PIMCO Ad

|

| Ad |

While it is convincing ad, you as an investor should do research about these best funds. I have provided each fund review below. Through this review, I would also suggest you to read the fund profile and prospectus to understand the prospects of them for your financial account.

The ad is as follow:

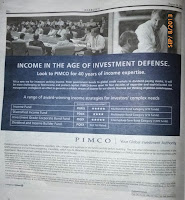

INCOME IN THE AGE OF INVESTMENT DEFENSE.

Look to PIMCO for 40 years of income expertise.

It’s a new era for investors seeking income. From government bonds to global credit markets to dividend-paying stocks, it will be more challenging to find income and protect capital. PIMCO draws upon its four decades of expertise and sophisticated risk management strategies in an effort to generate a reliable stream of income for our clients. Harness our thinking at pimco.com/income.

A range of award-winning income strategies for investors’ complex needs

PIMCO | Your Global Investment Authority

- Income Fund (PIMIX) – 5 stars rating by Morningstar| Multisector Bond Category (212 funds)

- Diversified Income Fund (PDIIX) – 4 stars rating by Morningstar | Multisector Bond Category (212 funds)

- Investment Grade Corporate Bond Fund (PIGIX) – 5 stars rating by Morningstar | Intermediate-Term Bond Category (1,005 funds)

- Dividend and Income Builder Fund (PQIIX) – Not Yet Rated

Investors should consider the investment objectives, risks, charges, and expenses of the funds carefully before investing. This and other information is contained in the fund’s prospectus and summary prospectus, if available, which may be obtained by contacting your financial advisor or PIMCO representative or by visiting pimco.com/investments. Please read them carefully before you invest or send money.

PIMCO Mutual Funds

PIMCO Income Fund (PIMIX) is the first mutual fund in this list. Ranked with 5 stars rating by Morningstar, this institutional class has a high minimum initial investment requirement. You can invest in this fund through your 401(k) account or brokerage. If your brokerage doesn’t offer, you can invest in other class such as Class A (PCDAX), Class A load waived (PCDAX.lw), Class C (PCSCX), Class D (PCDDX), and Class P (PCDPX). Class D and Class P funds are the only mutual fund with no sales load.

PIMCO Income Fund (PIMIX) is the first mutual fund in this list. Ranked with 5 stars rating by Morningstar, this institutional class has a high minimum initial investment requirement. You can invest in this fund through your 401(k) account or brokerage. If your brokerage doesn’t offer, you can invest in other class such as Class A (PCDAX), Class A load waived (PCDAX.lw), Class C (PCSCX), Class D (PCDDX), and Class P (PCDPX). Class D and Class P funds are the only mutual fund with no sales load.This PIMCO Income Fund is managed by Daniel J. Ivascyn and Alfred T. Murata. The fund invests in multi-sector portfolio of debts of varying maturities. It has high yield of 6.22%. It is also popular among investors with $27 billion of total assets. Its expense ratio is only 0.44%. The fund has stellar returns for the past 1 year, 3 years and 5 years. It has a 5 year average return of 12.70%. I think it is a great choice for long term investment with great management and past performance to show for.

Similar to previous PIMCO fund, PIMCO Diversified Income Fund (PDIIX) is a multisector bond. It uses its assets to purchase a diversified portfolio of Fixed Income Instruments of varying maturities. It has total assets of $6.4 billion. The current yield is 5.85%. The fund manager is Curtis A. Mewbourne. This mutual fund has top 3 sectors such as corporate bond, other government related debt, and non-U.S. government bond.

High Return

If you invest $10,000 5 years ago, your capital would have growth to be $15,232. This growth represents a 5 year average return of 8.78%. This bond fund has been struggling for the past 1 year. It ranks only in 75 percentile among its peers for the past year. Long term returns is still great though. If you are planning for a traditional mutual fund, PIMCO Investment Grade Corporate Bond Fund (PIGIX) could be the right choice for you. This top mutual fund uses its assets to purchase a diversified portfolio of investment grade corporate fixed income securities of varying maturities. Managed by Mark Kiesel since 2002, it has a yield of 4.60%. Kiesel is awarded with fund manager of the year by Morningstar in 2012. The fund’s portfolio turnover rate is rather high at 165%. Its expense fee is only 0.50%.

If you are planning for a traditional mutual fund, PIMCO Investment Grade Corporate Bond Fund (PIGIX) could be the right choice for you. This top mutual fund uses its assets to purchase a diversified portfolio of investment grade corporate fixed income securities of varying maturities. Managed by Mark Kiesel since 2002, it has a yield of 4.60%. Kiesel is awarded with fund manager of the year by Morningstar in 2012. The fund’s portfolio turnover rate is rather high at 165%. Its expense fee is only 0.50%.This silver rated fund has returned 5.95% over the past 3 years and 9.55% over the past 5 years. It has a stellar return compare to its peers and benchmark. The top 3 sectors are corporate bond, other government related debt, and U.S. Treasury.

In my opinion, PIMCO Investment Grade Corporate Bond Fund is a great choice for your long term investment in your brokerage or retirement account. With top fund manager and great returns, this fund may provide consistent income and capital growth in future.

If you are a fan of a new mutual fund, you should consider PIMCO Dividend and Income Builder Fund (PQIIX). With only $536 million, it has a low expense ratio fee of 0.83%. This institutional class doesn’t have a sales load. The 30-day SEC yield is 3.11%. This mutual fund invests in a diversified portfolio of income-producing investments including equities. It invests in global stock.

This world allocation mutual fund has a good short term performance. It has a year-to-date return of 9.31%. The top 5 stocks in its portfolio include Walgreen Company, Novartis AG, Roche Holding AG, Sanofi, and Microsoft Corporation.

With no past long term performance history, I can’t judge how this balanced fund will perform. Short term return has showed a great promise. I still can’t recommend this fund for your financial account. In 2-3 years, we should see whether it is a good choice or not.

Bottom Line

- These mutual funds are institutional shares. Unless you have a large minimum initial investment of $1 million, you can only invest through certain retirement account or brokerage account.

- The funds have great long term returns and they are suitable for long term.

- Please invest only in 1 or 2 funds. Don’t invest in all of these funds hence you might have some overlap among the funds. For instance, both PIMCO Income Fund and PIMCO Diversified Income Fund are categorized in multi-sector bond.

No comments:

Post a Comment