The best performing retirement income mutual funds October 2012 are Fidelity Income Replacement 2042, Vanguard Managed Payout Growth Focus fund, etc.

Top Performer Retirement Income Mutual Funds

Top Performer Retirement Income Mutual Funds

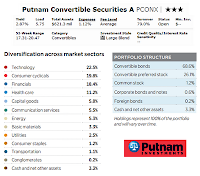

Retirement income mutual funds can provide great income for retiree or near retirement investors. Typically, they are actively managed by fund manager(s) to be able to pay regular income. The funds offer more flexibility than annuities, however they are less guarantees. The funds may consist of bonds, stocks, short term investment, and cash or money market. It typically has higher bond or cash portion than stock portion.

You can buy these funds from various fund companies. Each fund companies may provide different fund objective. Some of the family funds are Fidelity, Vanguard, John Hancock, Charles Schwab, etc.

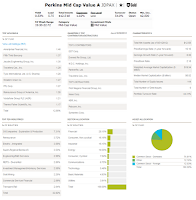

From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its year to date performance in 2012 (up to October 1, 2012).

The 12 best performing retirement income mutual funds 2012 are:

- Fidelity Income Replacement 2042

- Fidelity Income Replacement 2040

- Vanguard Managed Payout Growth Focus Inv

- Fidelity Income Replacement 2038

- Fidelity Income Replacement 2036

- Fidelity Income Replacement 2034

- Fidelity Income Replacement 2032

- Fidelity Income Replacement 2030

- Fidelity Income Replacement 2028

- Fidelity Income Replacement 2026

- Vanguard Managed Payout Gr & Dis Inv

- ING Global Target Payment A

Updated on 11/4/2012