|

| Best High Yield CEFs |

These investment funds are managed actively by the fund manager(s). The fund’s market price may trade at a discount or premium to its NAV (Net Asset Value). These CEFs are categorized into several classes such as stock CEF, bond CEF, and balanced CEF.

Top High Yield CEFs

These top high yield CEFs provide better value and yield for investors. Some of these CEFs in the list are traded at discount to their NAV. They also provide high dividend yield for income. From this list, you may find wide selection of funds.

The top high yield CEFs include: value fund, real estate fund, mortgage bond, emerging markets, high yield bond, corporate bond, etc. You can find the fund performance, expense ratio, and yield or dividend from the table.

Best high yield closed end funds for 2013 and 2014 are:

- John Hancock Tax-Advantaged Dividend Income fund (HTD)

- Neuberger Berman Real Estate Securities Income fund (NRO)

- Nuveen Dividend Advantage fund (NAD)

- Nuveen Quality Preferred Income fund 2 (JPS)

- BlackRock Credit Allocation Income fund (BTZ)

- Managed High Yield Plus fund (HYF)

- DWS Global High Income fund (LBF)

- Lazard Global Total Return & Income fund (LGI)

John Hancock Tax-Advantaged Dividend Income fund (HTD)

Ranked with 4 stars rating, this John Hancock Tax-Advantaged Dividend Income (Ticker: HTD) fund is a top US equity closed end fund. It invests mainly in dividend paying common and preferred securities. The fund’s aim is to provide high after-tax total return from income and capital growth. Its share price is $20.73.

|

| HTD fund details |

As of March 2013, the top 5 holdings are OGE Energy Corp (3.05%), Wells Fargo & Company (2.97%), DTE Energy Company (2.72%), Spectra Energy Corp (2.53%) and Atmos Energy Corp (2.51%). The top sector is Utilities (56.11%). Electric Utilities (27.53%) and Multi-Utilities (22.91%) are the top industries.

Neuberger Berman Real Estate Securities Income fund (NRO)

Neuberger Berman Real Estate Securities Income fund utilizes its assets to purchase income producing common equity, preferred and convertible securities and non-convertible debt securities issued by real estate companies. It has $410 million of total net assets as of April 16, 2013. The fund has 26.65% effective leverage. The fund managers are Brian C. Jones and Steve Shigekawa. It is currently traded at -11.13% from its NAV. The annual expense ratio is 1.87%.

Previous: Best California Municipal Bond Closed End Funds 2012

As one of best high yield closed end funds for 2013 and 2014, it has average UNII per share of -$0.0281. The total holdings as of February 2013 are 66 holdings. Its annual portfolio turnover is only 22%. The top 5 holdings are Ventas Inc, Starwood Property Trust Inc, Macerich Company, Sovran Self Storage Inc and HCP Inc.

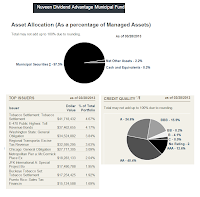

Nuveen Dividend Advantage fund (NAD)

|

| NAD fund details |

This municipal bond fund has a tax free high yield of 5.81%. Its dividend is distributed on monthly basis. The current distribution as of April 1, 2013 is $0.073. It has an average maturity of 18.28 years. The effective duration is 8.29 years.

The top holdings out of 226 total holdings as of March 2013 are Tobacco Settlement (4.67%), E-470 Public Highway: Toll Revenue Bonds (4.17%), Washington State: General Obligation (3.84%), Regional Transporta: Excise Tax Revenue (3.63%) and Chicago: General Obligation (3.09%).

Nuveen Quality Preferred Income Fund 2 (JPS)

This is the second Nuveen fund that makes to the top high yield closed-end funds. This Nuveen Quality Preferred Income Fund 2 has $1,644 million of total net assets. It uses its assets to purchase preferred stocks offered by companies. It is currently trading 3.16% discount to its NAV (as of April 17, 2013). The monthly-distributed yield is 6.95%. It has 1.80% annual expense ratio. The fund managers are Phillip Jacoby and Mark Lieb since September 2002.

The average portfolio coupon as of March 2013 is 6.69%. There are 41.1% foreign holdings in its total holdings. The top issuers are PNC Financial Service (3.41%), Prudential Finance (3.06%), QBE Insurance Group (2.91%), Deutsche Bank AG (2.87%) and HSBC Holdings PLC (2.80%).

BlackRock Credit Allocation Income fund (BTZ)

|

| BlackRock CEF details |

This taxable bond fund has $2.4 billion of total net assets. It annual expense ratio is only 1.15%. The current fund managers are Stephen Bassas, Jeffrey Cucunato and Mitchel Garfin. Its share price is $14.34.

The top 2 industries as of fourth quarter of 2012 are Banking (16.8%) and Communications (12.9%). The top issuers are Aviation Capital Group, JPM Chase Capital, Altria Group Inc, Moody’s Corp and Norfolk Southern Corp.

Managed High Yield Plus fund (HYF)

This HYF fund is part of the UBS fund family. It is currently traded at -4.82% from its NAV. Craig Ellinger and Matthew Iannucci are the fund managers since 2010. This Managed High Yield Plus fund has a high dividend yield of 8.09%. The most current dividend is $0.015 per share. It is payable on April 30, 2013. The bonds in its holdings have an average modified duration of 3.71 years. The expense ratio is 1.66% per year.

More: Best Performer High Yield Bond Closed End Funds 2012

The top 10 corporate bonds as of March 2013 are Square Two Financial Corp (1.4%), International Lease Finance Corp (1.2%), NRG Energy Inc (1.1%), Ally Financial Inc (1.1%) and DISH DBS Corp (1.1%). The top industries are Energy-exploration & production (8.2%), Telecom-integrated/services (5.6%) and Support services (5.4%).

DWS Global High Income fund (LBF)

|

| DWS CEF |

This top high yield closed end funds has a 5 year average returns of 9.73%. The past 5 years performance is as follow:

- Year 2013: 4.44% (YTD)

- Year 2012: 23.32%

- Year 2011: 3.63%

- Year 2010: 13.95%

- Year 2009: 52.43%

.png) |

| Lazard CEF |

The annual expense ratio of this Lazard Global Total Return & Income fund is 1.56%. This expense fee includes 1.45% baseline expense and 0.11% interest expense. It has low effective leverage of 7.95%. The fund has distributed a dividend of $0.09 per share to its investors in April 23, 2013. The current dividend yield is 6.48%. The portfolio manager is James Donald. The average duration is 6 months.

Morningstar has ranked this best high yield CEFs with 3 stars rating. It has returned 10.15% over the past 3 years, 4.5% over the past 5 year, and 6.34% over the past 9 year. It utilizes its assets to purchase 35 - 45 equity securities with a market cap of $5 billion of companies in the MSCI World Index and in emerging market debt instruments.

The top global equity holdings as of February 2013 are HSBC Holdings, Mitsubishi UFJ, Johnson & Johnson, Novartis, Roche, Microsoft, Sanofi, IBM, Home Depot and SAP. The top sectors are Financials (19.1%), Health Care (19.0%) and Information Technology (18.3%).

Other Best High Yield CEFs

Other high yield closed end funds are:

- RMR Real Estate Income Fund (RIF)

- Nuveen Quality Preferred Income fund 3 (JHP)

- Cohen & Steers Infrastructure fund (UTF)

- MS Emerging Markets Domestic fund (EDD)

- Virtus Total Return (DCA)

- Eaton Vance Tax-Advantage Global Dividend (ETG)

Fund Information

| No | Fund Name | Ticker | Effective Leverage | Distribution Rate | Premium/ Discount | Market Cap | Exp Ratio |

|---|---|---|---|---|---|---|---|

| 1 | John Hancock Tax-Advantaged Dividend Income | HTD | 33.55% | 5.76% | -7.03% | $1,223 | 1.64% |

| 2 | Neuberger Berman Real Estate Securities Income | NRO | 26.65% | 4.55% | -11.13% | $411 | 1.87% |

| 3 | Nuveen Dividend Advantage | NAD | 34.53% | 5.81% | -6.91% | $901 | 2.02% |

| 4 | Nuveen Quality Preferred Income Fund 2 | JPS | 28.48% | 6.95% | -3.16% | $1,644 | 1.80% |

| 5 | BlackRock Credit Allocation Income | BTZ | 30.87% | 6.62% | -8.49% | $2,421 | 1.15% |

| 6 | Managed High Yield Plus | HYF | 27.94% | 8.29% | -4.82% | $195 | 1.66% |

| 7 | DWS Global High Income | LBF | 30.85% | 6.00% | -8.91% | $101 | 2.32% |

| 8 | Lazard Global Total Return & Income | LGI | 7.95% | 6.48% | -10.32% | $194 | 1.56% |

No comments:

Post a Comment