|

| Top Performing Commodities funds |

Commodities Broad Basket Funds

Commodities broad basket fund invests in a diversified basket of commodity goods. The commodity goods include oils, minerals, metals, livestock, cotton, sugar, cocoa, grains, and coffee. The fund management invests in physical assets or derivative instruments including swap agreements / futures. This fund can be riskier than other fund types such as bond mutual fund or large cap stock fund. Some may provide high dividend yield for investors.The list is sorted based on the 1 year performance. You can find fund review and information in this article. Other information such as expense ratio, management, top holdings, top sector, sales load, and shares price can be found as well.

Top Commodity Funds

The top performing commodities broad basket mutual funds 2013 are:- TCW Enhanced Commodity Strategy Fund (TGABX)

- Harbor Commodity Real Return Strategy Fund (HACMX)

- PIMCO Commodity Real Return Strategy Fund (PCRAX)

- Direxion Monthly Commodity Bull 2X Fund (DXCLX)

- PIMCO CommoditiesPLUS Strategy Fund (PCLAX)

- DFA Commodity Strategy Fund (DCMSX)

- MFS Commodity Strategy Fund (MCSAX)

- Eaton Vance Commodity Strategy Fund (EACSX)

- Kottke Commodity Strategies Fund (KCFIX)

- Fidelity Series Commodity Strategy Fund (FCSSX)

- Parametric Commodity Strategy Fund (EAPCX)

- Credit Suisse Commodity Return Strategy Fund (CRSAX)

- Russell Commodity Strategies Fund (RCSAX)

- DWS Enhanced Commodity Strategy Fund (SKNRX)

- Van Eck CM Commodity Index Fund (CMCAX)

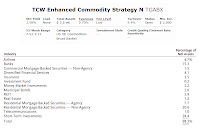

TCW Enhanced Commodity Strategy Fund (TGABX)

The investment aim of TCW Enhanced Commodity Strategy Fund is to provide total return which exceeds the commodity benchmark. It utilizes its assets to purchase commodity-linked derivative instruments backed by a portfolio of Fixed Income Instruments. This best performing commodities mutual fund is managed by Bret R. Barker, Stephen M. Kane and Tad Rivelle. The fund’s total net assets are only $3.9 million.This TGABX fund has an expense ratio of 0.70%. The fee is lower than the category’s average, 1.31%. The dividend yield is 1.95%. The most recent distribution was given in December 2012 in the amount of $0.04. It also has 9.39% annual holdings turnover as of March 26, 2013.

More: Best Ranked Commodities Broad Basket Mutual Funds 2012

|

| TGABX fund |

The top industries as of October 2012 are Short-Term Investments (28.4%), Residential Mortgage-Backed Securities – Non-Agency (20.6%) and Banks (15.3%).

Harbor Commodity Real Return Strategy fund (HACMX)

|

| HACMX fund |

As one of the top performing commodities broad basket mutual fund, it has a year-to-date return of -2.35%. Since 2008, the fund has recorded 3 years of positive return and 1 year of negative return. It has a 3-year beta risk of 1.02. The weighted average maturity is 5.69 years. The average duration is 3.90 years. This fund is a no load fund version of PIMCO Commodity Real Return Strategy Fund.

The top sector allocations as of December 2012 are U.S. Government Obligations (100%), Foreign Government Obligations (9.3%), Asset-backed Securities (4.6%) and Corporate Bonds & Notes (4.5%). The top benchmark sectors are Energy (31.7%) and Grains (21.3%).

PIMCO Commodity Real Return Strategy Fund (PCRAX)

PIMCO Commodity Real Return Strategy Fund is also managed by Mihir Worah. This PIMCO mutual fund has the largest total assets of $20.4 billion. The SEC Yield is -3.47%. The fund has annual expense ratio of 1.19%. And the annual holdings turnover as of March 2013 is 177%. This class A fund has a front-end sales load fee of 5.50%.This best performing commodities mutual fund has recorded 7 years of positive return and 3 years of negative return. Morningstar ranks it with 3 stars and Gold rating for its performance. The best 1-year total return was achieved in 2009 with 39.50%. The YTD return as of April 5, 2013 is -2.40%. Based on the load adjusted returns, the fund has returned 4.36% over the past 3-year and 4.85% over the past decade.

More: Best Performing Diversified Emerging Markets Mutual Funds 2012

The top 3 sector allocations as of February 2013 are Government-Treasury (77%), Other (14%) and Non-U.S. Developed (8%). It has effective duration of 4.5 years and effective maturity of 6.25 years.

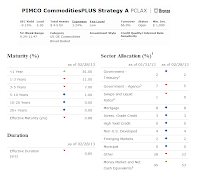

PIMCO CommoditiesPLUS Strategy fund (PCLAX)

|

| PCLAX fund |

This commodities broad basket mutual fund is ranked with Bronze rating by Morningstar. The mutual fund has just been incepted in 2010. It returned -2.93% in 2011 and 4.78% in 2012. For 2013, the YTD return is -2.02%. The fund’s benchmarks are Credit Suisse Commodity Benchmark Index and Lipper Commodities General Funds Average. You can buy this commodities fund from 34 brokerages.

The top holdings as of December 2012 are Short-Term Instruments (36.4%), U.S. Government Agencies (27.41%), U.S. Treasury Obligations (14.70%), Mortgage-Backed Securities (7.82%), Corporate Bonds & Notes (6.82%) and Asset-Backed Securities (5.31%).

DFA Commodity Strategy Fund (DCMSX)

This Dimensional Fund Advisors (DFA) fund is managed by David A. Plecha and Joseph F. Kolerich. It has no Morningstar rating yet. It is introduced to investor in 2010. The fund has low annual expense ratio of 0.35%. It also has $590.1 million of total net assets. The CUSIP is 233-20G-463. This DFA Commodity Strategy Fund objective is to provide total return consisting of capital appreciation and current income.In 2011, this commodities fund’s total return is -12.10%. The second year, it performed better with annual return of 1.33%. For 2013, the year-to-date return so far is -3.16%.

The top holdings as of January 2013 are Dimensional Cayman Commodity Fund I Ltd (19.96%), Federal National Mortgage Association (4.48%), Federal Home Loan Mortgage Corp (2.07%) and United Kingdom GLT (2.06%).

Commodities Fund Information

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield (%) | Net Assets (mil) | Min Invest |

|---|---|---|---|---|---|---|---|

| 1 | TCW Enhanced Commodity Strategy N | TGABX | N/A | 0.7 | 1.95 | $3.9 | $2,000 |

| 2 | Harbor Commodity Real Return ST Instl | HACMX | 5 | 0.94 | 1.56 | $377.0 | $1,000 |

| 3 | PIMCO Commodity Real Ret Strat A | PCRAX | 4 | 1.19 | 1.96 | $20,400.0 | $1,000 |

| 4 | Direxion Mthly Commodity Bull 2X | DXCLX | 1 | 1.9 | 0 | $10.3 | $25,000 |

| 5 | PIMCO CommoditiesPLUS Strategy A | PCLAX | N/A | 1.24 | 0.14 | $4,500.0 | $1,000 |

| 6 | DFA Commodity Strategy I | DCMSX | N/A | 0.35 | 0.57 | $598.3 | $- |

| 7 | MFS Commodity Strategy A | MCSAX | N/A | 1.08 | 0.69 | $396.0 | $1,000 |

| 8 | Eaton Vance Commodity Strategy A | EACSX | N/A | 1.5 | 0 | $587.1 | $1,000 |

| 9 | Kottke Commodity Strategies I | KCFIX | N/A | N/A | N/A | $100,000 | |

| 10 | Fidelity Series Commodity Strategy | FCSSX | 3 | 0.6 | 0 | $11,600.0 | $- |

| 11 | Parametric Commodity Strategy Investor | EAPCX | N/A | 1 | 3.75 | $99.4 | $1,000 |

| 12 | Credit Suisse Commodity Return Strat A | CRSAX | 3 | 1.04 | 0 | $5,400.0 | $2,500 |

| 13 | Russell Commodity Strategies A | RCSAX | N/A | 1.55 | 0 | $1,300.0 | $- |

| 14 | DWS Enhanced Commodity Strategy A | SKNRX | 4 | 1.51 | 2.12 | $866.3 | $1,000 |

| 15 | Van Eck CM Commodity Index A | CMCAX | N/A | 0.95 | 0 | $186.7 | $1,000 |

Fund Performance

| No | Fund Description | Ticker | YTD Return (%) | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|---|

| 1 | TCW Enhanced Commodity Strategy N | TGABX | -2.17 | -0.53 | N/A | N/A | N/A |

| 2 | Harbor Commodity Real Return ST Instl | HACMX | -2.35 | 0.1 | 5.94 | N/A | N/A |

| 3 | PIMCO Commodity Real Ret Strat A | PCRAX | -2.4 | 2.27 | 5.58 | -4.68 | 6.69 |

| 4 | Direxion Mthly Commodity Bull 2X | DXCLX | 11.84 | 0.68 | 2.94 | -10.82 | N/A |

| 5 | PIMCO CommoditiesPLUS Strategy A | PCLAX | -2.02 | -0.48 | N/A | N/A | N/A |

| 6 | DFA Commodity Strategy I | DCMSX | -0.98 | -1.6 | N/A | N/A | N/A |

| 7 | MFS Commodity Strategy A | MCSAX | -1.17 | -2.37 | N/A | N/A | N/A |

| 8 | Eaton Vance Commodity Strategy A | EACSX | -1.2 | -3.41 | N/A | N/A | N/A |

| 9 | Kottke Commodity Strategies I | KCFIX | -1.65 | -3.53 | N/A | N/A | N/A |

| 10 | Fidelity Series Commodity Strategy | FCSSX | -1.25 | -3.87 | 1.35 | N/A | N/A |

| 11 | Parametric Commodity Strategy Investor | EAPCX | -2.36 | -4.17 | N/A | N/A | N/A |

| 12 | Credit Suisse Commodity Return Strat A | CRSAX | -1.51 | -0.063492063 | 1.74 | -7.3 | N/A |

| 13 | Russell Commodity Strategies A | RCSAX | -1.29 | -4.88 | N/A | N/A | N/A |

| 14 | DWS Enhanced Commodity Strategy A | SKNRX | -1.9 | -5.14 | 2.35 | -7.07 | N/A |

| 15 | Van Eck CM Commodity Index A | CMCAX | -2.3 | -5.72 | N/A | N/A | N/A |

No comments:

Post a Comment