the next investment. This Van Eck fund can be purchased from 20 brokerages, such as JP Morgan, Scottrade Load, Fidelity Retails Funds Network, TD Ameritrade Retail, Ameriprise Brokerage, Pershing Fund Center, Raymond James WRAP Eligible, etc. Currently this fund is positioned on rank 24th in the category.

This fund is available in two other classes, which are Institutional Class (COMIX) and Y Class (CMCYX). The CMCI target weightings of this fund as of June 2011 are Energy (34.6%), Agriculture (29.6%), Industrial Metals (26.9%), Precious Metals (5.0%) and Livestock (3.9%). The asset allocations of this Van Eck fund as of March 2011 are 99.58% in cash and 0.42% in others.

9. Rydex Commodities Strategy A (RYMEX)

The Rydex Commodities Strategy investment seeks to provide investment results that correlate to the performance of the S&P GSCISM Commodity Index. The fund invests in exchange traded products (i.e. ETF and ETN), including investment companies and commodity pools, that provide exposure to the commodities markets and in commodity linked derivative instruments, which primarily consist of structured notes, swap agreements, commodity options, and futures and options on futures. It may hold U.S. government securities or cash equivalents to collateralize its derivative. The fund is non-diversified.

This Rydex fund was introduced to public in May 2005. And Ryan A. Harder has been the lead manager of this fund since 2008. This fund is rated as 2-stars from Morningstar. The last dividend distributed in December 2009 was $0.11. This fund has 1.56% annual expense ratio.

Should you want to invest in this fund, please note that there is a 0.25% of 12b1 fee and 4.75% of front-end sales load fee. The minimum amount needed to open a brokerage account in this fund is $2,500.

This fund has 7.22% of YTD return. It has performed in 3 years with positive return and 2 years in negative return. The best performance was in 2007 with 31.68%. This fund is available in A Class (RYMEX), C Class (RYMJX) and H Class (RYMBX). The benchmark of this fund is Goldman Sachs Commodity Index. The top components and dollar weights are Energy (69.32%), Agriculture (14.98%), Industrial Metals (7.99%), Livestock (4.38%) and Precious Metals (3.33%).

10. Oppenheimer Commodity Strategy Total Return A (QRAAX )

The Oppenheimer Commodity Strategy Total Return fund objective is to provide total return. The fund mainly invests in commodity-linked derivatives, investment-grade and non-investment-grade corporate bonds and notes. It may also invest minority of total assets (<25%) in a wholly-owned and controlled subsidiary.

This Oppenheimer fund has performed in 9 years of positive return and 4 years in negative return. It results in 1.64% of YTD return. This mutual fund has returned 17.05% over the past year and 1.13% over the past ten years. This QRAAX fund has total net assets of $1.93 billion.

This fund is managed by Carol Wolf since December 2008. It gives 1.46% of yield. The last dividend was distributed in December 2008 was 0.28%. QRAAX fund has 1.19% of annual expense ratio. It has 0.25% of 12b1 fee and 5.75% of front-end sales load. The minimum initial investment needed to invest in the brokerage account is $1,000 and $500 for IRA account. The minimum subsequent investment is $50. This fund can be purchased from a wide selection of 120 brokerages. The other classes of this Oppenheimer fund are Class B (QRABX), Class C (QRACX), Class N (QRANX) and Class Y (QRAYX).

The portfolio allocation as of December 2010 are 43.1% in cash equivalents, 23.8% in wholly-owned subsidiary, 18.9% in hybrid instruments, 9.9% in U.S. government obligations and 4.3% in short-term notes.

Disclosure: No Position

Other investment fund:

Details about the fund performance mentioned above can be found below.

Other investment fund:

Details about the fund performance mentioned above can be found below.

No comments:

Post a Comment