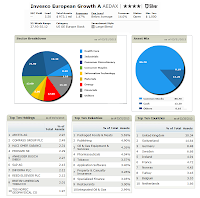

Invesco European Growth Fund (AEDAX)

The Invesco European Growth Fund objective is to seek long-term capital growth. The fund utilizes its assets to purchase a portfolio of securities of European issuers, and in derivatives and other instruments that have economic characteristics similar to such securities. It invests mainly in equity securities and depositary receipts. The fund may invest in the securities of issuers of all capitalization sizes; however, the fund may invest a significant amount of its net assets in the securities of small- and mid-capitalization issuers.

Fund Profile

|

| Invesco fund profile |

- Fund Inception Date: 11/2/1997

- Ticker Symbol: AEDAX

- CUSIP: 008882854

- Beta (3yr): 0.91

- Rank in category (YTD): 12%

- Category: Europe Stock

- Distribution: 1.72%

- Capital Gains: 0%

- Expense Ratio: 1.47%

- Net Assets: $ 973.1 million

- Number of Years Up: 10 years

- Number of Years Down: 5 years

- Annual Turnover Rate: 14%