Retirement Income Funds

Retirement income mutual funds invest in a mix of bonds, stocks, and cash for investors already in or near retirement. The funds are managed with conservative asset allocation strategy. The funds will provide consistent income for investors through dividend or interest income.These best retirement income mutual funds are sorted based on its value, performance and quality. You can find various funds to invest in your financial accounts. Please check the fund prospectus for investment risk, fund details, etc.

You may invest in your regular investment account or brokerage account, 401(k) account, traditional IRA, and Roth IRA. Please check with your brokerage or 401(k) account for details.

The 15 best retirement income mutual funds 2013 are:

- Vanguard Target Retirement Income Fund (VTINX)

- T. Rowe Price Retirement Income Fund (TRRIX)

- Harbor Target Retirement Income Fund (HARAX)

- USAA Target Retirement Income Fund (URINX)

- TIAA-CREF Lifecycle Retirement Income Fund (TLRIX)

- American Beacon Retirement Income and Appreciation Fund (AANPX)

- TIAA-CREF Lifecycle Index Retirement Income Fund (TRILX)

- Russell LifePoints In Retirement Fund (RZLRX)

- Legg Mason Target Retirement Fund (LMPAX)

- MFS Lifetime Retirement Income Fund (MLLAX)

- American Century Asset Allocation Portfolios LIVESTRONG Income Portfolio (ARTAX)

- JPMorgan SmartRetirement Income Fund (JSRAX)

- Vantagepoint Milestone Retirement Income Fund (VPRRX)

- Manning & Napier Target Income Series Fund (MTDCX)

- BlackRock LifePath Retirement Portfolio (LPRAX)

Vanguard Target Retirement Income Fund (VTINX)

This best retirement income fund is currently managed by Michael H. Buek, William Coleman and Walter Nejman. This Vanguard Target Retirement Income Fund has the largest total net assets of $10.6 billion. It also has the lowest annual expense ratio, 0.16%. The trailing 12-month dividend yield is 2.05%. The most recent dividend was distributed in March 2013 in the amount of $0.04. |

| Vanguard fund profile |

- 1-year: 5.79%

- 3-year: 7.93%

- 5-year: 5.33%

T. Rowe Price Retirement Income Fund (TRRIX)

The T. Rowe Price Retirement Income Fund has a low annual expense ratio rate of 0.57%. This T. Rowe Price fund is popular among investors and has $3.2 billion of total net assets. The minimum initial investment required is $2,500. The 30-day SEC Yield is 1.33%. Currently, it has annual holdings turnover of 20.70%. It utilizes its assets to purchase a diversified portfolio of other T. Rowe Price stock and bond funds.

The T. Rowe Price Retirement Income Fund has a low annual expense ratio rate of 0.57%. This T. Rowe Price fund is popular among investors and has $3.2 billion of total net assets. The minimum initial investment required is $2,500. The 30-day SEC Yield is 1.33%. Currently, it has annual holdings turnover of 20.70%. It utilizes its assets to purchase a diversified portfolio of other T. Rowe Price stock and bond funds.Morningstar analysts rank this TRRIX fund with 4-stars and Gold rating. There is no management fee and no front-end sales load fee for investing in this fund. Jerome A. Clark is the current fund manager.

The best 1-year total return so far was in 2009 with 22.07%. The only year it recorded a negative return was occurred in 2008 with -18.39%. Based on the load adjusted returns, the fund has returned 6.63% over the past 1-year and 6.80% over the past 10-year.

The top 5 fund holdings as of March 2013 are Emerging Markets Bond Fund, Emerging Markets Stock Fund, Equity Index 500 Fund, High Yield Fund and Inflation Focused Bond Fund. The top ten holdings represent 92.84% of total net assets.

Harbor Target Retirement Income Fund (HARAX)

| Harbor Fund |

Ranked with 4-stars rating by Morningstar, the fund has YTD return of 3.32%. It uses Large Growth investment style. The other classes are Investor Class (HARCX) and Administrative Class (HARBX). The past performance of this fund since its inception is listed below:

- Year 2012: 10.87%

- Year 2011: 3.20%

- Year 2010: 8.77%

USAA Target Retirement Income Fund (URINX)

This USAA Target Retirement Income Fund is managed by John Toohey and Wasif Latif. The total net assets are $359.6 million. It has high dividend yield of 2.68%. Its annual expense ratio is 0.68%. It uses its assets to purchase a selection of USAA mutual funds with its current asset allocation.You can buy this top retirement income fund with minimum initial investment of $1,000 for your brokerage account. For your 401(k) account or individual retirement account (IRA), please check with your investment account.

As part of best retirement income mutual funds, it has always performed in positive return since the inception in 2008. The highest return was achieved in 2009 with 25.04%. This fund has 3-stars rating from Morningstar. The 3-year beta risk is 0.56. S&P 500 Index and Barclays Aggregate Bond Index are the fund’s benchmarks.

The top 4 fund allocations as of March 2013 are Income Fund Institutional SHS (26.31%), Intermediate-Term Bond Fund Institutional (19.90%), Short Term Bond Fund Institutional SHS (19.86%) and International Fund Institutional SHS (7.87%).

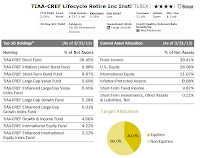

TIAA-CREF Lifecycle Retirement Income Fund (TLRIX)

|

| TIAA-CREF fund |

This top retirement income fund has 4-stars and Bronze rating from Morningstar. Managed by John Cunniff and Has L. Erikson, it has 5-year average return of 5.12%. It has YTD return of 5.31%. The best 1-year total return was in 2009 with 16.33%. The benchmark index is Lifecycle Retirement Income Fund Composite Index. The largest asset allocation is in Fixed Income (39.41%) and US Equity (28.96%).

Top Fund Information

| No | Fund Description | Ticker | Rating | Assets (Mil) | Min to Invest | Expense Ratio | Yield |

|---|---|---|---|---|---|---|---|

| 1 | Vanguard Target Retirement Income Inv | VTINX | 5 | $10,600.0 | $1,000 | 0.16% | 2.05% |

| 2 | T. Rowe Price Retirement Income | TRRIX | 4 | $3,200.0 | $2,500 | 0.57% | 1.66% |

| 3 | Harbor Target Retirement Income Instl | HARAX | 4 | $17.2 | $1,000 | 0.59% | 3.95% |

| 4 | USAA Target Retirement Income URINX | URINX | 3 | $359.6 | $1,000 | 0.68% | 2.68% |

| 5 | TIAA-CREF Lifecycle Retire Inc Instl | TLRIX | 4 | $217.3 | $ 2 mil | 0.39% | 2.55% |

| 6 | American Beacon Retire Inc & Apprec Inv | AANPX | 3 | $153.4 | $2,500 | 1.12% | 2.06% |

| 7 | TIAA-CREF Lifecycle Index Ret Inc Inst | TRILX | 5 | $26.6 | $ 2 mil | 0.17% | 1.74% |

| 8 | Russell LifePoints In Retirement A | RZLAX | 3 | $70.3 | $- | 0.25% | 2.78% |

| 9 | Legg Mason Target Retirement A | LMPAX | 3 | $4.2 | $1,000 | 1.15% | 2.06% |

| 10 | MFS Lifetime Retirement Income A | MLLAX | 4 | $280.8 | $1,000 | 0.91% | 2.25% |

| 11 | American Century LIVESTRONG Inc A | ARTAX | 3 | $471.6 | $2,500 | 1.02% | 1.68% |

| 12 | JPMorgan SmartRetirement® Income A | JSRAX | 3 | $761.5 | $500 | 0.84% | 2.38% |

| 13 | Vantagepoint Milestone Retire Inc Inv M | VPRRX | 3 | $318.2 | $- | 0.83% | 1.80% |

| 14 | Manning & Napier Target Income C | MTDCX | 4 | $61.3 | $2,000 | 1.73% | 1.58% |

| 15 | BlackRock LifePath Retirement Investor A | LPRAX | 3 | $582.8 | $1,000 | 1.10% | 1.66% |

Best Funds Performance

| No | Fund Description | YTD Return % | 1-Year Return % | 3-Year Return % | 5-Year Return % |

|---|---|---|---|---|---|

| 1 | Vanguard Target Retirement Income Inv | 3.85% | 8.06% | 8.30% | 5.57% |

| 2 | T. Rowe Price Retirement Income | 5.24% | 10.01% | 8.64% | 5.31% |

| 3 | Harbor Target Retirement Income Instl | 3.32% | 8.67% | 8.14% | N/A |

| 4 | USAA Target Retirement Income URINX | 2.94% | 8.50% | 7.70% | N/A |

| 5 | TIAA-CREF Lifecycle Retire Inc Instl | 5.31% | 11.03% | 9.73% | 5.57% |

| 6 | American Beacon Retire Inc & Apprec Inv | 2.30% | 6.12% | 5.72% | 5.49% |

| 7 | TIAA-CREF Lifecycle Index Ret Inc Inst | 5.09% | 9.88% | 9.38% | N/A |

| 8 | Russell LifePoints In Retirement A | 3.95% | 9.08% | 8.06% | 5.13% |

| 9 | Legg Mason Target Retirement A | 4.81% | 10.90% | 9.93% | N/A |

| 10 | MFS Lifetime Retirement Income A | 3.84% | 8.20% | 6.90% | 6.78% |

| 11 | American Century LIVESTRONG Inc A | 5.88% | 10.39% | 9.47% | 5.04% |

| 12 | JPMorgan SmartRetirement® Income A | 4.78% | 9.43% | 8.44% | 5.59% |

| 13 | Vantagepoint Milestone Retire Inc Inv M | 3.88% | 7.33% | 6.42% | 4.14% |

| 14 | Manning & Napier Target Income C | 4.90% | 9.17% | 7.06% | 5.32% |

| 15 | BlackRock LifePath Retirement Investor A | 3.88% | 7.95% | 8.09% | 4.89% |

No comments:

Post a Comment