Top Investment Fund Review

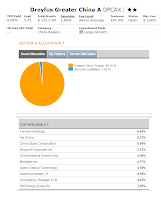

Dreyfus Greater China Fund (DPCAX) seeks long-term capital growth. The mutual fund uses its assets to purchase stocks of companies that (i) are principally traded in China, Hong Kong or Taiwan (Greater China), (ii) derive at least 50% of their revenues from Greater China, or (iii) have at least 50% of their assets in Greater China. The portfolio managers generally seek companies with accelerated earnings outlooks and whose share prices appear to be reasonably valued relative to their growth potential. The fund is non-diversified.Fund Profile

- Fund Inception Date: May 11, 1998

- Ticker Symbol: DPCAX

- CUSIP: 261986-50-9

- Beta (3yr): 1.15

- Rank in category (YTD): 35%

- Category: China Region

- Distribution: 0.00%

- Capital Gains: 0%

- Expense Ratio: 1.88%

- Net Assets: $ 332.2 million

- Number of Years Up: 10 years

- Number of Years Down: 4 years

- Annual Turnover Rate: 141.37%

This best performer investment fund in China Region category has total net assets of $332.2 million. The annual expense ratio is 1.88%. It uses Large Growth investment style. The management team consists of Hugh Simon, Raymond Chan and William Liu. The annual holdings turnover as of July 11, 2013 is 141.37%. The average category turnover is 67.91%.

China Region Mutual Fund

This investment fund has 2-stars rating from Morningstar. The fund has its best 1-year total return in 2009 with 119.08%. The worst return was occurred in 2008 with -56.71%. Based on the load adjusted returns, the fund’s performance is as below:- 1-year: 10.08%

- 3-year: -1.63%

- 5-year: 1.97%

- 10-year: 13.02%

The minimum initial investment is $1,000 for brokerage account and $759 for retirement (IRA) account. The fund has no management fee, but there is a front-end sales load fee of 5.75%. The fund is also available in Class C (DPCCX) and Class I (DPCRX). There are 112 brokerages that provide the sale of this fund.

The minimum initial investment is $1,000 for brokerage account and $759 for retirement (IRA) account. The fund has no management fee, but there is a front-end sales load fee of 5.75%. The fund is also available in Class C (DPCCX) and Class I (DPCRX). There are 112 brokerages that provide the sale of this fund.The top countries of this mutual fund are Hong Kong (37.34%) and Cayman Islands (31.97%). The top ten holdings as of the second quarter of 2013 are Tecent Holdings (6.42%), AIA Group (6.33%), China State Construction (5.69%), Kingsoft Corporate Ltd (5.53%), China Medical System Holdings (5.09%), Mediatek Inc (4.77%), AviChina Industry (4.59%), Sunny Optical Technology (4.59%), Chongqing Changan (4.42%) and SPT Energy Group Inc (3.95%).

The principal risks of investing in this Dreyfus fund are risks of stock investing, foreign investing risk, risks of concentrating investments in Greater China, emerging market risk, foreign currency risk, liquidity risk, portfolio turnover risk and non-diversification risk.

Disclosure: No Position

No comments:

Post a Comment