|

| Best Funds |

Best Lord Abbett Mutual Funds

Lord Abbett is a private money management company. It is popular among investors who want to invest in taxable bond fund. It provides investment advices to individual investors, financial advisors, and institutional investors. For individual investors, it offers various financial services such as mutual funds, retirement planning, and education & insights.Lord Abbett fund family has more than 40 different mutual funds. There are 5 main categories such as tax-free income fund, domestic equity fund, international fund, asset allocation fund, and taxable fixed income fund. The 3 most popular funds are: Lord Abbett Short Duration Income fund, Lord Abbett Affiliated, and Lord Abbett Bond-Debenture fund.

These best Lord Abbett mutual funds for 2013 are selected based on its performance history. Most of these investment funds do have a sales load hence they are class A fund. The funds are ranked with 3 star rating or higher by Morningstar. You may find the fund review below and other fund information. I also have selected my favorite funds below.

The top 23 Lord Abbett mutual funds 2013 are:

- Lord Abbett Short Duration Income fund (LALDX)

- Lord Abbett Income fund (LAGVX)

- Lord Abbett Intermediate Tax Free fund (LISAX)

- Lord Abbett National Tax-Free Income fund (LANSX)

- Lord Abbett Total Return fund (LTRAX)

- Lord Abbett Developing Growth fund (LAGWX)

- Lord Abbett Calibrated Dividend Growth fund (LAMAX)

- Lord Abbett High Yield fund (LHYAX)

- Lord Abbett Dividend Income Strategy fund (ISFAX)

- Lord Abbett Bond-Debenture fund (LBNDX)

- Lord Abbett Fundamental Equity fund (LDFVX)

- Lord Abbett Floating Rate fund (LFRAX)

- Lord Abbett Short Duration Tax Free fund (LSDAX)

- Lord Abbett Small Cap Value fund (LRSCX)

- Lord Abbett Balanced Strategy fund (LABFX)

- Lord Abbett Value Opportunities fund (LVOAX)

- Lord Abbett Growth & Income Strategy fund (LWSAX)

- Lord Abbett Core Fixed Income fund (LCRAX)

- Lord Abbett Alpha Strategy fund (ALFAX)

- Lord Abbett New York Tax-Free fund (LANYX)

- Lord Abbett CA Tax-Free Income fund (LCFIX)

- Lord Abbett New Jersey Tax-Free fund (LANJX)

- Lord Abbett Convertible fund (LACFX)

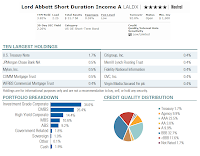

Lord Abbett Short Duration Income fund (LALDX)

Lord Abbett Short Duration Income fund uses its assets to purchase a portfolio of short duration bonds including corporate debts. It has total net assets of $31.7 billion. The investment portfolio managers are Robert A. Lee, Andrew H. O’Briend, Jerald M. Lanzotti and Kewjin Yuoh. They are supported by 25 investment professionals with average 11 years industry experience. The fund has a high dividend of 3.82%. The annual expense ratio is 0.59%. |

| LALDX fund details |

- 1-year: 2.47%

- 3-year: 4.05%

- 5-year: 5.67%

- 10-year: 4.18%

Lord Abbett Income fund (LAGVX)

This LAGVX fund has expense ratio of 0.80% per year. Its total net assets are $2.3 billion. This Lord Abbett Income fund invest mainly in investment grade debt securities including securities issued or guaranteed by the U.S. government. Its annual holdings turnover is 265% as of April 11, 2013. It is currently managed by a management team, led by Robert A. Lee, Andrew H. O’Brien, Jerald M. Lanzotti and Kewjin Yuoh. The fund’s yield is 4.78%. The current shares price is $3.03.

As of April 22, 2013, the year-to-date return of this top bond fund is 2.16%. It is ranked on top 7% in its category. The best 1-year total return was occurred in 2009 with 30.22%. The lowest return was occurred in 2008 with -10.16%%. It has returned 7.25% over the past 1-year and 6.12% over the past decade (based on the load adjusted returns). Morningstar ranks it with 5 stars rating.

The largest issuers as of March 2013 are Federal Home Loan Mortgage (2.8%), TBA Federal National Mortgage (2.2%), TBA Federal Home Loan Mortgage-3.5% coupon (1.8%), TBA Federal Home Loan Mortgage-4.0% coupon (1.5%), Bank of America Corp (0.9%), SLM Corp (0.9%) and Goldman Sachs Group Inc (0.9%).

Lord Abbett Total Return fund (LTRAX)

The investment team of this LTRAX fund consists of Robert A. Lee, Andrew H. O’Brien, Jerald M. Lanzotti and Kewjin Yuoh. It fund’s objective is to provide income and capital appreciation to produce a high total return. The fund’s expense ratio is 0.86%. The current dividend yield is 3.21%. It invests majority of assets in investment grade debts. The fund’s NAV is $10.83.As one of the best Lord Abbett mutual funds, it was first introduced to public in 2000. It has achieved 18 years of positive return since then. The only year it has negative return was occurred in 2008 with -1.22%. Based on the load adjusted returns, this best fund has returned 6.01% over the past 3-year and 6.64% over the past 5-year. As of April 22, 2013, it has YTD return of 1.32%.

It has a total of 508 total issuers as of 2013 first quarter. The top 10 issuers represent 47.3% of the total assets. They are US Treasury Note, Federal Home Loan Mortgage, TBA Federal National Mortgage, TBA Federal Home Loan Mortgage, US Treasury Bond and Federal National Mortgage.

Popular Muni Bond Fund

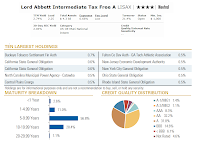

Lord Abbett Intermediate Tax Free fund (LISAX) |

| LISAX fund details |

Previous: Top Performing Municipal Bond Mutual Funds 2011

Since the inception in 2003, the only year the fund recorded with negative return was in 2008 with -0.39%. The best performance was in 2009 with 12.09%. It has YTD return of 1.43%. It also has 3-year beta risk of 0.91. This best bond fund is ranked with 4-stars and Neutral rating by Morningstar. The average effective maturity is 8.6 years with 5.3 years of modified duration.

The largest holdings as of March 2013 are Buckeye Tobacco Settlement Finance Authority (0.7%), California State Obligation (0.6%), North Carolina Municipal Power Agency (0.5%), Central Plains Energy (0.5%), Fulton Co Development Authority – GA Tech Athletic Association (0.5%), New Jersey Economic Development Authority (0.5%), New York City General Obligation (0.5%), Ohio State General Obligation (0.5%) and Rhode Island State General Obligation (0.5%).

Equity Mutual Fund

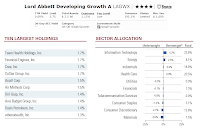

Lord Abbett Developing Growth fund (LAGWX)

|

| LAGWX fund details |

More: Best PIMCO Mutual Funds for 2013

This top small growth mutual fund has year-to-date return of 8.79% as of April 22, 2013. It is also ranked with 4-stars rating and Bronze rating by Morningstar. The best 1 year return was achieved in 2009 with 47.03%. The worst 1 year performance was occurred in 2008 with -47.50%. The annual performance for the past 5 years is listed below:

- Year 2012: 10.39%

- Year 2011: -1.66%

- Year 2010: 36.54%

- Year 2009: 47.03% (highest)

- Year 2008: -47.50% (lowest)

Lord Abbett Fundamental Equity fund (LDFVX)

This Lord Abbett Fundamental Equity fund invests most of its assets in undervalued equity securities of U.S. and multinational companies. Robert P. Fetch, Deepak Khanna and Sean J. Aurigemma are the current fund managers of this Lord Abbett fund. The total net assets are $5.0 billion. The fund also has an expense ratio of 1.09%.

This top Lord Abbett mutual fund has a yield of 0.63%. The dividend is paid annually. This large blend mutual fund has 3-stars rating from Morningstar. The YTD return is 12.77% as of April 22, 2013. The top sectors are Financials (24.5%) and Health Care (18.7%).

Lord Abbett Fund Information

| No | Fund Description | Ticker | Category | Rating | Assets (MS) | Assets (Mil) | Yield |

|---|---|---|---|---|---|---|---|

| 1 | Lord Abbett Short Duration Income A | LALDX | Short-Term Bond | 5 | $31,700.0 | 12818.1 | 3.82 |

| 2 | Lord Abbett Income A | LAGVX | Intermediate-Term Bond | 5 | $2,300.0 | 1264.91 | 4.78 |

| 3 | Lord Abbett Intermediate Tax Free A | LISAX | Muni National Interm | 4 | $4,300.0 | 2289.6 | 2.74 |

| 4 | Lord Abbett Natl Tax-Free Income A | LANSX | Muni National Long | 4 | $2,200.0 | 1800.06 | 3.92 |

| 5 | Lord Abbett Total Return A | LTRAX | Intermediate-Term Bond | 4 | $1,800.0 | 1011.52 | 3.21 |

| 6 | Lord Abbett Developing Growth A | LAGWX | Small Growth | 4 | $2,500.0 | 970.39 | 0.00 |

| 7 | Lord Abbett Calibrated Dividend Gr A | LAMAX | Large Blend | 4 | $1,100.0 | 948.06 | 2.69 |

| 8 | Lord Abbett High Yield A | LHYAX | High Yield Bond | 4 | $2,500.0 | 871.43 | 6.61 |

| 9 | Lord Abbett Div Income Strategy A | ISFAX | Conservative Allocation | 4 | $762.9 | 414.72 | 4.32 |

| 10 | Lord Abbett Bond-Debenture A | LBNDX | Multisector Bond | 3 | $8,700.0 | 4900.63 | 5.62 |

| 11 | Lord Abbett Fundamental Equity A | LDFVX | Large Blend | 3 | $5,000.0 | 2652.78 | 0.63 |

| 12 | Lord Abbett Floating Rate A | LFRAX | Bank Loan | 3 | $5,100.0 | 2108.53 | 5.08 |

| 13 | Lord Abbett Short Duration Tax Free A | LSDAX | Muni National Short | 3 | $2,600.0 | 1556.79 | 1.45 |

| 14 | Lord Abbett Small Cap Value A | LRSCX | Small Blend | 3 | $3,400.0 | 1276.9 | 0.64 |

| 15 | Lord Abbett Balanced Strategy A | LABFX | Moderate Allocation | 3 | $1,600.0 | 1217.15 | 3.33 |

| 16 | Lord Abbett Value Opportunities A | LVOAX | Mid-Cap Blend | 3 | $2,100.0 | 937.81 | 0.00 |

| 17 | Lord Abbett Growth & Inc Strat A | LWSAX | Aggressive Allocation | 3 | $845.2 | 660.49 | 3.09 |

| 18 | Lord Abbett Core Fixed Income A | LCRAX | Intermediate-Term Bond | 3 | $1,200.0 | 485.82 | 2.39 |

| 19 | Lord Abbett Alpha Strategy A | ALFAX | Small Growth | 3 | $915.7 | 438.43 | 0.14 |

| 20 | Lord Abbett New York Tax-Free A | LANYX | Muni New York Long | 3 | $399.1 | 319.99 | 3.46 |

| 21 | Lord Abbett CA Tax-Free Income A | LCFIX | Muni California Long | 3 | $273.4 | 203.94 | 3.61 |

| 22 | Lord Abbett New Jersey Tax-Free A | LANJX | Muni New Jersey | 3 | $155.1 | 146.51 | 3.54 |

| 23 | Lord Abbett Convertible A | LACFX | Convertibles | 3 | $473.7 | 61.82 | 2.65 |

| No | Fund Description | Ticker | 1 Year Return % | 3 Year Return % | 5 Year Return % |

|---|---|---|---|---|---|

| 1 | Lord Abbett Short Duration Income A | LALDX | 5.05% | 4.83% | 6.13% |

| 2 | Lord Abbett Income A | LAGVX | 10.43% | 9.24% | 9.37% |

| 3 | Lord Abbett Intermediate Tax Free A | LISAX | 5.05% | 6.16% | 6.27% |

| 4 | Lord Abbett Natl Tax-Free Income A | LANSX | 8.66% | 8.24% | 6.96% |

| 5 | Lord Abbett Total Return A | LTRAX | 2.60% | 1.23% | 1.45% |

| 6 | Lord Abbett Developing Growth A | LAGWX | 9.54% | 12.78% | 8.64% |

| 7 | Lord Abbett Calibrated Dividend Gr A | LAMAX | 14.74% | 10.20% | 6.38% |

| 8 | Lord Abbett High Yield A | LHYAX | 10.85% | 4.78% | 4.79% |

| 9 | Lord Abbett Div Income Strategy A | ISFAX | 1.21% | 0.06% | 2.25% |

| 10 | Lord Abbett Bond-Debenture A | LBNDX | 7.71% | 3.72% | 2.49% |

No comments:

Post a Comment