|

| Top Performer Funds |

Long government mutual fund invests mainly in long duration U.S. government debts including U.S. treasuries. These bonds are backed by U.S. government; hence they have low credit risk default. The bonds have duration of more than six years. These portfolios are more sensitive to interest rates, and are riskier than bonds with shorter durations.

From this best performing funds list, you may find each individual fund review. You can find the fund performance, expense ratio, and yield or dividend from the table below. The list is sorted based on its 1 year total return up to April 15, 2013.

The top performing long Government mutual funds April 2013 are:

- Direxion Monthly 10 Year Note Bull 2X fund (DXKLX)

- American Century Zero Coupon 2025 fund (BTTRX)

- Rydex Government Long Bond 1.2x Strategy fund (RYGBX)

- Vanguard Extended Duration Treasury Index fund (VEDTX)

- PIMCO Extended Duration fund (PEDIX)

- PIMCO Long-Term US Government fund (PGOVX)

- American Century Zero Coupon 2020 fund (BTTTX)

- ProFunds US Government Plus fund (GVPIX)

- Vanguard Long-Term Government Bond Index fund (VLGIX)

- Vanguard Long-Term Treasury fund (VUSTX)

- Fidelity Spartan L/T Treasury Bond Index fund (FLBIX)

- T. Rowe Price US Treasury Long-Term fund (PRULX)

Direxion Monthly 10 Year Note Bull 2X fund (DXKLX)

Direxion Monthly 10 Year Note Bull 2X fund is a leverage mutual fund. It invests most of its assets in the U.S. government securities that comprise the NYSE Current 10-Year U.S. Treasury Index. Paul Brigandi and Tony Ng are the current fund managers. The fund has an expense ratio of 1.90%.

More: Best Long Government Bond Mutual Funds 2012

This top performing Long Government mutual fund has 3-stars rating from Morningstar. The fund has recorded 5 years of positive return and 2 years of negative return since its inception in 2005.

|

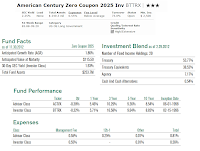

| American Century fund |

American Century Zero Coupon 2025 fund objective is to provide highest return consistent with investment in U.S. Treasury securities. G. David MacEwen, Robert V. Gahagan, Brian Howell and Jim Platz are the fund managers. It has $249.3 million of total net assets. The annual expense ratio is 0.55% and the annual holdings turnover as of March 19, 2013 is 73%. The average turnover in the category is 563.53%. It also has a decent dividend yield of 2.66%. The last dividend distributed in December 2012 was $2.44.

As one of the best long government mutual funds, it has YTD return of -0.64%. Morningstar analysts rank this fund with 3-star rank. Since 1996, the fund has 12 years of positive return. Its best 1-year total return was achieved in 2000 with 32.65%. The worst 1-year total return was occurred in 2009 with -20.96%. Based on the load adjusted returns, the fund has returned 5.86% over the past 1-year, 14.52% over the past 3-year and 8.25% over the past 10-year.

This taxable bond fund had a total of 29 fixed income holdings. The percentage of the investment blend is Treasury (53.77%), Treasury Equivalents (38.52%), Agency (7.17%) and Cash and Cash Alternatives (0.54%). The other class of this fund is Advisor Class (ACTVX).

Rydex Government Long Bond 1.2x Strategy fund (RYGBX)

Rydex Government Long Bond 1.2x Strategy fund invests mainly in U.S. government securities and derivative instruments. This RYGBX fund is part of the Guggenheim Investments’ fund family. It has 2-stars rating from Morningstar. The total net assets are $425.8 million.

Investors of this mutual fund receive a dividend yield of 1.53%. It has an annual expense ratio of 0.95%. This no-load fund is managed by an investment team of 9 fund managers, such as Michael P. Byrum, Mike Dellapa, Ryan Harder, Matthew Wu, etc.

The fund’s benchmark is 30-year Treasury Bond. The best 1-year total return was occurred in 2008 with 49.98%. Based on the load adjusted returns, the fund performance is listed as below:

- 1-year: 5.02%

- 3-year: 15.86%

- 5-year: 10.01%

- 10-year: 7.19%

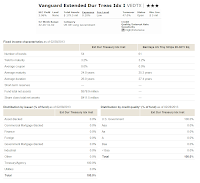

Vanguard Extended Duration Treasury Index fund (VEDTX)

|

| VEDTX fund |

More: 25 Best Vanguard Mutual Funds 2013

This top performing long government mutual fund has total assets of $179.5 million. The 12-month dividend yield is 3.33%. Investors of this fund had just received the latest dividend in December 2012 in the amount of $0.36.

Ranked with 3-stars rating by Morningstar, this VEDTX fund has its best 1-year total return in 2011 with 55.79%. This institutional class fund had only 1 negative return since its inception. It was occurred in 2009 with -36.65%. In 2013, the fund has YTD return of -4.54%. The average maturity is 24 years and the average duration is 26 years.

PIMCO Extended Duration fund (PEDIX)

As part of PIMCO fund family, this PEDIX fund is also managed by Steve A. Rodosky. The fund’s CUSIP is 72201F599. The dividend of 2.53% accrues daily and is distributed monthly. The February 2013 distribution was $0.02. It has $266 million of total net assets. The annual expense ratio is 0.50%. It also has SEC Yield of 2.70%.

This top performing long government fund is ranked with 4-stars rating by Morningstar. It has year-to-date return of -4.45%. The fund has returned 3.23% over the past 1-year and 13.12% over the past 5-year. The best 1-year total return was 55.81% in 2011 and the worst was -28.19% in 2009. It has 4-star ranking from Morningstar. The effective maturity is 28.76 years and the effective duration is 28.23 years.

Fund Information

| No | Fund Description | Ticker | Rating | Expense Ratio | Yield (%) | Net Assets (mil) | Min Invest |

|---|---|---|---|---|---|---|---|

| 1 | Direxion Mthly 10 Year Note Bull 2X | DXKLX | 3 | 1.9 | 0 | $27.9 | $25,000 |

| 2 | American Century Zero Coupon 2025 Inv | BTTRX | 3 | 0.55 | 2.66 | $249.3 | $2,500 |

| 3 | Rydex Govt Long Bond 1.2x Strategy Inv | RYGBX | 2 | 0.95 | 1.53 | $425.8 | $2,500 |

| 4 | Vanguard Extended Dur Treas Idx I | VEDTX | 3 | 0.1 | 3.33 | $179.5 | $ 5 mil |

| 5 | PIMCO Extended Duration Instl | PEDIX | 4 | 0.5 | 2.53 | $266.0 | $ 1 mil |

| 6 | PIMCO Long-Term US Government Instl | PGOVX | 5 | 0.47 | 2.52 | $1,900.0 | $ 1 mil |

| 7 | American Century Zero Coupon 2020 Inv | BTTTX | 4 | 0.55 | 3.29 | $295.2 | $2,500 |

| 8 | ProFunds US Government Plus Inv | GVPIX | 1 | 1.47 | 0 | $64.4 | $15,000 |

| 9 | Vanguard Long-Term Govt Bond Idx I | VLGIX | N/A | 0.09 | 2.81 | $250.2 | $ 5 mil |

| 10 | Vanguard Long-Term Treasury Inv | VUSTX | 4 | 0.2 | 2.82 | $3,400.0 | $3,000 |

| 11 | Fidelity Spartan L/T Tr Bd Idx Inv | FLBIX | 3 | 0.2 | 3.02 | $421.7 | $2,500 |

| 12 | T. Rowe Price US Treasury Long-Term | PRULX | 3 | 0.55 | 2.69 | $427.5 | $2,500 |

| No | Fund Description | Ticker | YTD Return (%) | 1-Year Return % | 3-Year Return % | 5-Year Return % | 10-Year Return % |

|---|---|---|---|---|---|---|---|

| 1 | Direxion Mthly 10 Year Note Bull 2X | DXKLX | -1.09 | 10.04 | 14.79 | 9.37 | N/A |

| 2 | American Century Zero Coupon 2025 Inv | BTTRX | -0.64 | 9.73 | 15.67 | 9.09 | 8.84 |

| 3 | Rydex Govt Long Bond 1.2x Strategy Inv | RYGBX | -3.54 | 9.35 | 16.95 | 9.55 | 7.56 |

| 4 | Vanguard Extended Dur Treas Idx I | VEDTX | -4.54 | 9.1 | 20.18 | 10.39 | N/A |

| 5 | PIMCO Extended Duration Instl | PEDIX | -4.45 | 8.57 | 20.46 | 12.42 | N/A |

| 6 | PIMCO Long-Term US Government Instl | PGOVX | -1.81 | 7.73 | 13.35 | 9.76 | 7.76 |

| 7 | American Century Zero Coupon 2020 Inv | BTTTX | 0.45 | 7.67 | 12.01 | 8.22 | 7.98 |

| 8 | ProFunds US Government Plus Inv | GVPIX | -4.29 | 7.08 | 15.95 | 7.97 | 6.52 |

| 9 | Vanguard Long-Term Govt Bond Idx I | VLGIX | -1.9 | 6.93 | N/A | N/A | N/A |

| 10 | Vanguard Long-Term Treasury Inv | VUSTX | -2.02 | 6.78 | 12.45 | 8.21 | 7.15 |

| 11 | Fidelity Spartan L/T Tr Bd Idx Inv | FLBIX | -1.89 | 6.79 | 12.55 | 8.24 | N/A |

| 12 | T. Rowe Price US Treasury Long-Term | PRULX | -2.2 | 6.28 | 12.05 | 8.22 | 6.92 |

No comments:

Post a Comment