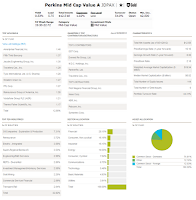

Perkins Mid Cap Value A (Ticker: JDPAX)

The investment objective of Perkins Mid Cap Value fund is to provide capital growth. The mutual fund mainly invests in the common stocks of undervalued mid-sized companies. It invests its net assets in equity securities of companies whose market capitalization falls, at the time of purchase, within the 12-month average of the capitalization range of the Russell Midcap Value Index. It may also invest in foreign equity and debt securities, including investments in emerging markets.

Fund Details

- Fund Inception Date: July 5, 2009

- Ticker Symbol: JDPAX

- CUSIP: 47103C266

- Beta (3yr): 0.92

- Rank in category (YTD): 90%

- Category: Mid-Cap Value

- Distribution: 0.54%

- Capital Gains: 0%

- Expense Ratio: 1.02%

- Net Assets: $ 12.52 billion

- Number of Years Up: 1 year

- Number of Years Down: 1 year

- Annual Turnover Rate: 54%

The Class A of this fund has just been introduced to public in July 2009. It started with Institutional Class in 1998. Thomas M. Perkins has managed the Mid Cap Value strategy since 1998. It also has total net assets of $12.52 billion. The dividend yield is 0.54%. The annual holdings turnover as of September 27, 2012 is 54%. This mid cap value fund also has expense ratio of 1.02%.

Previous: Best Mid Cap Value Mutual Funds 2010

It only has 1-star rating from Morningstar. In 2010, it has returned 14.65%. For 2012, the YTD return is 6.88. It also has 5-year annualized return of 2.61%. Based on the load adjusted returns, the performance of this fund is as follow:

- 1-year: 1.61%

- 3-year: 6.77%

- 5-year: 1.40%

- 10-year: 8.93%

As of June 2012, the top holdings are Ameriprise Financial Inc (1.46%), Fifth Third Bancorp (1.37%), Jacobs Engineering Group Inc (1.30%), Travelers Companies Inc (1.29%), Tyco International Ltd (1.28%), Western Union Co (1.27%), PPL Corp (1.27%), Reinsurance Group of America Inc (1.26%), Vodafone Group PLC (1.21%) and Thermo Fisher Scientific Inc (1.17%). These ten holdings represent 12.88% of the total portfolio. The top industries are Oil Companies – Exploration & Production (7.31%), Reinsurance (3.72%), Electric – Integrated (3.56%) and Super – Regional Banks – US (3.53%).

According to the fund prospectus, the principal investment risks are value investing risks, market risk, Mid-sized companies risk, foreign exposure risk, derivatives risk, etc.

Disclosure: No Position

Other domestic stock mutual funds:

No comments:

Post a Comment