TCW Total Return Bond I (Ticker: TGLMX)

The TCW Total Return Bond fund is seeking to maximize current income and achieve above average total return consistent with prudent investment management over a full market cycle. This TCW fund invests >80% of net assets in debt obligations. It invests mostly in mortgage-backed securities of any maturity or type guaranteed by, or secured by collateral that is guaranteed by, the United States Government, its agencies, sponsored corporations, and in privately issued mortgage-backed securities rated Aa or higher by any nationally recognized statistical organization.

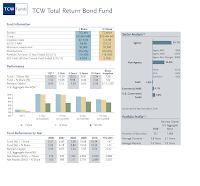

TGLMX Fund Details

- Fund Inception Date: June 1993TGLMX fund details

- Ticker Symbol: TGLMX (Institutional Class)

- CUSIP: 87234N880

- Beta (3yr): 0.42

- Rank in category (YTD): 50

- Category: Intermediate-Term Bond

- Distribution: 7.13%

- Capital Gains: N/A

- Number of Years Up: 15 years

- Number of Years Down: 2 years

- Average Duration: 3.8 years

- Average Maturity: 7.4 years

updated on 7/2/2011

This TCW fund has a net asset of $5.33 billion. It has been managed by Tad Rivelle since December 2009. This TCW fund used to be managed by Jeffrrey Gundlach. TCW fired Jeffrrey Gundlach, the firm's chief investment officer and a co-manager of the fund in late 2009. This move was a response to fears that Gundlach would leave TCW soon and take other important fund’s advisors with him. Currently this fund is managed by a team from MetWest Asset Management. This fund currently may invest <50% of asset in junk bonds.

This fund also has a high dividend of 7.13%. The minimum balance required to open a brokerage account in this fund is $2,000 and for IRA account is $500. The fund has annual expense ratio of 0.44%. This is a no fee fund. It has neither management fee nor front-end sales load fee.

The fund has a five star rating from Morning star. It has recorded 15 years positive performance with the best total return in 2009 with 19.88% and the worst in 1999 with -0.46%. It has returned 9.44% over the past one year and 7.51% over the past decade. The other class of this fund is N Class (Ticker: TGMNX).

TGLMX can be purchased from 68 brokerages such as Merrill Lynch, Vanguard, JP Morgan, T Rowe Price, Schwab Retail, TD Ameritrade, Pershing Fund Center, Firstrade, Bear Stearns, etc. As of March 2011, the sector analysis of this fund is 55.1% in agency, 34.6% in non-agency, 7.6% in U.S. Government Credit, 4.1% in Commercial MBS.

Pros:

Pros:

- No sales load

- Low expense ratio

- New management team since 2010

Disclosure: No Position

No comments:

Post a Comment