|

| Best Funds |

Top 19 Hartford Mutual Funds

Hartford Funds is part of The Hartford Financial Services Group Inc (NYSE: HIG). It is mostly known as The Hartford. It is one of the America’s largest insurance and investment companies for individual and business customers. It has 4 business segments: commercial markets, consumer markets, wealth management, and runoff operations.

The Hartford funds consist of 54 mutual funds. There are 5 main categories such as domestic equity, international/ global equity, fixed income, alternatives, and multi strategy. For instance, you can find the Hartford Target Retirement 2020 fund in multi strategy category.

These best Hartford mutual funds for 2013 are selected based on its performance history. The funds are ranked with 3 star rating or higher by Morningstar. You may find the fund review below and other fund information.

The best Hartford mutual funds 2013 are:

- Hartford Balanced Income fund (HBLAX)

- Hartford Equity Income fund (HQIAX)

- Hartford Dividend & Growth fund (IHGIX)

- Hartford Midcap fund (HFMCX)

- Hartford Growth Opportunities fund (HGOAX)

- Hartford Inflation Plus fund (HIPAX)

- Hartford Growth Allocation fund (HRAAX)

- Hartford Healthcare fund (HGHAX)

- Hartford International Opportunities fund (IHOAX)

- Hartford Short Duration fund (HSDAX)

- Hartford Small Company fund (IHSAX)

- Hartford Mid Cap Value fund (HMVAX)

- Hartford Small Cap Growth fund (HSLAX)

- Hartford Unconstrained Bond fund (HTIAX)

- Hartford Value Opportunities fund (HVOAX)

- Hartford Disciplined Equity fund (HAIAX)

- Hartford Value fund (HVFAX)

- Hartford Global Research fund (HLEAX)

- Hartford Diversified International fund (HDVAX)

The class A funds do have the sales load. If you are investing in 401(k) or retirement account (traditional IRA or Roth IRA), you can choose institutional class of these funds. These institutional class funds don’t have the sales load; the expense ratio is lower than other classes as well. The institutional classes are Class I, Class R3, Class R4, Class R5, and Class Y.

|

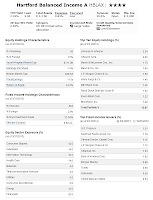

| HBLAX fund |

Hartford Balanced Income Fund uses its assets to purchase stocks and bonds. This balanced fund has total net assets of $3.2 billion. Its yield is 2.39%. The portfolio managers are W. Michael Reckmeyer, III; Karen H. Grimes; Ian R. Link; Lucius T. Hill and Scott I. St. John. It also has expense ratio of 0.83%. There is a 0.25% management fee included in the expense fee. This class A fund also has a front-end sales load fee of 5.50%.

Morningstar analysts rank this top performing fund with 4-stars rating. It has YTD return of 7.03% as of April 30, 2013. The fund has 5 years of positive return since the inception. The only year it returned negatively was in 2008 with -18.53%. Based on the load adjusted returns, the fund has returned 5.33% over the past 1-year and 10.01% over the past 3-year.

The top equity holdings as of March 2013 are Johnson & Johnson (2.24%), Chevron Corp (2.00%), March & McLennan Cos Inc (1.70%), Merck & Co Inc (1.65%) and JP Morgan Chase % Co (1.50%). This best Harford mutual fund has a total of 68 holdings. The top ten stocks represent 15.87% of total portfolio. The top equity sectors exposure are Financials (20.0%), Industrials (14.0%) and Health Care (14.0%).

Hartford Equity Income fund (HQIAX)

The investment objective of Hartford Equity Income fund is to provide high income level and consistent capital growth. The fund’s expense ratio is 1.10% per year. It has low annual holdings turnover of 27% as of April 24, 2013. The total net assets are $2.4 billion. The dividend yield is 1.85%. The fund’s shares price is currently $16.39.

Ranked with 4-stars by Morningstar, this top Harford fund has a year-to-date return of 12.96%. The 5-year average return is 6.52%. The best 1-year total return was recorded in 2006 with 20.63%. The worst was occurred in 2008 with -28.95%. It also has 3-year beta risk of 0.87.

The top sector exposures are Financials (22.0%) and Industrials (14.0%). The top holdings out of 69 total holdings are Johnson & Johnson (4.59%), Chevron Corp (4.13%), Exxon Mobil Corp (3.42%), Wells Fargo & Co (3.12%) and Merck & Co Inc (3.12%).

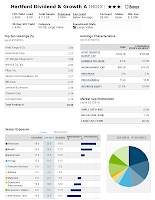

Hartford Dividend & Growth fund (IHGIX)

|

| IHGIX fund |

Best Wells Fargo Mutual Funds for 2013

You can buy this top large value mutual fund with a minimum initial investment of $2,000. For individual retirement account or 401(k), please check with your fund administrator. The total assets of this fund are $7.1 billion. Since the inception in 1996, this fund has recorded 13 years of positive return and 3 years of negative return. It has 3-stars and Bronze rating from Morningstar. The fund’s year-to-date performance as of April 30, 2013 is 13.01%. The fund uses S&P 500 Index as the fund’s benchmark.

The top 5 stocks in its portfolio as of March 2013 are Wells Fargo & Co (3.94%), Exxon Mobil Corp (3.27%), JP Morgan Chase & Co (2.98%), Merck & Co Inc (2.92%) and Pfizer Inc (2.92%). Financials and Health are the top sector exposure of this IHGIX fund.

Hartford Midcap fund (HFMCX)

Hartford Midcap fund invests mainly in common stocks of high quality mid-capitalization companies. It has an expense ratio of 1.23%. The fund’s total net assets are $3.3 billion. It has very small dividend yield of 0.03%. The 12b1 fee is 0.25% and the front-end sales load fee is 5.50%. It is managed by Philip W. Ruedi and Mark A. Whitaker.

You can buy this best Harford mutual fund with $2,000 initial investment. The other classes of this fund are Class B (HAMBX), Class C (HMDCX), Class Y (HMDYX) and Institutional Class (HFMIX). S&P MidCap 400 Index is the fund’s benchmark. The fund’s YTD return is 14.30%. Based on the load adjusted returns, the fund’s performance is listed below:

- 1-year: 7.97%

- 3-year: 10.63%

- 5-year: 4.94%

- 10-year: 10.60%

Hartford Growth Opportunities fund (HGOAX)

|

| HGOAX details |

As one of the best Harford Funds, it uses Large Growth investment style. The minimum initial investment is $2,000 for brokerage account with $50 minimum subsequent investment. This equity mutual fund has 3-stars rating from Morningstar. The 3-year beta risk is 1.18. It also has 8.89% year-to-date return as of April 30, 2013. The fund’s best performance was achieved in 2003 with 43.61%. The worst 1 year return was occurred in 2008 with -45.32%. It has 2.36% 5-year average return.

The top 7 stocks in its holdings are Amazon.com Inc (2.52%), Apple Inc (2.27%), LinkedIn Corp (2.17%), Cisco Systems Inc (2.16%), Hologic Inc (2.09%), Google Inc (2.08%) and Lowe’s Co Inc (2.07%). Data is as of March 2013. Information Technology (32.0%) and Consumer Discretionary (20.0%) are the top sector exposure.

Fund Information

| No | Fund Description | Ticker | Category | Rating | Assets (MS) | Yield |

|---|---|---|---|---|---|---|

| 1 | Hartford Balanced Income A | HBLAX | Conservative Allocation | 4 | $3,200.0 | 2.39 |

| 2 | Hartford Equity Income A | HQIAX | Large Value | 4 | $2,400.0 | 1.85 |

| 3 | Hartford Dividend & Growth A | IHGIX | Large Value | 3 | $7,100.0 | 1.48 |

| 4 | Hartford Midcap A | HFMCX | Mid-Cap Growth | 3 | $3,300.0 | 0.03 |

| 5 | Hartford Growth Opportunities A | HGOAX | Large Growth | 3 | $2,200.0 | 0 |

| 6 | Hartford Inflation Plus A | HIPAX | Inflation-Protected Bond | 3 | $2,100.0 | 0.82 |

| 7 | Hartford Growth Allocation A | HRAAX | Aggressive Allocation | 3 | $891.5 | 2.56 |

| 8 | Hartford Healthcare A | HGHAX | Health | 3 | $529.2 | 0 |

| 9 | Hartford Intl Opportunities A | IHOAX | Foreign Large Blend | 3 | $1,300.0 | 1.12 |

| 10 | Hartford Short Duration A | HSDAX | Short-Term Bond | 3 | $555.7 | 1.9 |

| 11 | Hartford Small Company A | IHSAX | Small Growth | 3 | $742.0 | 0 |

| 12 | Hartford Mid Cap Value A | HMVAX | Mid-Cap Value | 3 | $370.5 | 0.91 |

| 13 | Hartford Small Cap Growth A | HSLAX | Small Growth | 3 | $288.9 | 0 |

| 14 | Hartford Unconstrained Bond A | HTIAX | Nontraditional Bond | 3 | $157.6 | 3.01 |

| 15 | Hartford Value Opportunities A | HVOAX | Large Value | 3 | $128.0 | 1.35 |

| 16 | Hartford Disciplined Equity A | HAIAX | Large Blend | 3 | $112.4 | 0.92 |

| 17 | Hartford Value A | HVFAX | Large Value | 3 | $196.8 | 2.21 |

| 18 | Hartford Global Research A | HLEAX | World Stock | 3 | $75.0 | 1.74 |

| 19 | Hartford Diversified International A | HDVAX | Foreign Large Blend | 3 | $28.1 | 1.75 |

Fund Performance

| No | Fund Description | Ticker | YTD Return % | 1 Year Return % | 3 Year Return % |

|---|---|---|---|---|---|

| 1 | Hartford Balanced Income A | HBLAX | 7.03% | 13.89% | 11.81% |

| 2 | Hartford Equity Income A | HQIAX | 12.96% | 17.42% | 13.49% |

| 3 | Hartford Dividend & Growth A | IHGIX | 13.01% | 16.90% | 10.73% |

| 4 | Hartford Midcap A | HFMCX | 14.30% | 16.86% | 10.58% |

| 5 | Hartford Growth Opportunities A | HGOAX | 8.89% | 13.21% | 10.50% |

| 6 | Hartford Inflation Plus A | HIPAX | 41.00% | 4.24% | 7.63% |

| 7 | Hartford Growth Allocation A | HRAAX | 7.32% | 11.86% | 8.30% |

| 8 | Hartford Healthcare A | HGHAX | 20.10% | 25.30% | 16.28% |

| 9 | Hartford Intl Opportunities A | IHOAX | 5.77% | 11.71% | 6.51% |

| 10 | Hartford Short Duration A | HSDAX | 0.87% | 3.44% | 3.10% |

| 11 | Hartford Small Company A | IHSAX | 12.76% | 10.20% | 10.30% |

| 12 | Hartford Mid Cap Value A | HMVAX | 11.01% | 17.19% | 10.69% |

| 13 | Hartford Small Cap Growth A | HSLAX | 12.89% | 15.02% | 15.03% |

| 14 | Hartford Unconstrained Bond A | HTIAX | 1.36% | 5.57% | 6.98% |

| 15 | Hartford Value Opportunities A | HVOAX | 12.67% | 18.61% | 10.12% |

| 16 | Hartford Disciplined Equity A | HAIAX | 12.17% | 15.25% | 12.25% |

| 17 | Hartford Value A | HVFAX | 13.07% | 17.08% | 10.08% |

| 18 | Hartford Global Research A | HLEAX | 9.91% | 14.08% | 8.76% |

| 19 | Hartford Diversified International A | HDVAX | 7.18% | 12.80% | 7.48% |

No comments:

Post a Comment