Mid Cap Growth Funds

Mid Cap Growth funds are equity funds or stock funds which invest in mid capitalization companies with higher growth potential. The mid capitalization companies usually have a market cap from $2 billion to $10 billion.

Investors or individuals who seek higher capital appreciation than typical large companies should invest in these mid cap growth stock funds. Typically, this type of investment has higher risks than typical large cap companies’ investment. It is appropriate for both regular brokerage account and retirement account or tax deferred accounts such as IRA or 401k.

Risks of investing in Mid Cap Growth Stock Funds include:

The 10 Top Performer Mid Cap Growth Equity Mutual Funds 2011 (Up to July 2011):

Five selected Top Performer Mid Growth Equity Funds 2011

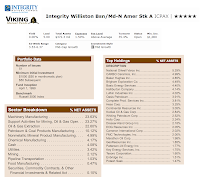

1. Integrity Williston Basin/Mid-North America Stock A (ICPAX)

As the top performer, the Integrity Williston Basin/Mid-North America Stock fund objective is to provide long-term capital appreciation. The fund typically invest most of net assets (>80%), including borrowing, in the stock of domestic and foreign issuers that are participating or benefiting from the development of the resources in the Williston Basin area and/or Mid-North America area. It may invest in new companies with little / No significant revenues (i.e. development stage companies).

Note: Williston Basin includes area in eastern Montana, western North and South Dakota, and southern Saskatchewan.

This top performer fund was previously known as the Integrity Small Cap Growth Fund. Shannon D. Radke has managed this fund since February 2010. The fund only has $372.34 million net assets. The annual expense ratio is 1.50%. There is a 0.50% management fee and 5.0% of front-end sales load fee.

Morningstar has rated this fund with 5-stars rating. This Integrity fund has 23.45% YTD return. The fund has returned 73.10% over the past year and 14.55% over the past five years. Currently this fund is on the first rank in the mid growth category.

If you are interested in investing in this Integrity fund, you will need a minimum of $1,000 for the initial investment in regular brokerage account with $50 minimum subsequent investment. This ICPAX can be bought from 52 brokerages.

Best Mid Cap Domestic Stock Mutual Funds 2012

As of June 2011, the top holdings of this fund are National Oilwell Varco Inc (5.29%), Carbo Ceramics Inc (4.99%), Baker Hughes Inc (4.85%), Brigham Exploration Co (4.49%), Basic Energy Services (4.40%), Halliburton Company (4.14%), Lufkin Industries Inc (4.02%), Oasis Petroleum (3.91%), Complete Prod Services Inc (3.81%) and Hess Corp (3.25%). And the top sector breakdowns are Machinery Manufacturing (23.63%), Support Activities for Mining, Oil and Gas Operating (23.27%), Oil & Gas Extraction (22.60%) and Petroleum & Coal Products Manufacturing (10.12%).

4. Delaware Smid Cap Growth A (MUTF: DFCIX)

The Delaware Smid Cap Growth is seeking long-term growth of capital. The fund typically invests >80% of its net assets in small- and mid-capitalization companies’ stocks. This Delaware fund considers companies that have comparable market capitalization as the companies in the Russell 2500 Growth Index. This DFCIX fund invests mainly in common stocks of growth-oriented companies that the fund Advisor believes has long-term capital appreciation potential and expects to grow faster than the U.S. economy condition.

This DFCIX fund has $1.07 billion net assets. The annual expense ratio of this fund is 1.50%. This expense ratio is higher than the average expense in the category of 1.41%. The fund dividend yield is 0.78%. This fund does have 0.30% management fee and 5.75% front-end sales load fee. This fund is managed by Christopher J. Bonavico and Kenneth F. Broad.

This 4 stars rated fund currently has 20.09% YTD return. As one of the best rated fund, this domestic stock fund has returned 45.92% over the past year, 11.51% over the past 3 year, 7.82% over the past five year, and 6.34% over the past decade. The best performance was achieved in 1999 with 64.69%.

The minimum balanced to invest in the regular brokerage account of this Delaware fund is $1,000. This fund can be purchased from 102 brokerages, include JP Morgan, Merrill Lynch, Schwab Retail, etc. Since its inception, this fund has performed in 18 years of positive achievement and 6 years of negative return. The other classes of this fund are Class B (DFBIX), Class C (DEEVX), Class R (DFRIX) and Institutional Class (DFDIX).

As of June 2011, the top sectors of this Delaware fund are Consumer Discretionary (23.0%), Technology (21.3%), Financial Services (15.8%), Healthcare (12.2%) and Producer Durables (7.3%). And the top holdings f this fund are Weight Watchers International (6.1%), Core Laboratories NV (4.5%), Techne Corp (4.4%), SBA Communications Corp (4.3%), j2 Global Communications Inc (4.0%), Polycom Inc (3.9%), Perrigo Co (3.9%), Affiliated Managers Group Inc (3.9%), Graco Inc (3.8%) and Intercontinental Exchange (3.8%). These top ten companies make up 42.6%.

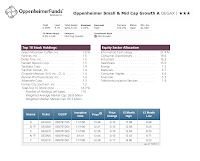

7. Oppenheimer Small & Mid Cap Growth A (MUTF: OEGAX)

The Oppenheimer Small & Mid Cap Growth seeks capital appreciation. The fund assets are mostly invests in common stocks of U.S. companies. This Oppenheimer fund invests in newer or more established companies that are in the early growth phase of their business cycle. These companies sually have above-average growth rates. The fund emphasizes equity investments in companies whose market capitalizations range from the company with the smallest market capitalization in the Russell 2000 Index to the company with the largest market capitalization in the Russell MidCap Index. It may also invest in foreign countries stocks.

This top performer mutual fund has been managed by Ronald J. Zibelli, Jr. since June 2007. The fund has 0.24% management fee and 5.75% front-end sales load fee. The minimum amount needed to open a brokerage account in this fund is $1,000 and $500 for IRA account. For 2011 year-to-date, this OEGAX fund has returned 16.17%. This 3 stars rated fund has returned 33.62% over the past year, and 5.05% over the past 10 year.

Other classes of this mid cap growth fund are Class B (OEGBX), Class C (OEGCX), Class N (OEGNX) and Class Y (OEGYX). Investor can buy this Oppenheimer fund from 106 brokerages like JP Morgan, Vanguard, Merrill Lynch, TD Ameritrade, Scottrade Load, etc.

As of June 2011, this fund has 116 holdings. And the top 10 holdings are Green Mountain Coffee Inc (1.6%), Fortinet Inc (1.5%), Dollar Tree Inc (1.5%), Hansen Natural Corp (1.5%), Teradata Corp (1.4%), Gardner Denver Inc (1.4%), Chipotle Mexican Grill Inc (1.4%), Alexion Pharmaceuticals Inc (1.3%), Albemarle Corp (1.3%) and Kansas City Southern Inc (1.3%). The top equity sector allocations are Information Technology (21.4%), Consumer Discretionary (19.6%), Industrials (16.3%) and Healthcare (15%).

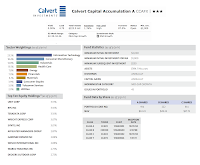

12. Calvert Capital Accumulation A (MUTF: CCAFX)

The Calvert Capital Accumulation investment seeks long-term appreciation of capital. The fund mainly invests in common stocks of mid-size U.S. companies whose market capitalization falls within the range of the Russell MidCap Growth Index. This Calvert Investments fund seeks to invest in companies and other enterprises that demonstrate positive environmental, social and governance performance. The fund may invest minority of assets (<25%) in foreign securities. It is considered as non-diversified fund.

The lead manager of this Calvert fund is Michelle Clayman. She has managed this fund since September 2005. Investor can invest in this fund by opening a brokerage account with $2,500 minimum initial investment. There is no IRA account available for this fund. The 12b1 of this fund is 0.25% and the front-end sales load fee is 4.75%. The expense ratio of this CCAFX fund is 1.76% per year.

This mid cap growth fund has received 3-stars rating from Morningstar. It has 14.92% YTD return. Since its 16 years performance, this CCAFX fund has 12 years in positive return. This 3 stars rated fund had its best performance in 2003 with 30.55%. There are 112 brokerages that provide this fund, such as Merrill Lynch, JP Morgan, Vanguard, EP Fee Small, etc. This fund is available in other classes like Class B (CWCBX), Class C (CCACX) and Class Y (CCAYX).

The top sector weightings of this fund as of March 2011 are Information Technology (23.5%), Consumer Discretionary (18.4%), Industrials (14.8%) and Health Care (13.5%). And the top ten equity holdings are Unit Corp (3.13%), RPC Inc (3.10%), Teradata Corp (3.10%), Wright Express Corp (3.07%), Syntel Inc (3.01%), Affiliated Managers Group (2.87%), Gardner Denver Inc (2.86%), Wesco International Inc (2.86%), Wabco Holdings Inc (2.73%) and Deckers Outdoor Corp (2.72%).

13. AllianceBernstein Small/Mid Cap Growth A (CHCLX)

The AllianceBernstein Small/Mid Cap Growth investment seeks long-term capital growth. This fund invests primarily in a diversified portfolio of equity securities with relatively smaller capitalizations as compared to the overall U.S. market. It normally invests at least 80% of net assets in the equity securities of small- and mid-capitalization companies. The fund may also invest in preferred stocks, reverse repurchase agreements and up to 20% of total assets in rights and warrants. It invests in approximately 60-120 stocks broadly diversified by sector.

This AllianceBernstein fund’s manager is N. Kumar Kirpalani since 2008. The fund has annual expense ratio of 1.33%. The 12b1 fee of this fund is 0.23% and the front-end sales load fee is 4.25%. Morningstar has rated this CHCLX fund with 2-stars rating. The fund total net assets are $691.15 million. Since its inception, this fund has recorded 50 years positive performance with the best total return in 2003 with 65.96%. It has returned 52.08% over the past year and 6.55% over the past decade. This CHCLX fund has 14.88% YTD return.

Investor can invest in other classes of this mid cap growth fund such as Class C (CHCCX) or Advisor Class (CHCYX). The minimum balance needed to open either brokerage account or IRA account of this fund is $2,500 with the $50 for the minimum subsequent investment. CHCLX is available for purchase from a wide selection of 106 brokerages.

This Alliance Bernstein fund has a total 90 holdings as of June 2011. The top ten holdings are Joy Global (1.70%), CarMax (1.65%), Ametex (1.65%), Green Mountain Coffee Roaster (1.62%), Dollar Tree (1.55%), SXC Health Solutions (1.54%), HMS Holdings (1.54%), Lincoln Electric Holdings Inc (1.54%), Solutia (1.46%) and MSC Industrial Direct Co (1.45%). And the top sectors are Producer Durables (20.25%), Technology (20.12%), Consumer Discretionary (17.30%) and Healthcare (15.89%).

Disclosure: No Position

Details on Fund Performance

Full page view:

Mid Cap Growth funds are equity funds or stock funds which invest in mid capitalization companies with higher growth potential. The mid capitalization companies usually have a market cap from $2 billion to $10 billion.

Investors or individuals who seek higher capital appreciation than typical large companies should invest in these mid cap growth stock funds. Typically, this type of investment has higher risks than typical large cap companies’ investment. It is appropriate for both regular brokerage account and retirement account or tax deferred accounts such as IRA or 401k.

Risks of investing in Mid Cap Growth Stock Funds include:

|

| Top Mid Growth Stock Fund |

- Market Risk – Equity fund can be very volatile depending on economic, political or market conditions

- Company Risk or Financial risk – Over short term or long term time, some companies’ financial may deteriorate and cause the decrease in their stock value.

- Foreign Investment Risk – Some funds may invest in foreign company which can be riskier than typical US company stocks

- Mid Cap and Small Cap Risk – Smaller companies may have greater price volatility than big or large capitalization companies

- Active Management Risk

- Style Risk – Certain investing style such as growth or value approach may provide additional volatility

- Other Risks - Please check the fund's prospectus for additional risks associated with specific fund.

The 10 Top Performer Mid Cap Growth Equity Mutual Funds 2011 (Up to July 2011):

- Integrity Williston Basin/Mid-North America Stock A (ICPAX)

- GMO US Small/Mid Cap Growth III (GMSPX)

- Allianz AGIC Focused Opportunity A (AFOAX)

- Delaware Smid Cap Growth A (DFCIX)

- Delaware Select Growth A (DVEAX)

- Eventide Gilead Retail (ETGLX)

- Oppenheimer Small & Mid Cap Growth A (OEGAX)

- Value Line (VLIFX)

- Eventide Gilead A (ETAGX)

- Artio US Midcap A (JMDAX)

Fund Information

Note: the funds are sorted based on their YTD performance up to July 24th, 2011| No | Name | Ticker | M* Rating | Yield | Expense Ratio | Load | Net Assets (mil) | Min to Invest |

|---|---|---|---|---|---|---|---|---|

| 1 | Integrity Williston Bsn/Md-N Amer Stk A | ICPAX | 5 | 0.00% | 1.50% | 5.00% | $372 | $1,000 |

| 2 | GMO US Small/Mid Cap Growth III | GMSPX | 3 | 0.28% | 0.46% | 0.00% | $5 | $ 10 mil |

| 3 | Allianz AGIC Focused Opportunity A | AFOAX | N/A | 0.00% | 0.00% | 5.50% | $4 | $1,000 |

| 4 | Delaware Smid Cap Growth A | DFCIX | 4 | 0.78% | 1.50% | 5.75% | $1,100 | $1,000 |

| 5 | Delaware Select Growth A | DVEAX | 3 | 0.00% | 1.51% | 5.75% | $1,000 | $483 |

| 6 | Eventide Gilead Retail | ETGLX | N/A | 0.00% | 1.63% | 0.00% | $16 | $1,000 |

| 7 | Oppenheimer Small & Mid Cap Growth A | OEGAX | 3 | 0.00% | 1.62% | 5.75% | $253 | $1,000 |

| 8 | Value Line | VLIFX | 1 | 0.00% | 0.91% | 0.00% | $142 | $1,000 |

| 9 | Eventide Gilead A | ETAGX | N/A | 0.00% | 1.67% | 5.75% | $16 | $1,000 |

| 10 | Artio US Midcap A | JMDAX | 3 | 0.00% | 1.35% | 0.00% | $4 | $1,000 |

Five selected Top Performer Mid Growth Equity Funds 2011

1. Integrity Williston Basin/Mid-North America Stock A (ICPAX)

As the top performer, the Integrity Williston Basin/Mid-North America Stock fund objective is to provide long-term capital appreciation. The fund typically invest most of net assets (>80%), including borrowing, in the stock of domestic and foreign issuers that are participating or benefiting from the development of the resources in the Williston Basin area and/or Mid-North America area. It may invest in new companies with little / No significant revenues (i.e. development stage companies).

|

| Integrity ICPAX fund |

This top performer fund was previously known as the Integrity Small Cap Growth Fund. Shannon D. Radke has managed this fund since February 2010. The fund only has $372.34 million net assets. The annual expense ratio is 1.50%. There is a 0.50% management fee and 5.0% of front-end sales load fee.

Morningstar has rated this fund with 5-stars rating. This Integrity fund has 23.45% YTD return. The fund has returned 73.10% over the past year and 14.55% over the past five years. Currently this fund is on the first rank in the mid growth category.

If you are interested in investing in this Integrity fund, you will need a minimum of $1,000 for the initial investment in regular brokerage account with $50 minimum subsequent investment. This ICPAX can be bought from 52 brokerages.

Best Mid Cap Domestic Stock Mutual Funds 2012

As of June 2011, the top holdings of this fund are National Oilwell Varco Inc (5.29%), Carbo Ceramics Inc (4.99%), Baker Hughes Inc (4.85%), Brigham Exploration Co (4.49%), Basic Energy Services (4.40%), Halliburton Company (4.14%), Lufkin Industries Inc (4.02%), Oasis Petroleum (3.91%), Complete Prod Services Inc (3.81%) and Hess Corp (3.25%). And the top sector breakdowns are Machinery Manufacturing (23.63%), Support Activities for Mining, Oil and Gas Operating (23.27%), Oil & Gas Extraction (22.60%) and Petroleum & Coal Products Manufacturing (10.12%).

4. Delaware Smid Cap Growth A (MUTF: DFCIX)

|

| Delaware Smid Cap Growth fund |

This DFCIX fund has $1.07 billion net assets. The annual expense ratio of this fund is 1.50%. This expense ratio is higher than the average expense in the category of 1.41%. The fund dividend yield is 0.78%. This fund does have 0.30% management fee and 5.75% front-end sales load fee. This fund is managed by Christopher J. Bonavico and Kenneth F. Broad.

This 4 stars rated fund currently has 20.09% YTD return. As one of the best rated fund, this domestic stock fund has returned 45.92% over the past year, 11.51% over the past 3 year, 7.82% over the past five year, and 6.34% over the past decade. The best performance was achieved in 1999 with 64.69%.

The minimum balanced to invest in the regular brokerage account of this Delaware fund is $1,000. This fund can be purchased from 102 brokerages, include JP Morgan, Merrill Lynch, Schwab Retail, etc. Since its inception, this fund has performed in 18 years of positive achievement and 6 years of negative return. The other classes of this fund are Class B (DFBIX), Class C (DEEVX), Class R (DFRIX) and Institutional Class (DFDIX).

As of June 2011, the top sectors of this Delaware fund are Consumer Discretionary (23.0%), Technology (21.3%), Financial Services (15.8%), Healthcare (12.2%) and Producer Durables (7.3%). And the top holdings f this fund are Weight Watchers International (6.1%), Core Laboratories NV (4.5%), Techne Corp (4.4%), SBA Communications Corp (4.3%), j2 Global Communications Inc (4.0%), Polycom Inc (3.9%), Perrigo Co (3.9%), Affiliated Managers Group Inc (3.9%), Graco Inc (3.8%) and Intercontinental Exchange (3.8%). These top ten companies make up 42.6%.

7. Oppenheimer Small & Mid Cap Growth A (MUTF: OEGAX)

The Oppenheimer Small & Mid Cap Growth seeks capital appreciation. The fund assets are mostly invests in common stocks of U.S. companies. This Oppenheimer fund invests in newer or more established companies that are in the early growth phase of their business cycle. These companies sually have above-average growth rates. The fund emphasizes equity investments in companies whose market capitalizations range from the company with the smallest market capitalization in the Russell 2000 Index to the company with the largest market capitalization in the Russell MidCap Index. It may also invest in foreign countries stocks.

|

| Oppenheimer Small & Mid Cap Growth |

Other classes of this mid cap growth fund are Class B (OEGBX), Class C (OEGCX), Class N (OEGNX) and Class Y (OEGYX). Investor can buy this Oppenheimer fund from 106 brokerages like JP Morgan, Vanguard, Merrill Lynch, TD Ameritrade, Scottrade Load, etc.

As of June 2011, this fund has 116 holdings. And the top 10 holdings are Green Mountain Coffee Inc (1.6%), Fortinet Inc (1.5%), Dollar Tree Inc (1.5%), Hansen Natural Corp (1.5%), Teradata Corp (1.4%), Gardner Denver Inc (1.4%), Chipotle Mexican Grill Inc (1.4%), Alexion Pharmaceuticals Inc (1.3%), Albemarle Corp (1.3%) and Kansas City Southern Inc (1.3%). The top equity sector allocations are Information Technology (21.4%), Consumer Discretionary (19.6%), Industrials (16.3%) and Healthcare (15%).

12. Calvert Capital Accumulation A (MUTF: CCAFX)

The Calvert Capital Accumulation investment seeks long-term appreciation of capital. The fund mainly invests in common stocks of mid-size U.S. companies whose market capitalization falls within the range of the Russell MidCap Growth Index. This Calvert Investments fund seeks to invest in companies and other enterprises that demonstrate positive environmental, social and governance performance. The fund may invest minority of assets (<25%) in foreign securities. It is considered as non-diversified fund.

|

| Calvert Capital Accumulation fund |

This mid cap growth fund has received 3-stars rating from Morningstar. It has 14.92% YTD return. Since its 16 years performance, this CCAFX fund has 12 years in positive return. This 3 stars rated fund had its best performance in 2003 with 30.55%. There are 112 brokerages that provide this fund, such as Merrill Lynch, JP Morgan, Vanguard, EP Fee Small, etc. This fund is available in other classes like Class B (CWCBX), Class C (CCACX) and Class Y (CCAYX).

The top sector weightings of this fund as of March 2011 are Information Technology (23.5%), Consumer Discretionary (18.4%), Industrials (14.8%) and Health Care (13.5%). And the top ten equity holdings are Unit Corp (3.13%), RPC Inc (3.10%), Teradata Corp (3.10%), Wright Express Corp (3.07%), Syntel Inc (3.01%), Affiliated Managers Group (2.87%), Gardner Denver Inc (2.86%), Wesco International Inc (2.86%), Wabco Holdings Inc (2.73%) and Deckers Outdoor Corp (2.72%).

13. AllianceBernstein Small/Mid Cap Growth A (CHCLX)

The AllianceBernstein Small/Mid Cap Growth investment seeks long-term capital growth. This fund invests primarily in a diversified portfolio of equity securities with relatively smaller capitalizations as compared to the overall U.S. market. It normally invests at least 80% of net assets in the equity securities of small- and mid-capitalization companies. The fund may also invest in preferred stocks, reverse repurchase agreements and up to 20% of total assets in rights and warrants. It invests in approximately 60-120 stocks broadly diversified by sector.

|

| AllianceBern Small/Mid Cap Growth |

Investor can invest in other classes of this mid cap growth fund such as Class C (CHCCX) or Advisor Class (CHCYX). The minimum balance needed to open either brokerage account or IRA account of this fund is $2,500 with the $50 for the minimum subsequent investment. CHCLX is available for purchase from a wide selection of 106 brokerages.

This Alliance Bernstein fund has a total 90 holdings as of June 2011. The top ten holdings are Joy Global (1.70%), CarMax (1.65%), Ametex (1.65%), Green Mountain Coffee Roaster (1.62%), Dollar Tree (1.55%), SXC Health Solutions (1.54%), HMS Holdings (1.54%), Lincoln Electric Holdings Inc (1.54%), Solutia (1.46%) and MSC Industrial Direct Co (1.45%). And the top sectors are Producer Durables (20.25%), Technology (20.12%), Consumer Discretionary (17.30%) and Healthcare (15.89%).

Disclosure: No Position

Details on Fund Performance

Full page view:

No comments:

Post a Comment