Introduction

Exchange traded funds or ETF has become the core investment for many investors (long term, short term, intermediate term). There are two main reasons to invest in ETF. The reasons are liquidity and tax-efficiency. ETFs are traded just like stock. You can trade any ETFs (buy ETF or sell ETF) during the trading day (pre-market, market and post-market) through stock exchange such as New York Stock Exchange (NYSE) and Nasdaq.ETFs are very liquid compare to mutual funds. Mutual funds can only be bought by end of the day. Also, ETFs are very tax efficient since ETFs don’t distribute any capital gain for the investors or shareholders. Typical mutual funds will distribute its capital gain near end of the year or middle of the year. Without this frequent trading activity such as buying and selling, there isn't much likelihood for an ETF to realize capital gains. Note: This is a feature that ETFs have in common with index mutual funds—low trading generally means low capital gains.

There are many major ETF sponsors such as:

- Vanguard: VTI (Total Stock Market), VV (Large Cap), VO (Mid Cap), VWO (Emerging Market)

- State Street Global Advisor SPDR: SPY (S&P500), DIA (Dow Jones Industrial Average)

- Invesco Powershares: QQQQ (Nasdaq 100 index)

- BlackRock iShares: GD (Gold Commodity ETF), IVV (S&P 500), EEM (Emerging Markets), IWM (iShares Russell 2000 Index)

- Schwab: SCHP (Schwab US TIPS ETF), SCHB (Schwab US Broad Market ETF), SCHF (Schwab International Equity ETF)

ETF Categories

Exchange Traded Funds (ETFs) are similar to mutual funds; they also can be categorized into 2 main classes such as Equity ETF or stock ETF and Fixed Income ETF or bond ETF. As usual, the bond ETF is less volatile than stock ETF.

Exchange Traded Funds (ETFs) are similar to mutual funds; they also can be categorized into 2 main classes such as Equity ETF or stock ETF and Fixed Income ETF or bond ETF. As usual, the bond ETF is less volatile than stock ETF.Bond ETF can be divided into two main branches such as taxable bond ETF and municipal bond ETF or non taxable bond ETF. Taxable bond ETF can consist of short term bond, intermediate term bond, and long term bond ETF. In term of style, Taxable Bond ETF can be Investment Grade Bond, High Yield Bond ETF, Government bond, Mortgage Bond, etc.

The other bond ETFs are non taxable bond ETF or municipal bond ETF. The municipal bond has advantages especially for people that pay high income tax on Federal and state level since these Bond ETFs are tax free.

Stock ETF can be classified into three main groups such as US Domestic Stock ETF, International Stock ETF, and Emerging Market ETF. Domestic Stock ETFs include small cap stock ETF, mid cap stock ETF, and large cap stock ETF. International Stock ETFs include European Stock ETF, Pacific Stock ETF, World Stock, and more. Emerging Stock ETF include most developing countries in Asia, South America, Africa and Eastern Europe. Some of these emerging markets countries are known as BRIC acronym (Brazil, Russia, India and China).

For specialize sectors, ETFs also have many sector ETFs are: REIT ETF (VNQ or IYR), Technology ETF (QQQ), Health Care ETF, Energy ETF, commodity ETF (Gold, Silver, Natural Gas etc), and specific country ETF (Brazil, Russia, India etc).

Recently, there is also many leverage ETFs are being introduced such as SDS, TNA, TZA, EDZ, EDC, etc.

Top 40 ETF 2011

The following list has been compiled based on its total assets. The ETFs also are well known by many investors. They are suitable for long term investment as well as short term investment.The top 40 popular ETFs 2011 are:

- Vanguard Total Stock Market ETF (VTI)

- Vanguard S&P 500 ETF (VOO)

- Vanguard Total Bond Market ETF (BND)

- SPDR S&P 500 (SPY)

- Vanguard MSCI Emerging Markets ETF (VWO)

- Vanguard Total International Stock Index ETF (VXUS)

- SPDR Gold Shares (GLD)

- iShares MSCI EAFE Index (EFA)

- iShares MSCI Emerging Markets Index (EEM)

- Vanguard Mid-Cap ETF (VO)

| No | Fund Name | Ticker | YTD | 1 Year | 3 Year | 5 Year | 10 Year |

|---|---|---|---|---|---|---|---|

| 1 | Vanguard Total Stock Market ETF | VTI | 5.86% | 26.48% | 5.35% | 3.82% | 3.91% |

| 2 | Vanguard S&P 500 ETF | VOO | 5.32% | N/A | N/A | N/A | N/A |

| 3 | Vanguard Total Bond Market ETF | BND | 3.69% | 4.78% | 6.72% | N/A | N/A |

| 4 | SPDR S&P 500 | SPY | 4.90% | 23.36% | 4.03% | 2.84% | 2.67% |

| 5 | Vanguard MSCI Emerging Markets ETF | VWO | -2.01% | 19.47% | 4.87% | 10.54% | N/A |

| 6 | Vanguard Total Intl Stock Idx ETF | VXUS | N/A | N/A | N/A | N/A | N/A |

| 7 | SPDR Gold Shares | GLD | 10.13% | 30.19% | 17.09% | 18.67% | N/A |

| 8 | iShares MSCI EAFE Index | EFA | 0.94% | 18.94% | -1.41% | 0.88% | N/A |

| 9 | iShares MSCI Emerging Markets Index | EEM | -2.23% | 18.43% | 4.22% | 10.49% | N/A |

| 10 | Vanguard Mid-Cap ETF | VO | 7.09% | 32.11% | 7.84% | 5.31% | N/A |

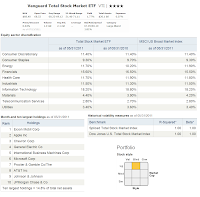

Vanguard Total Stock Market ETF (Ticker: VTI)

Vanguard Total Stock Market ETF is the most popular exchange traded funds because of its low expense ratio fee. It only has 0.06% annual expense ratio. This Vanguard ETF tracks the performance of a benchmark index, MSCI US Broad Market Index, which represents 99.5% or more of the total market capitalization of all the U.S. common stocks regularly traded on the New York Stock Exchange (NYSE) and the Nasdaq over-the-counter market. This fund employs passive management style to invest in variety of company stocks in its index. It holds a broadly diversified collection of securities in more than 3,000 of the stocks in its target index.Best Performing ETFs May 2012

The ETF has returned 26.48% over the past year and 5.35% over the past three years. Morningstar has rated this VTI fund with 4 stars rating. This fund also has a dividend yield of1.77%. The annual turnover rate is only 6%. If you are interested in Vanguard Mutual Fund version of this ETF, you can choose Investor Shares (VTSMX) and Admiral Shares (VTSAX).

The ETF has returned 26.48% over the past year and 5.35% over the past three years. Morningstar has rated this VTI fund with 4 stars rating. This fund also has a dividend yield of1.77%. The annual turnover rate is only 6%. If you are interested in Vanguard Mutual Fund version of this ETF, you can choose Investor Shares (VTSMX) and Admiral Shares (VTSAX).The primary portfolio consists of large blend stocks. As of June 2011, the top 10 sectors of fund are Information Technology, Financials, Energy, Health care, industrials, consumer discretionary, consumer staples, materials, utilities, and telecommunication services. Top 10 largest equity holdings for this fund include Exxon Mobil Corp, Apple Inc, Chevron Corp, General Electric (GE), International Business Machines Corp (IBM), Microsoft Corporation, Procter & Gamble Company (P&G), AT&T Inc, Johnson & Johnson (JNJ), and JPMorgan Chase & Co.

Vanguard S&P 500 ETF (Ticker: VOO)

The Vanguard S&P 500 ETF fund objective is to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. Similar to Vanguard Total Stock Market ETF, this Vanguard fund also uses a passive management or indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index. This S&P 500 index is a widely recognized benchmark of U.S. stock market performance and it consists of the large U.S. companies stocks. This ETF is relative new ETF; the ETF is opened for investment since September 2010.

The Vanguard S&P 500 ETF fund objective is to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. Similar to Vanguard Total Stock Market ETF, this Vanguard fund also uses a passive management or indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index. This S&P 500 index is a widely recognized benchmark of U.S. stock market performance and it consists of the large U.S. companies stocks. This ETF is relative new ETF; the ETF is opened for investment since September 2010.This Vanguard S&P 500 ETF has a year to date return of 5.77%. Any long term performance is not available at this time. The SEC yield is 1.96%. The fund has not been rated by Morningstar. For Mutual Fund shares, you can select either Investor Shares (VFINX) or Admiral Shares (VFIAX).

As of June 2011, there are 504 stocks in its holding. This Vanguard VOO fund median market cap is $49.1 billion. The top 10 equity sectors include information technology, financials, energy, health care, industrials, consumer staples, consumer discretionary, materials, utilities, and telecommunication services. Top 10 largest equity holdings for this fund include Exxon Mobil Corp, Apple Inc, Chevron Corp, General Electric (GE), International Business Machines Corp (IBM), Procter & Gamble Company (P&G), AT&T Inc, Microsoft Corporation, Johnson & Johnson (JNJ), and JPMorgan Chase & Co.

Vanguard Total Bond Market ETF (BND)

The Vanguard Total Bond Market ETF seeks to track the performance of a broad, market-weighted bond index. As the third Vanguard ETF in this list, this Vanguard Total Bond Market ETF also employs a passive management or indexing investment approach designed to track the performance of the Barclays Capital U.S. Aggregate Float Adjusted Index. The fund invests its assets to track its index through a broadly diversified collection of securities holdings. This Vanguard BND fund will invest majority of assets (>80%) in bonds held in the index. It maintains a dollar-weighted average maturity consistent with that of the index, ranging between 5 and 10 years. This Vanguard fund usually invest in >3,000 bonds representative of the US investment grade market bond.

This Vanguard BND fund will invest majority of assets (>80%) in bonds held in the index. It maintains a dollar-weighted average maturity consistent with that of the index, ranging between 5 and 10 years. This Vanguard fund usually invest in >3,000 bonds representative of the US investment grade market bond.This exchange traded fund is rated with 3 stars by Morningstar. The fund has returned 2.27% over the past three month, 3.55% over the past year, and 6.29% over the past three years. It is considered as Intermediate Term Bond ETF with high credit quality and medium interest rate sensitivity. The fund’s average duration is 5.2 years and the fund’s average maturity is 7.4 years. The fund has $90.6 billion total net assets. The expense ratio of this bond ETF is only 0.11% per year. The yield is 3.31%.

As of June 2011, the fund assets are allocated as follow: 41.5% in Treasury / Agency, 28.5% in Government Mortgage Backed, 11.3% in Industrials, 7.7% in Finance, 5.5% in Foreign, 2.7% in Commercial Mortgage Backed, 2.3% in Utilities, 0.3% in Asset Backed, and 0.2% in other. The number of bonds in this fund is 4902 bonds.

SPDR S&P 500 (Ticker: SPY)

As the oldest ETF and part of State Street Global Advisors fund, SPDR S&P 500 has been known by most investors since 1993. The SPDR S&P 500 ETF objective is to seek the price and yield performance, before fees and expenses, of the S&P 500 Index. SPDR Trust is an exchange-traded fund that holds all of the S&P 500 Index stocks. It is comprised of undivided ownership interests called SPDRs. The fund issues and redeems SPDRs only in multiples of 50,000 SPDRs in exchange for S&P 500 Index stocks and cash. The total expense ratio is 0.09% per year which is low compare to most mutual funds and average category.

As the oldest ETF and part of State Street Global Advisors fund, SPDR S&P 500 has been known by most investors since 1993. The SPDR S&P 500 ETF objective is to seek the price and yield performance, before fees and expenses, of the S&P 500 Index. SPDR Trust is an exchange-traded fund that holds all of the S&P 500 Index stocks. It is comprised of undivided ownership interests called SPDRs. The fund issues and redeems SPDRs only in multiples of 50,000 SPDRs in exchange for S&P 500 Index stocks and cash. The total expense ratio is 0.09% per year which is low compare to most mutual funds and average category.The fund has a yield of 1.84% and it receives 3 stars rating. The fund yield is distributed quarterly. This SPDR fund has 502 stocks in its holdings. This SPY fund performance has returned 29.64% over the past year, 3.09% over the past 3 year, and 2.73% over the past five year.

The primary portfolio of this SPDR S&P 500 fund consists of large blend stocks.

As of July 2011, the top 5 sectors of fund are Technology, Financial Services, Industrials, Energy and Healthcare. The top 10 largest equity holdings for this fund include Exxon Mobil Corp, Apple Inc, International Business Machines Corp (IBM), Chevron Corporation, Microsoft Corporation, General Electric (GE), Johnson & Johnson (JNJ), AT&T Inc, Procter & Gamble Company (P&G), and Pfizer Inc.

Vanguard MSCI Emerging Markets ETF (VWO)

Vanguard Emerging Markets Stock ETF objective is to track the performance of the MSCI Emerging Markets index. The fund employs a passively managed investment approach by investing all or substantially all of assets in a representative sample of the common stocks included in the MSCI Emerging Markets index. This fund invest majority of assets in companies stocks located in emerging markets around the world such as Brazil, Russia, China, Korea, and Taiwan.

Vanguard Emerging Markets Stock ETF objective is to track the performance of the MSCI Emerging Markets index. The fund employs a passively managed investment approach by investing all or substantially all of assets in a representative sample of the common stocks included in the MSCI Emerging Markets index. This fund invest majority of assets in companies stocks located in emerging markets around the world such as Brazil, Russia, China, Korea, and Taiwan.The current total expense ratio of this Vanguard ETF is 0.22% per year. It also has 1.69% yield. This ETF has 912 stocks in its holdings. The median market cap of the companies is $18.4 billion. This fund has 3 years beta of 1.15 against its index. If you are interested in mutual fund of this ETF, you can choose the following classes such as Investor Shares (VEIEX) or Admiral Shares (VEMAX).

The primary portfolio consists of large blend Diversified Emerging Markets stocks. As of July 2011, the 5 sectors of this emerging markets stock ETF are Financial Services (23.5), Basi materials (15.5%), Energy (14.1%), Technology (12.7%), and Consumer Cyclical (8.1%). The top 6 countries of fund are China, Brazil, South Korea, Taiwan, South Africa, and India. Top 10 largest equity holdings for this fund include Petroleo Brasileiro SA, Samsung Electronics Co, Vale SA, Gazprom OAO, Taiwan Semiconductor Manufacturing Co Ltd, China Mobile Ltd, Itau Unibanco Holding SA, America Movil S.A.B de CV, Industrial And Commercial Bank Of China Limited, and China Construction Bank Corporation.

Vanguard Total International Stock Index ETF (VXUS)

Vanguard Total International Stock ETF is seeking to track the MSCI All Country World ex USA Investable Market Index performance. This index measures the investment return of companies stocks located outside the United States (USA). Since it is an index ETF, it uses a passively management style.YTD Best Performing Non Leveraged ETFs

The fund consists of 6731 stocks. This Vanguard Total International Stock ETF has a median market cap of $24 billion. The fund’s annual expense ratio is 0.20%. This ETF is just newly introduced; there is no long term performance history. You can check the mutual fund classes to find its fund performance. The mutual funds versions include Investor Shares (VGTSX), and Admiral Shares (VTIAX).

The month-end ten largest holdings are BHP Billiton Ltd, Royal Dutch Shell Plc, Nestle SA, HSBC Holdings Plc, Novartis AG, BP Plc, Vodafone Group Plc, Rio Tinto Plc, Roche Holding AG, and Total SA. The top 10 countries in this fund include United Kingdom, Japan, Canada, France, Australia, Germany, Switzerland, China, Korea, and Brazil.

SPDR Gold Shares (Ticker: GLD)

SPDR Gold Shares fund objective is to replicate the performance, after expenses, of the price of gold bullion. Issuing shares backed by physical bullion, SPDR Gold Shares GLD aims to offer investors the price performance of spot gold, minus administrative expense costs. The Bullion is held in London vaults under the custody of HSBC Bank USA, N.A., ridding investors of the inefficiencies and inconveniences associated with transporting and storing the commodity.

SPDR Gold Shares fund objective is to replicate the performance, after expenses, of the price of gold bullion. Issuing shares backed by physical bullion, SPDR Gold Shares GLD aims to offer investors the price performance of spot gold, minus administrative expense costs. The Bullion is held in London vaults under the custody of HSBC Bank USA, N.A., ridding investors of the inefficiencies and inconveniences associated with transporting and storing the commodity.The primary portfolio consists of gold commodity. As of July 2011, the top holding is Physical Gold Bullion which is valued at 61 billion.

iShares MSCI EAFE Index (Ticker: EFA)

iShares MSCI EAFE Index ETF is to seek investment results that correspond generally to the MSCI EAFE index benchmark price and yield performance, before fees and expenses. The fund invests majority of the assets in the securities of the underlying index. The underlying index has been developed by MSCI as an equity benchmark for its international stock performance. The underlying index includes stocks from Europe, Australasia and the Far East as measured by the MSCI EAFE Index.

iShares MSCI EAFE Index ETF is to seek investment results that correspond generally to the MSCI EAFE index benchmark price and yield performance, before fees and expenses. The fund invests majority of the assets in the securities of the underlying index. The underlying index has been developed by MSCI as an equity benchmark for its international stock performance. The underlying index includes stocks from Europe, Australasia and the Far East as measured by the MSCI EAFE Index.IShares MSCI EAFE Index EFA tracks the most established foreign large-cap index. It is still one of the best choices for a core foreign-stock holding. This fund has nearly 8 times the assets of the next-largest developed-market foreign-equity ETF and almost 15 times the daily dollar trading volume, making it the most liquid core foreign option in the ETF universe. The fund’s CUSIP is 464287465.

The primary portfolio consists of large blend International stocks. As of June 2011, the top 6 countries of fund are United Kingdom, Japan, France, Germany, Australia, and Switzerland. There are 933 holdings in this ETF. Top 10 largest equity holdings for this fund include Nestle SA, HSBC Holding PLC, BHP Billiton Limited, Novartis AG, BP Plc, Vodafone Group, Royal Dutch Shell PLC ADR, Total SA, Roche Holdings AG Genusschein, and Siemens AG Reg.

iShares MSCI Emerging Markets Index (EEM)

iShares MSCI Emerging Markets Index objective is to provide investment results that correspond generally to the price and yield performance of the MSCI Emerging Markets index. The fund invests most of assets (>90%) in the securities of the underlying index or in ADRs and GDRs representing such securities. The index was developed by MSCI as an equity benchmark for international stock performance.IShares MSCI Emerging Markets Index EEM provides broad exposure to the emerging-markets large-cap universe. This fund is appropriate as a core investor holding although it would be not recommended for the bulk of international equity exposure given its higher level of volatility. The emerging-markets large caps have been about 60% more volatile than U.S. large caps over the past 15 years according to latest studies.

Best Diversified Emerging Markets Stock Mutual Funds 2012

The primary portfolio consists of large blend Diversified Emerging Markets stocks. As of June 2011, the top 5 countries of fund are China, Brazil, South Korea, Taiwan, and South Africa. Top 10 largest equity holdings for this fund include Samsung Electronics Co, Gazprom OAO, Petrobras - Petroleo Brasileiro S.A. ADR PR, Vale SA ADR, Petrobras - Petroleo Brasileiro, China Mobile Ltd, America Movil S.A.B., Taiwan Semiconductor SP, And Commercial Bank Of China Limited, and Infosys Ltd SP ADR.

Vanguard Mid-Cap ETF (Ticker: VO)

Vanguard Mid-Cap ETF is seeking to track the MSCI US Mid Cap 450 Index. The fund mainly invests majority of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index. The index measures the investment return of mid-capitalization stocks. The companies usually have market capitalizations of approximately $1 billion to $8.5 billion.

Vanguard Mid-Cap ETF is seeking to track the MSCI US Mid Cap 450 Index. The fund mainly invests majority of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index. The index measures the investment return of mid-capitalization stocks. The companies usually have market capitalizations of approximately $1 billion to $8.5 billion.The fund currently has 453 stocks. This Vanguard Mid-Cap ETF has a median market cap of $6.7 billion. The fund’s annual expense ratio is 0.12%. There is also two different mutual funds versions include Investor Shares (VIMSX), and Admiral Shares (VIMAX). The fund has returned 38.68% over the past year, and 6.39% over the past three years.

The month-end ten largest holdings are El Paso Corp, Netflix Inc, Humana Inc, Dover Corp, Cliffs Natural Resources Inc, Host Hotels & Resorts Inc, Starwood Hotels & Resorts Worldwide Inc, NVIDIA Corp, Consol Energy Inc, and AvalonBay Communities Inc. The top 8 sectors include Financials, Consumer Discretionary, Information Technology, Industrials, Health care, Energy, Materials, And Utilities.

Where and how can I purchase these ETFs?

You will need a brokerage to buy ETFs since it is traded like a stock. Don’t be afraid with this, you can check my review of various brokerages to buy and sell ETF. I would recommend using the following brokerages:

- Vanguard – You can buy or sell Vanguard ETFs for free online. Vanguard currently has more than 50 ETFs for free to trade. If you trade stock, you can trade as little as $7.00 per trade up to 25 trades a year otherwise it is $20 per trade. It also offers various mutual funds that track indexes.

- Fidelity – Fidelity offers 30 ishares ETF for free which include iShares Russell 2000 Index (IWM), iShares S&P 500 Index (IVV) and more. It is also a one stop shop for mutual funds as well as cash management banking. Commission for trading is only $7.95 per trade.

- TD Ameritrade – There are 100+ ETFs for free trade. Please check the details about the limitation. You can trade stock for $9.95 per trade.

- Charles Schwab – Schwab offers 14 Schwab ETFs for free trading. You can trade stocks for $8.95 per trade.

- Scottrade – You can trade ETF using Scottrade for $7.00 per trade. You can also trade stock for the same commission fee. It also offers 3,000 No load & No Transaction Fees (NTF) fund for free and 15,000 mutual funds.

Disclosure: As of July 13th 2011, I’m long VTI & VWO. I may trade these positions at anytime.

Top 40 Popular and Best ETF 2012: Funds Information

| No | Fund Name | Ticker | Category | Net Assets | Expense Ratio | Yield | Rating | Annual Turnover Ratio |

|---|---|---|---|---|---|---|---|---|

| 1 | Vanguard Total Stock Market ETF | VTI | Large Blend | 167.88B | 0.06% | 1.77% | 4 | 5.00% |

| 2 | Vanguard S&P 500 ETF | VOO | Large Blend | 108.03B | 0.06% | 1.96% | NR | 5.00% |

| 3 | Vanguard Total Bond Market ETF | BND | Intermediate-Term Bond | 90.55B | 0.11% | 3.31% | 3 | 75.00% |

| 4 | SPDR S&P 500 | SPY | Large Blend | 89.23B | 0.09% | 1.84% | 3 | 5.38% |

| 5 | Vanguard MSCI Emerging Markets ETF | VWO | Diversified Emerging Mkts | 64.17B | 0.22% | 1.69% | 4 | 12.00% |

| 6 | Vanguard Total Intl Stock Idx ETF | VXUS | Foreign Large Blend | 60.80B | 0.20% | N/A | NR | 6.00% |

| 7 | SPDR Gold Shares | GLD | Commodities Precious Metals | 60.68B | 0.40% | 0.00% | NR | 0.00% |

| 8 | iShares MSCI EAFE Index | EFA | Foreign Large Blend | 39.40B | 0.35% | 2.81% | 3 | 5.00% |

| 9 | iShares MSCI Emerging Markets Index | EEM | Diversified Emerging Mkts | 38.41B | 0.68% | 1.79% | 4 | 14.00% |

| 10 | Vanguard Mid-Cap ETF | VO | Mid-Cap Blend | 29.40B | 0.12% | 1.10% | 3 | 16.00% |

| 11 | iShares S&P 500 Index | IVV | Large Blend | 27.61B | 0.09% | 1.85% | 3 | 5.00% |

| 12 | Vanguard Small Cap ETF | VB | Small Blend | 26.12B | 0.12% | 1.08% | 4 | 12.00% |

| 13 | PowerShares QQQ | QQQ | Large Growth | 24.34B | 0.20% | 0.73% | 3 | 8.19% |

| 14 | Vanguard Short-Term Bond ETF | BSV | Short-Term Bond | 22.05B | 0.11% | 2.09% | 4 | 60.00% |

| 15 | Vanguard Growth ETF | VUG | Large Growth | 21.03B | 0.12% | 1.19% | 4 | 26.00% |

| 16 | Vanguard REIT Index ETF | VNQ | Real Estate | 20.94B | 0.12% | 3.28% | 3 | 12.00% |

| 17 | iShares Barclays TIPS Bond | TIP | Inflation-Protected Bond | 20.59B | 0.20% | 3.61% | 4 | 13.00% |

| 18 | Vanguard Extended Market Index ETF | VXF | Mid-Cap Blend | 20.10B | 0.12% | 0.93% | 3 | 10.00% |

| 19 | iShares Russell 2000 Index | IWM | Small Blend | 16.22B | 0.20% | 1.07% | 3 | 20.00% |

| 20 | Vanguard Value ETF | VTV | Large Value | 15.62B | 0.12% | 2.35% | 3 | 27.00% |

| 21 | Vanguard FTSE All-World ex-US ETF | VEU | Foreign Large Blend | 14.42B | 0.22% | 2.06% | 3 | 6.00% |

| 22 | iShares iBoxx $ Invest Grade Corp Bond | LQD | Long-Term Bond | 13.70B | 0.15% | 4.71% | 3 | 7.00% |

| 23 | iShares Russell 1000 Growth Index | IWF | Large Growth | 13.54B | 0.20% | 1.24% | 4 | 24.00% |

| 24 | iShares MSCI Brazil Index | EWZ | Latin America Stock | 12.69B | 0.61% | 4.96% | 4 | 13.00% |

| 25 | iShares Silver Trust | SLV | Commodities Precious Metals | 12.35B | 0.50% | 0.00% | NR | 0.00% |

| 26 | Vanguard Intermediate-Term Bond ETF | BIV | Intermediate-Term Bond | 12.05B | 0.11% | 3.89% | 4 | 46.00% |

| 27 | iShares Barclays Aggregate Bond | AGG | Intermediate-Term Bond | 11.85B | 0.20% | 3.39% | 3 | 406.00% |

| 28 | iShares Russell 1000 Value Index | IWD | Large Value | 11.64B | 0.20% | 1.94% | 3 | 24.00% |

| 29 | iShares S&P MidCap 400 Index | IJH | Mid-Cap Blend | 11.48B | 0.20% | 1.05% | 4 | 14.00% |

| 30 | SPDR S&P MidCap 400 | MDY | Mid-Cap Blend | 11.20B | 0.25% | 0.93% | 4 | 14.93% |

| 31 | SPDR Dow Jones Industrial Average | DIA | Large Value | 9.92B | 0.18% | 2.45% | 5 | 0.12% |

| 32 | Energy Select Sector SPDR | XLE | Equity Energy | 9.78B | 0.20% | 1.41% | 4 | 7.68% |

| 33 | Vanguard Small Cap Growth ETF | VBK | Small Growth | 9.20B | 0.12% | 0.43% | 4 | 34.00% |

| 34 | Vanguard MSCI European ETF | VGK | Europe Stock | 8.83B | 0.14% | 4.33% | 3 | 11.00% |

| 35 | Vanguard MSCI EAFE ETF | VEA | Foreign Large Blend | 8.75B | 0.12% | 2.37% | 3 | 6.00% |

| 36 | iShares Barclays 1-3 Year Treasury Bond | SHY | Short Government | 8.46B | 0.15% | 0.95% | 3 | 85.00% |

| 37 | iShares iBoxx $ High Yield Corporate Bd | HYG | High Yield Bond | 8.33B | 0.50% | 7.84% | 2 | 16.00% |

| 38 | iShares Barclays 1-3 Year Credit Bond | CSJ | Short-Term Bond | 8.29B | 0.20% | 2.17% | 3 | 12.00% |

| 39 | Vanguard Dividend Appreciation ETF | VIG | Large Blend | 8.28B | 0.18% | 2.01% | 5 | 15.00% |

| 40 | iShares S&P U.S. Preferred Stock Index | PFF | Miscellaneous Sector | 8.00B | 0.48% | 7.18% | NR | N/A |

- For full page view, please check the following Top 40 Popular and Best ETFs 2011.

No comments:

Post a Comment